Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

What fresh hell is this?

PARAMOUNT GLOBAL SHARES RISE 4% PREMARKET AFTER APEX CAPITAL TRUST SUBMITS COMPETING BID OF UP TO $43 BLN FOR CO

The press release somewhat answers that question, while also raising others:

In the after-market hours on July 12, 2024, Apex Capital Trust, a conglomerate of financial institutions and financial services providers, submitted a competing offer to purchase Paramount Global shares (“Paramount”). The economic terms of the competing offer submitted by Apex include an all-cash offer with a total commitment of up to $43 Billion.

The offer was sent to National Amusements, Inc. (“NAI”) and to an investment firm retained by the Special Committee of Paramount’s Board on an exclusive basis to facilitate the “go-shop” provision of Paramount’s agreement with Skydance. Under the “go-shop” provision, Paramount has until August 21, 2024, to identify and evaluate competing offers that could be superior to Skydance’s deal.

Apex says it has “also committed to infusing approximately $10 Billion into Paramount’s working capital post-closing for purposes of implementing its business plan for Paramount designed to achieve the following strategic goals” (our emphasis):

— Content creation, acquisition, protection and monetization

— Cutting-edge innovation, technology, and AI, including quantum computing

— Consumer focus

— Global expansion

— The hiring of additional team members

Sure, OK.

The release says:

Apex Capital Trust is a multinational holding company and a qualified institutional investor in key finance and fintech sectors. Apex holds a significant stake in banks, credit unions, trust companies, escrow and trustee services providers, investment advisory, financial and tax planning companies, corporate management and fiduciary services providers, fund administrators, credit card processing centers, cryptocurrency issuer, blockchain technology and digital asset management company, financial literacy program provider, identity theft protection company, and actively producing gold mines in the US, Canada, and Mexico.

Banks, crypto, blockchain, gold mines and, uh, financial literacy.

It adds:

Apex Trust has acquired 40% ownership of Simmtronics, a multinational technology company manufacturing phones and other electronic devices, ranked #3 worldwide in tablet PCs, after Apple and Samsung

FT Alphaville has to admit we hadn’t heard of Simmtronics, and was surprised to hear Huawei has given up the tablet bronze medal with so little fanfare. After some searching, we weren’t much the wiser: Simmtronics appears to be a New Delhi-based wholesaler of random access memory sticks.

Readers who, quite understandably, want more information are directed to an interesting selection of links:

apexcapitalbank.com was registered last year, and describes the group as “your trusted partner for all your banking needs”.

Whether you are looking for a checking or savings account, loan, or investment and wealth management services, we have the expertise and resources to help you achieve your financial goals.

Its ‘about us’ page, oddly, also makes the case for the advantages of having a sovereign bank, which is cool we suppose, if a bit random:

Perhaps most eye-catching is the link to Norton LifeLock, a piece of anti-identity theft software. Very reassuring!

The final link is the email for Tatiana Logan, Apex Trust’s general counsel. Or, at least, it’s looks like her email — the press release misspells “capital” as “captial”.

Apexcapitalmegatrust.com, with the correct spelling — registered via GoDaddy’s free website service last Tuesday — seems… low budget. If you can’t be bothered to navigate to it, it’s literally just this and an email signup box:

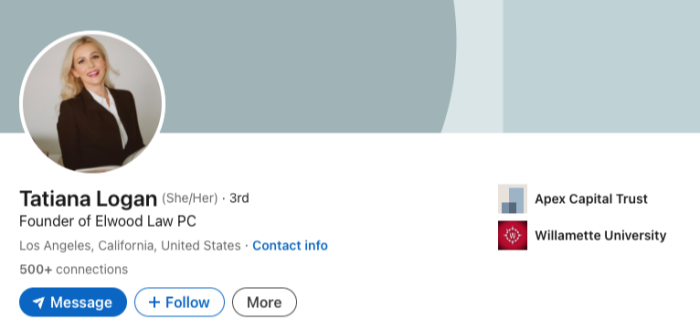

So far, so good. Who is Logan? Well, according to what appears to be her LinkedIn…

…she’s a lawyer, originally from the “Russian Far East”, who seems to have worked a fair bit in cannabis M&A, and has been Apex’s general council for *checks notes* almost a whole month:

She’s also the founder of Elwood Law PC, “offering strategic counseling services to business owners”.

Logan’s bio on the page for a… blockchain? healthcare? event? (h/t MainFT’s Josh Spero)… hosted in 2022 sheds some light on the company name, which it says is:

a subtle shoutout to Elle Woods of Legally Blonde

Elwood Law’s website — which claims Logan was “Named ‘Best Lawyer’ from 2014–2021” — lists former clients including Lavinia Cannabis Lubricant.

There have been had plenty of twists and turns in the Paramount sale saga, and this could possibly prove to be one of them.

We have reached out to Logan, and will update if she gets back to us.