Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A group of institutional investors in Entain is bringing a lawsuit against the UK gambling company to demand compensation for a decline in its share price following an investigation into bribery at its former Turkish subsidiary.

Law firm Fox Williams said on Wednesday it had filed a claim this month at London’s High Court on behalf of 20 investors who were demanding a total of more than £150mn from the Ladbrokes and Coral owner. Entain has instructed Slaughter and May to defend it.

The betting group is the latest FTSE 100 company to face an investor lawsuit following a stock price drop. Glencore, Barclays and Standard Chartered are also facing legal claims from shareholders.

The civil litigation against Entain comes after it struck a deal with prosecutors over alleged bribery at its former Turkish subsidiary, agreeing to pay £615mn to avoid a trial.

Dame Victoria Sharp, one of England’s most senior judges, approved the deferred prosecution agreement in December, one of the largest such penalties issued against a UK company.

UK authorities had accused Entain, which was previously named GVC Holdings, of failing to prevent bribery between July 2011 and December 2017.

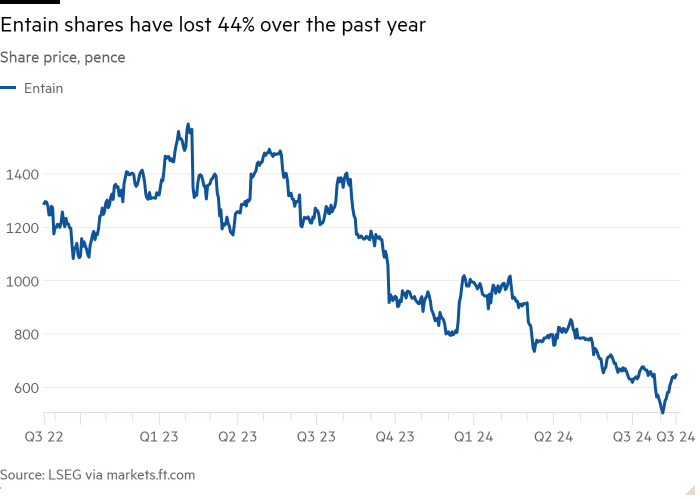

Shares in Entain have lost 44 per cent over the past year, although several factors have contributed to the decline, including a series of costly acquisitions.

The degree to which the Turkey episode led to losses for shareholders is likely to form an important part of the civil case, should it proceed to trial.

Entain said in a statement that it “is aware of these claims but has not yet been formally served with them, so these matters are at a very early stage. Entain intends to defend any proceedings robustly.”

Investors face substantial hurdles in bringing successful claims against companies in the UK, including pinpointing individual executives who can be held responsible for failing to disclose the information that they should have.

Several such claims have settled before trial, including one against outsourcing group Serco earlier this year. Serco said the settlement terms were “not material” to the company.

Glencore, Barclays and Standard Chartered deny the claims against them.

The identity of the shareholders who are suing Entain has yet to be disclosed. People with knowledge of the claim said they were mostly US-based, with some in the UK and other countries, and included public pension funds and asset managers.

Entain named industry veteran Gavin Isaacs as chief executive last month as it tried to restore investor confidence. His predecessor Jette Nygaard-Andersen stepped down in December.