Stay informed with free updates

Simply sign up to the ESG investing myFT Digest — delivered directly to your inbox.

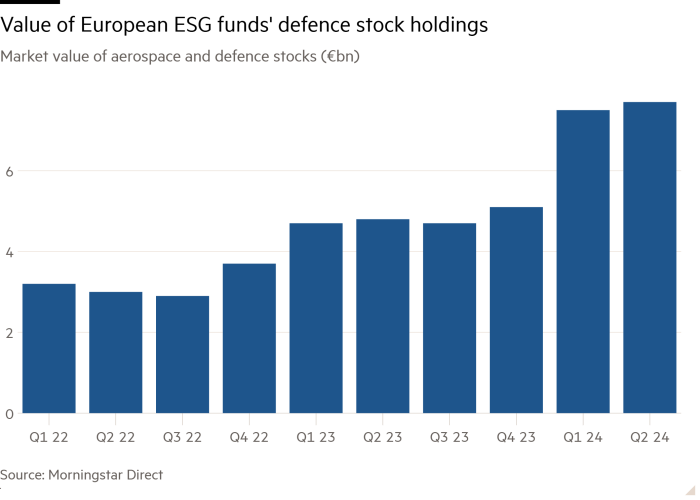

The value of European sustainable investment funds’ exposure to defence stocks has more than doubled since Russia’s invasion of Ukraine, as policymakers push the need for a strong defence industrial base.

About a third of funds in Europe and the UK focused on environmental, social and governance issues now have €7.7bn invested in the sector, compared with €3.2bn in the first quarter of 2022, according to an analysis for the Financial Times by Morningstar Direct.

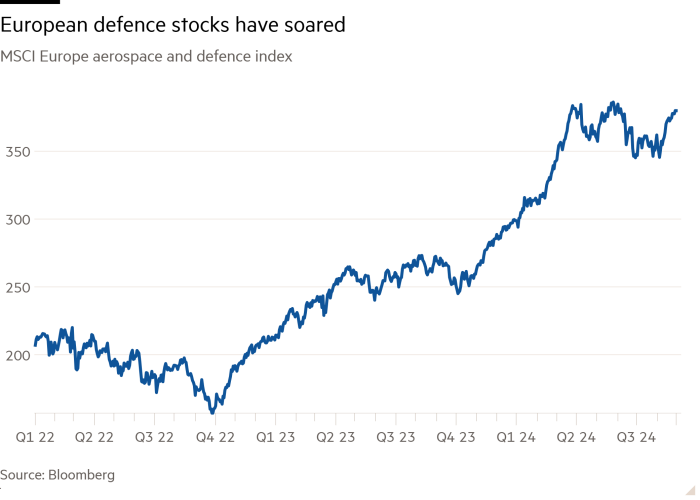

Although the rise in value is in part due to the share prices of defence companies soaring since Moscow’s full-scale attack on Ukraine in February 2022, many investors have also bought into the argument from governments that backing arms makers, long the subject of boycotts and student protests, should carry positive social connotations rather than exclusively downside risk.

“The situation in Ukraine has very much brought to the fore this idea of, ‘Can we actually defend ourselves?’,” said Sonja Laud, chief investment officer at Legal and General Investment Management.

The fighting in Ukraine sparked a debate about whether military contractors can be viewed as an ESG investment.

While investment in controversial weapons such as cluster bombs and landmines as defined in international treaties is banned — a status that is well-established in the asset management industry — Laud believes defence can be seen as sustainable.

Companies would still need to be assessed individually, as would the weapons they make and which countries these were sold to, “but we would not exclude defence as a principle”.

Morningstar’s analysis also shows the number of European ESG funds holding more than 5 per cent in aerospace and defence companies tripled, going from 22 to 66 in the past two years.

BNP Paribas ETFs, including its Easy CAC 40® ESG UCITS ETF, have breached 10 per cent of holdings in aerospace and defence, as has Paris-based Amundi’s Index Solutions CAC 40 ESG. Amundi declined to comment.

Michael Field, Morningstar’s European Equity Strategist, said the sector had “always been an ESG minefield, but this too is shifting in investors’ minds” with managers viewing it more “with an open mind” in the wake of the conflict in Ukraine.

The value of the funds’ aerospace and defence sector holdings are still small relative to their overall assets, accounting for less than 1 per cent of the €1.5tn held.

However, the sector has gone from a “relatively uninteresting sector in a lot of investors’ minds” to one that many now “feel they need to be invested in, otherwise they may get left behind”, Field said.

The MSCI Europe aerospace and defence index has risen by 1.8 times since the start of 2022 as shares in leading contractors have soared. In the wider investment market, holdings in defence-themed mutual funds and exchange traded funds more than tripled from $5.8bn in Jan 2022 to $17.6bn July 2024, according to data from LSEG Lipper.

In the US, the value of ESG funds’ exposure to aerospace and defence rose to €1.2bn in the second quarter of 2024, up from €779mn in the second quarter of 2022, according to Morningstar.

BlackRock’s iShares ESG Aware MSCI USA, one of the world’s largest ESG funds, includes US defence giants RTX and Northrop Grumman, as well as industrial conglomerate Honeywell. RTX and Northrop have both benefited from Pentagon orders, including for missiles and rocket motors.

The fund tracks an underlying index provided by MSCI, and excludes controversial weapons and producers and retailers of civilian firearms.

Policymakers in the UK and Europe are continuing to push investors to back the sector.

In the UK, the new Labour government has promised to introduce a law to regulate agencies that evaluate the ESG performance of companies amid concerns over a lack of transparency in the ratings process. Defence sector executives have previously warned that overcautious or misapplied ESG considerations often impacted the ability of the sector to attract investment and secure financial services.

David Coombs, head of multi-asset investments at Rathbones, said that while the UK-based manager had not added defence stocks to its sustainable funds, it considered “ESG risk” as part of a general risk analysis across its all its funds.

For example, Rathbones has held Lockheed Martin since 2016, over which time the stock’s ESG risk has continually fallen according to its analysis.

But exposure to defence can cut both ways. “You’ve got defence stocks that might be selling to the Israeli military. [There, the] ESG risk is super high,” Coombs added.

Student protests have targeted universities with calls for divestment from companies linked to the conflict in Gaza.