Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

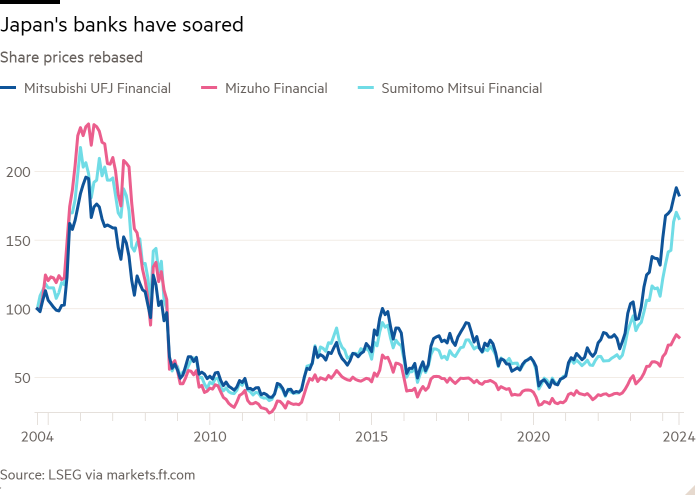

It is quite something when some of the most boring stocks in Asia put in a burst of outperformance that outstrips even many local tech names. But Japan’s banks, for years among the least volatile investments in the region, have staged a dramatic revival this year.

The Bank of Japan’s decision to increase interest rates pushed shares of the biggest banks higher still, by more than 4 per cent on Wednesday. The move is a clear signal that it will now maintain its push to unwind a decade of ultra-easy monetary policy.

The central bank’s board decided to increase the policy rate to around 0.25 per cent from 0-0.1 per cent. It also laid out a detailed quantitative tightening plan that will reduce monthly bond buying in several stages to about Y3tn ($19.6bn) as of the first quarter of 2026.

That provided another boost for shares of Japan’s largest lenders including Mitsubishi UFJ Financial Group, Mizuho Financial Group and Sumitomo Mitsui Financial Group, bringing gains of the latter, for example, up 60 per cent in the past year. Trading at just around tangible book value, their valuation has nearly doubled over the past two years. That reflects investors’ growing hopes that the sector had passed a turning point — especially since March when the BoJ lifted a negative interest rate policy and ended equity purchases and yield curve controls.

Just one rise may not have been enough to convince more cautious investors, harbouring memories of an eight-year stretch of negative interest rates and 17 years without a rate rise. Indeed, for some lenders including Mizuho, shares remain about two-thirds below their 2006 peak, having languished for more than a decade up until last year.

But this second rate increase, and the governor’s comments that the central bank will continue raising rates if economic conditions develop as forecast, offers more reassurance.

Expectations of further rate increases are rising, as are expectations of higher inflation and wages. Japan’s biggest companies agreed to raise wages by 5.28 per cent for this year, the steepest pay increases in more than three decades, which should boost household spending and economic growth. Each 1 percentage point increase in domestic interest rates equates to an earnings boost of about ¥3tn ($19.7bn) to local lenders, according to central bank estimates.

Even before the rate rises, profits at Japanese lenders have been improving since last year on fatter loan margins and growing total assets. All that means room for further upside for the country’s banks.