Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The worst thing about holidays is usually coming home. Markets are experiencing that same despondence as the post-pandemic boom in leisure travel nears its end. Shares in the sector have struggled this year. But a slowdown could open a new door for those wanting in on some of the strongest fundamentals in the property world.

Hotel companies have had a great time as a combination of inflation, excess savings and pent-up demand pushed sales growth into double digits in recent years. The inevitable slowdown has arrived: Holiday Inn owner IHG said this week that revenue per available room grew at 3.2 per cent in the second quarter. That is higher than in the first quarter but a fraction of the 16 per cent RevPar growth it managed in 2023. Marriott cut its growth expectations last week citing a US and China slowdown. Shares in the two are down a tenth in the past month due to fears that the travel bubble has burst.

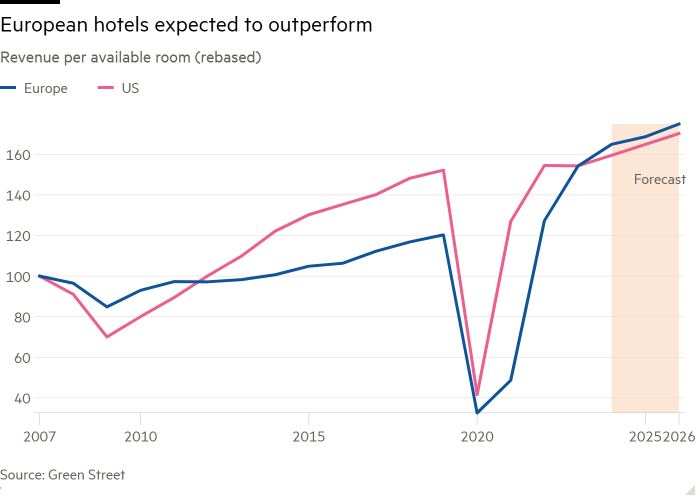

It isn’t all bad news. The Olympics mean a golden spell for Europe, with sector-wide RevPar expected to grow at 5 per cent this year versus 2 per cent in the US, says Green Street’s Edoardo Gili. He thinks European outperformance is likely to last.

A big reason why is the lack of supply of new hotel rooms, as regulatory and environmental concerns combine with tougher financing conditions and high building costs. New European supply might grow at between 1 and 2 per cent a year over the next five years. That is well below demand growth, which is being pushed higher by factors such as changing demographics and increased leisure spending.

In fact, Europe presents an opportunity for consolidators like IHG, which does not own properties but brings hotel owners within its franchises. Chains have a 40 per cent market share in Europe compared to 60 per cent in the US. IHG signed up a record 384 new hotels in the first half of this year, lured in by the prospect of lower costs and higher profits for their owners.

IHG’s valuation may not have quite caught up with the new travel reality. At 20 times forward earnings, it is still too rich if the cycle does turn further. That is in line with its past average and trough valuations have typically been about half of that. But Europe’s shortage of new hotels might mean that this travel downturn stays a pretty smooth trip.