Shortages of rare nuclear isotopes that rapidly shrink tumours threaten to undermine the development of breakthrough treatments in which health companies have invested billions of dollars, experts in the nascent radiopharmaceuticals field have warned.

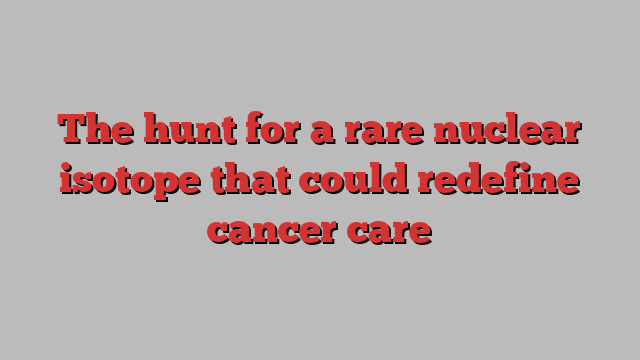

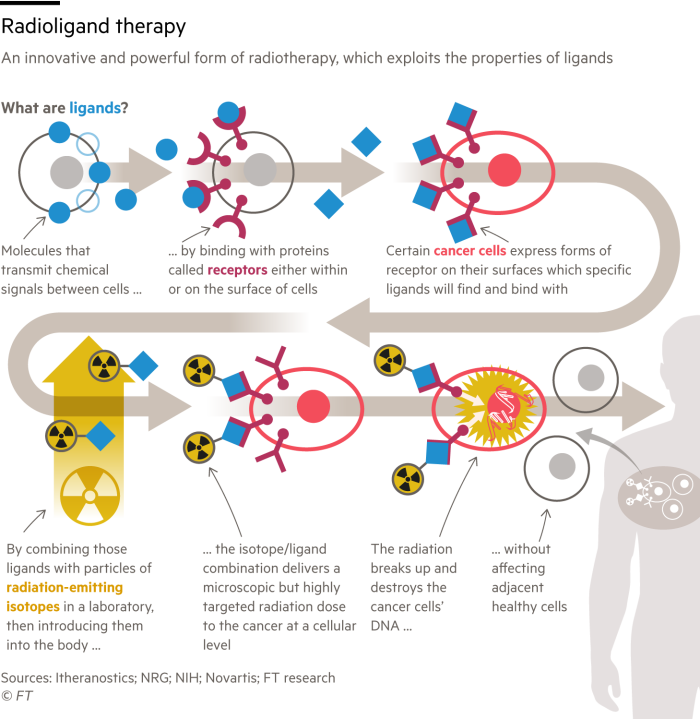

By combining a nuclear isotope with an antibody, the microscopic drugs — also known as radioligands — deliver a toxic payload directly to cancer cells. But actinium-225, the most common isotope used in the experimental treatment, whose decaying protons and neutrons emit powerful “alpha” radiation, is in increasingly low supply.

Reliant largely on dwindling supplies from Soviet and American cold war-era stockpiles of precursor radioactive materials, companies have struggled to obtain enough actinium to treat the thousands of patients being enrolled in clinical trials.

But they are betting that this highly targeted form of radiotherapy could become the next big innovation in cancer care if they overcome these supply chain challenges. With half of all cancer patients receiving traditional radiation therapy, radioligands have the potential to offer a more powerful treatment with fewer side effects to millions of patients.

Jeff Legos, global head of oncology at Novartis, said radiopharmaceuticals could become “a mainstream therapy” tackling the “big traditional cancers”, which make the disease the leading cause of death worldwide. Morgan Stanley analysts predict the radiopharma market will be worth $39bn in sales by 2032, up from $7bn in 2022.

The rollout of Novartis’ Pluvicto drug, which became its second approved radiopharma treatment in 2022 and is mainly being used to target prostate cancer, was hampered by shortages of lutetium, another isotope. While those issues have now been resolved, the industry is facing other bottlenecks — especially with actinium-225.

