Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Airbus reported a sharp drop in second-quarter profits as previously announced charges in its space business and persistent supply chain challenges weighed on the performance of the European aerospace and defence group.

The world’s largest plane maker said adjusted operating profit fell more than half to €814mn in the quarter, while revenues rose marginally to €15.9bn.

Airbus said it had recorded a charge of €989mn against its space business, higher than the €900mn estimate it had announced last month alongside a profit warning.

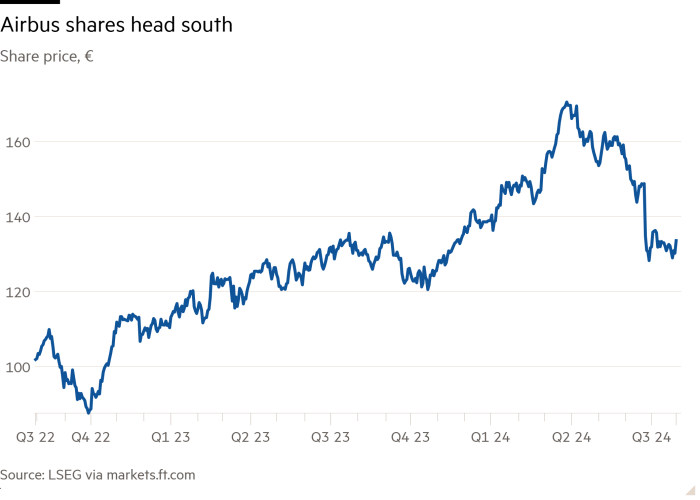

The company spooked investors in June when it cut its annual profit forecast and lowered its full-year commercial aircraft delivery target, citing a degraded operating environment and problems in its space business.

The warning triggered a sharp sell-off in Airbus shares, wiping more than $10bn off its market value the day after the announcement. Its shares are now trading more than 5 per cent down year to date, closing at €133.58 a on Tuesday.

Guillaume Faury, Airbus chief executive, on Tuesday said the company’s financial performance in the first six months of the year “mainly reflects significant charges in our space business”, adding the company was “addressing the root causes of these issues”.

The company has initiated a review of long-term programmes in its space systems unit, and has reassessed timelines and risks for each. It is also evaluating all strategic options including “restructuring, portfolio review, co-operation and M&A” for the division.

Airbus has held exploratory talks with Thales about merging some of their space activities.

In its key commercial aircraft division, Airbus has launched a cost-savings programme called Project Lead to ensure the company is as “cost efficient” as it can be as it seeks to deliver its ambitious plans to meet resurgent demand from airline customers.

The company continues to struggle with shortages of critical components including aircraft seats and landing gears, as well as engines from Pratt & Whitney and CFM International, both of which supply the best-selling A320 family of jets.

Airbus will deliver “around 770” commercial aircraft this year, down from a previous forecast of 800. It has also pushed back its target of producing 75 a month of its A320 family of aircraft from 2026 to 2027.

Airbus on Tuesday said it delivered 323 planes in the first six months of the year, including 261 A320s, up from last year’s 316.

The production problems are hampering airline plans to revamp their fleets, forcing many to fly older, less fuel-efficient jets for longer. Earlier on Tuesday, Air New Zealand cited delays in producing new planes and a lack of alternative fuels among reasons for scrapping its 2030 carbon emission reduction target.

The airline said it was working on a new short-term target, adding it remains committed to an industry-wide goal of achieving net zero emissions by 2050.

Airbus on Tuesday stuck with its new financial guidance, released last month, that it expected adjusted earnings before interest and tax of €5.5bn for the full year, down from a previous forecast of as much as €7bn. Free cash flow before customer financing will come in at about €3.5bn, down from about €4bn.