Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Nowadays, miners looking to shine need exposure to copper, the future-facing commodity whose price is expected to rocket as the energy transition wraps electricity cables around the earth. BHP is no exception. Following the failed bid through which it hoped to gain control of Anglo American’s copper assets, it has been at pains to burnish its organic growth potential in this sphere. Yet its pitch is hardly copper bottomed.

BHP’s first problem is that it is mid-pivot. The miner has made progress in refocusing its portfolio to one that benefits, rather than suffers, from the energy transition, shedding oil and coal assets. Yet copper accounted for less than 30 per cent of its underlying ebitda in the year to June 2024. Almost 65 per cent came from iron ore.

Here, prospects are dull. Supply from major producers is growing. Troubles in China’s property sector are dampening demand. True, BHP is relatively well-positioned for a downturn. It sits at the very bottom of the cost curve, and has reasonable hopes that higher-cost producers will be edged out. In the meanwhile, it too will suffer. With every dollar off the iron ore price costing it $233mn of ebitda, the commodity’s near-term performance weighs heavily on investors’ minds.

BHP’s second issue is that, while it has managed to rustle up a fair pipeline of copper projects, both organic and acquired through bolt-on deals, these are a long way from delivering sizeable production growth. The miner has put its best foot forward, growing copper production by an industry-leading 300,000 tonnes over the past two years. Yet, on Barclays’ estimates, its 2030 production will not be entirely dissimilar from today’s 1.9mn tonnes, with increases coming through only after that date. Indeed, despite BHP’s game face, its backloaded growth highlights why it fancied a crack at Anglo in the first place. It also explains continued M&A speculation.

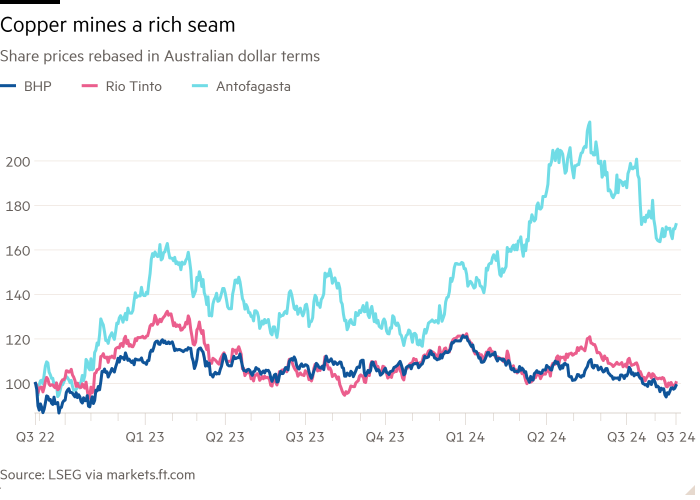

The problem is that picking up copper assets on the cheap is hard to do in a market that appears to be entirely populated by copper bulls. The strong performance of Chilean copper miner Antofagasta, whose shares have gained nearly 30 per cent in the past year, compared with diversified groups such as BHP and Rio Tinto, offers a clue as to the value differential that has opened up. In the absence of reasonable opportunities, the next stage of BHP’s transformation will be a slow grind.