Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Funding new nuclear plants has always been a hard pitch to investors. Huge cost overruns for large plants such as EDF’s Hinkley Point C in Somerset have only added to the perception that nuclear is risky and technologically challenging.

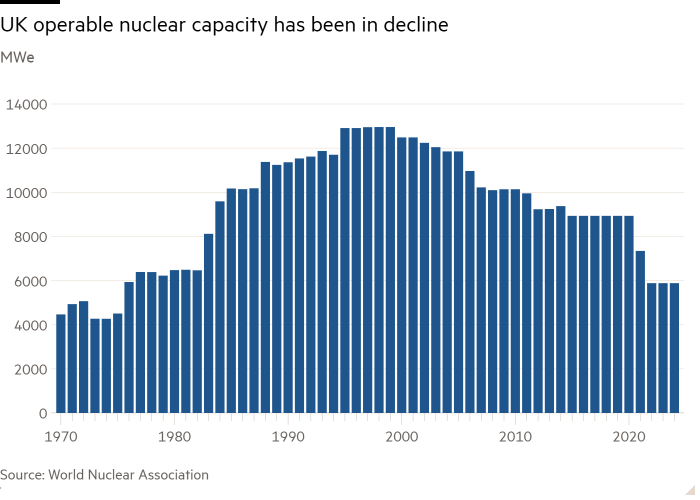

Still, there is a clear desire for more nuclear generation capacity from western governments. Belatedly, policymakers have realised they are unlikely to achieve their aims without some state involvement to entice private investment. In Britain, a new state-owned nuclear body should help reassure potential investors that taxpayers will shoulder at least some of the risk. Even then, any nuclear renaissance will be a slow burn.

Greater government intervention should work to the advantage of Rolls-Royce. The UK engineering group is the majority owner of a joint venture that is developing small modular reactor technology — plants built in factories and assembled on site to reduce cost and risk. It is looking at potentially selling down its 70 per cent stake further.

At its last fundraising in 2021, the unit secured £490mn — £210mn of which was UK government grant funding. But this is expected to run out in the first quarter next year. The JV is currently midway through a lengthy and costly regulatory design process which won’t conclude before 2026.

Any new fundraising deal could reportedly value this venture at a similar level to New York-listed SMR developer NuScale, which has a $2bn market capitalisation. That would be a big step up for a lossmaking business with little revenue to speak of: in 2021 the Qatar Investment Authority put in £85mn and took a 10 per cent equity stake.

Its success still depends on a UK government-led SMR design competition. By the end of the year, the UK’s new state-owned nuclear body Great British Nuclear is expected to select two SMR designs out of five in the running.

Each winning design would be assigned a site in Britain before GBN sets up development companies, initially 100 per cent state-owned, to work with the technology providers to progress the projects. A tender document published in 2023 suggested government match-funding would be available, should developers require it, to ensure their technology is ready for final investment decisions to be taken in 2029.

Meanwhile, SMR developers must prove their technologies can provide value for money. One easier way would be to measure build costs against the £13bn-£14bn cost per gigawatt of Hinkley Point C at today’s prices. Harder to argue will be whether SMRs can generate electricity at comparable prices to other low carbon technologies such as onshore wind.

These remain unknowns. Investing in SMR technology still relies on a — sometimes disputed — conviction that nuclear will be indispensable to low carbon energy systems.