The market for rough diamonds for jewellery is suffering one of its worst downturns as consumers switch to factory-made stones because of the plunge in prices.

But now, the direction of the $83.5bn market may be set to turn with some forecasting a recovery in rough or natural stones as lab-grown prices have fallen too far.

They believe the sliding prices of mass-produced factory diamonds will spark a profitability crisis for retailers that will prompt them to promote stones dug out of the ground.

“We are getting to a pivot point where the profitability of retailers selling lab-grown is a lot less than it was in the previous three to five years,” said Paul Zimnisky, an independent industry analyst.

“This could be a catalyst to returning to natural diamonds. Retailers aren’t loyal to lab-grown or natural diamonds, they’re loyal to making money.”

The world’s biggest diamond miner De Beers — which flagged last week that it would cut production further to cope with torrid market conditions — backs this view.

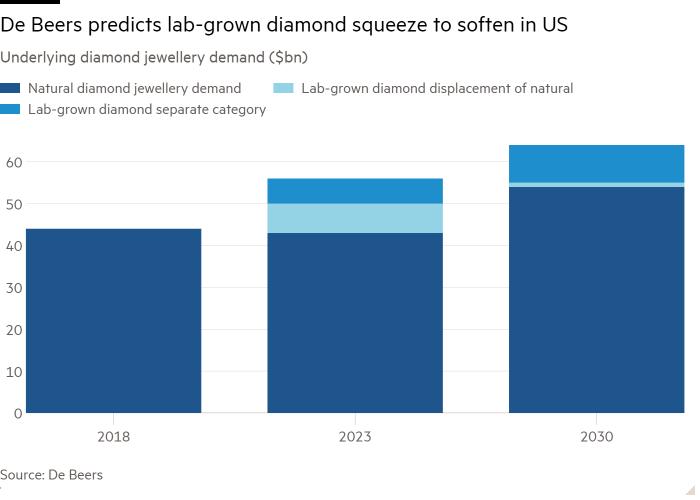

It expects the market share of lab-grown diamonds to plummet 20 per cent from $13bn to $10bn by 2030, with prices dropping as consumers start to view them as cheap fashion jewellery rather than precious stones.

De Beers, which draws on research it commissioned the Boston Consulting Group to produce, also estimates the US jewellery market for mined or rough diamonds will expand from $43bn last year to $54bn by 2030.

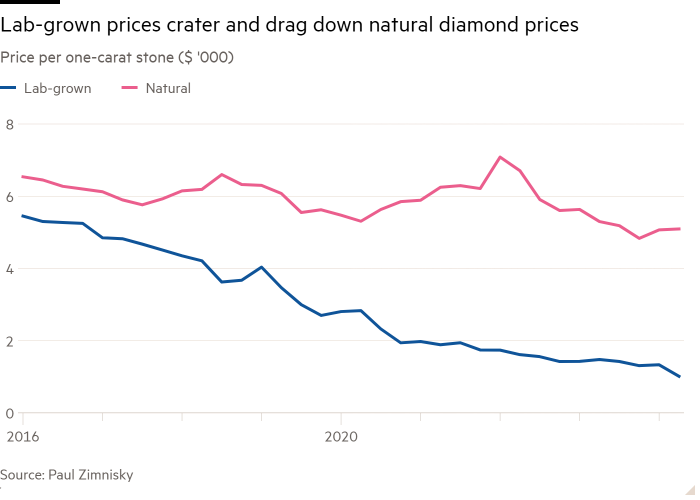

The diamond market has been turned on its head by the fall in prices for factory-made stones. Lab-grown diamond prices now cost a fifth of what they did in 2016 at $1,015 per one-carat stone, analysis by Zimnisky shows.

Five man-made stones can be bought for the price of one natural diamond, which have fallen almost 30 per cent to $5,000 per one-carat since the start of 2022 — one of its biggest market collapses in the past 25 years.