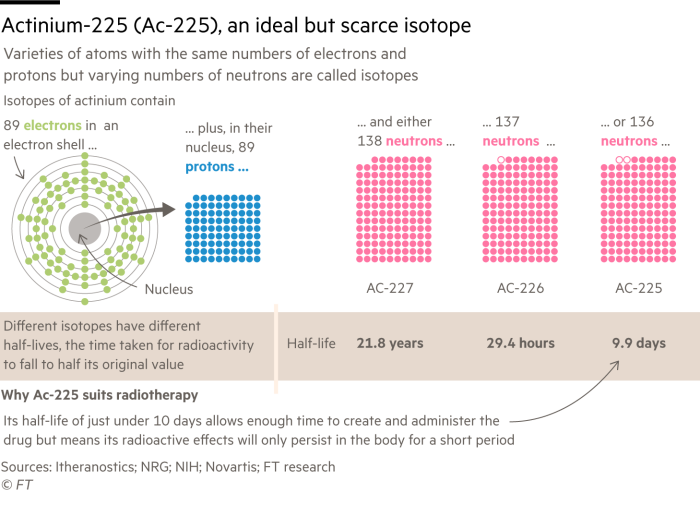

As actinium-225 is not naturally occurring, medical suppliers are having to hunt far and wide for starting materials from which they can extract the isotope.

British start-up PanMediso approached the UK’s Nuclear Decommissioning Authority about gaining access to decommissioned nuclear submarines as a source of radium-226, a precursor for actinium-225, but the talks fell through, according to people briefed on discussions.

Radiopharma biotech RayzeBio, which was acquired by Bristol Myers Squibb for $4.1bn this year, was forced to pause patient enrolment in a late-stage trial of an actinium-based cancer drug for several months before restarting this month.

Actinium’s “big cannonball punch” of radiation and a 10-day half-life, meaning its radio waves are quickly cleared from the body, made it the ideal cancer treatment, said Chris Levesque, chief executive of TerraPower, the Bill Gates-backed nuclear engineering company, which started commercial production of the isotope this year. “Nature couldn’t have planned it better.”

The rush for actinium-225 starting materials has disrupted the market. In 2019 Eckert & Ziegler, a German isotope supplier, tried to pay a nuclear waste company to dispose of radium, but the parties could not agree on a price, according to people close to the company.

A gramme of radium can create 1 curie — a measure of radioactivity named after pioneering French chemist Marie Curie — of actinium which can treat about 1,000 patients. That could be worth up to $10mn now, the people said.

“Companies would pay anything to get hold of actinium starting materials, but there are no willing sellers, everyone is hoarding what they have,” said John Carney, chief executive of Itheranostics, which advises pharma groups on nuclear medicine supply. Bristol Myers Squibb, AstraZeneca and Eli Lilly have spent nearly $8bn between them in the past year on acquiring biotechs with lead drugs based on actinium-225.

Industry estimates suggest there are no more than 2 curies of actinium-225 available each year worldwide. Actinium-225 for clinical trials is either sourced from Russia’s state-owned nuclear agency Rosatom or from dwindling US energy department reserves of thorium-229, which can be used to create actinium-225 in its decay process. Medical materials are exempt from the sanctions regime imposed on Russia after its invasion of Ukraine.

But these supplies are running out and now pharma groups are looking elsewhere for starting materials — and even exploring alternative isotopes, such as Lead-212.

“While actinium production methods are very well characterised, it never needed to be done at a large scale until today,” said Aryeh Sand, an investment banker at Solomon Partners who has advised on more than 10 radiopharma deals. “We have to now scale up those activities. Isotope production even with less complex starting materials is just tough, it’s not for the faint of heart.”

Most of Eckhert & Ziegler’s radium-226 supplies come from disused brachytherapy equipment — a rudimentary form of cancer treatment pioneered by Curie which involved injecting radioactive materials directly into a patient’s body. The company then uses a particle accelerator known as a cyclotron to blast the isotope with a proton beam to transform it into actinium-225.

Jay Simon, Eckhert & Ziegler’s chief operating officer, said the company had been approached by many pharma and biotech groups but it had been cautious about committing to new supply agreements until it was “more definite” about the speed at which it could deliver.

Levesque expected TerraPower would be able to produce enough actinium for 500,000 radioligand doses a year by 2030, but he said that “isn’t really enough” for a market that could eventually treat more than 50 types of cancer. TerraPower extracts actinium-225 from decaying thorium-229, which it purchased from the US government.

The intense procurement focus on actinium-225 — long heralded by researchers as the ideal isotope to attack cancer cells — means it could still become the go-to material to drive the radiopharma revolution, Levesque said.

But If supplies of actinium-225 cannot be swiftly increased, some predict a rush to other materials such as lead-212, which releases “beta” radiation that is less powerful but causes fewer side-effects.

“It’s very possible that companies will start to see the merits of lead-212 both in terms of supply chains and toxicity, as it deposits more of the isotope in the tumour,” said Itheranostics’ Carney.

“There is an alternative to actinium if pharma decides to push that button.”

Illustrations by Ian Bott