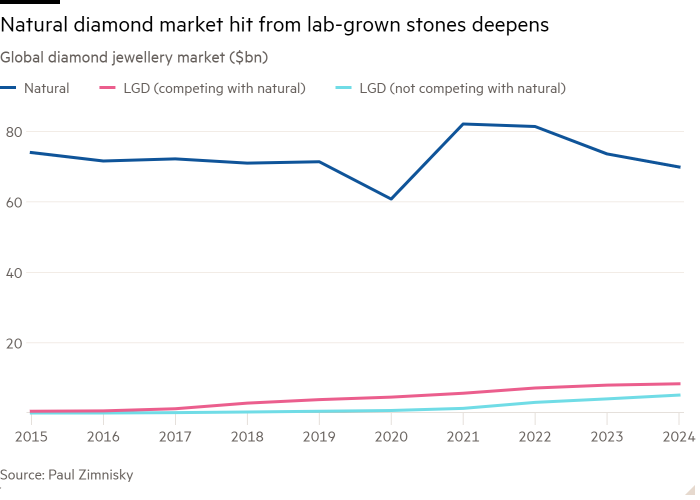

Lab-grown diamonds are forecast to surge to $13.6bn of jewellery sales — 16 per cent of the overall market — this year, up 12 per cent on last year as mass manufacturing has driven costs down, according to Zimnisky.

In contrast, diamond jewellery that use stones from mines spanning the globe from Botswana to Russia is on course to shrink 5 per cent this year to $69.9bn, although it is still 84 per cent of the overall market.

“The investor presentations by the mining companies show the upward curve of demand and decline of supply but the truth is with lab-grown [stones] taking a chunk of the market, it has changed the economics of diamond mining,” said Avi Krawitz, a diamond sector analyst.

Some of the biggest casualties of the rise of the mass-produced factory stone are diamond miners, the largest of which is De Beers by value.

Challenges in the diamond market pushed its owner Anglo American, the FTSE 100 diversified mining group, to announce plans in May to sell or list the company within 18 months as part of its defence against a failed £39bn takeover bid by rival BHP.

Following De Beers in size is Russia’s Alrosa, which has responded to the problems in the gemstone market by diversifying. In June, it bought a gold mine from Moscow-based Polyus.

The winners in the newly shaped industry have been the largest producers of factory made diamonds from China and India — as well as consumers who until now could not afford to buy the precious stones.

The market is also suffering because of a slowdown in spending in China, depressing revenues at De Beers by 30 per cent year on year and prompting a warning from chief executive Al Cook in June that a recovery could be slow and “U-shaped”.

The tumbling profit margins in lab-grown diamonds has led De Beers to suspend its production for jewellery sales, as well as reducing output of mined diamonds by 15 per cent in the second quarter.

Its subsidiary Element Six, which produces synthetic stones, is focusing solely on high-tech applications such as diamond wafers for semiconductors with the aim of doubling revenues by the end of the decade.

One country where the strains are increasing for manufacturers of synthetic stones is India, the global home of diamond polishing and cutting.

Protests by 600 workers at lab-grown diamond producer Bhanderi in Surat turned violent in June over three months of unpaid wages. Bhanderi did not respond to a request for comment.

Even though staff were eventually paid, Bhavesh Tank, vice-president of the Diamond Workers Union Gujarat, said a “recession” was savaging the factory diamond industry as oversupply has hit turnover.

“Diamonds once sold at $500 per carat. Today nobody is ready to buy them at $40 per carat,” he said.

In an effort to re-establish natural diamonds’ allure, De Beers is embarking on a marketing drive with jewellers such as Chow Tai Fook and Signet, which now put labels on lab-grown stones warning they will depreciate as soon as they leave the store.

The industry leader also plans to sell $10,000 machines to retailers to put on shop floors to help consumers identify whether a stone was dug out of the ground or created in a factory.

“Our challenge in the natural diamond space is to drive marketing around what differentiates us from lab-grown diamonds, which is that our products are rare, billions of years old and enduring,” said Richard Duffy, chief executive of London-listed Petra Diamonds, one of the struggling smaller miners.

Others said value preservation still mattered for some consumers, which could help the natural diamond market to recover.

“Indians prioritise products that offer long-term value rather than mere adornments,” said Ajesh Mehta of the Indian government-backed Gem & Jewellery Export Promotion Council.

However, turning the tide in favour of natural diamonds could prove challenging.

Alexander Lacik, chief executive of Pandora, the world’s largest jewellery retailer by volume, which has decided to sell lab-grown diamonds only, thinks miners overestimate retailers’ ability to influence consumers when an identical product is available at a fraction of the price.

“This is an incredibly internal view that all of a sudden the retail industry could impose a product choice on consumers,” he said.

“Ultimately the consumer will vote with their wallet . . . They don’t buy based on the margin of the retailers. When you buy a car, do you pick one because it has a higher or lower margin for the dealer?”