Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Investors’ hunger for obesity drugs is unsatiated. Roche’s share price jumped by 6 per cent this week after the Swiss company announced promising early stage trial data from a potential obesity drug.

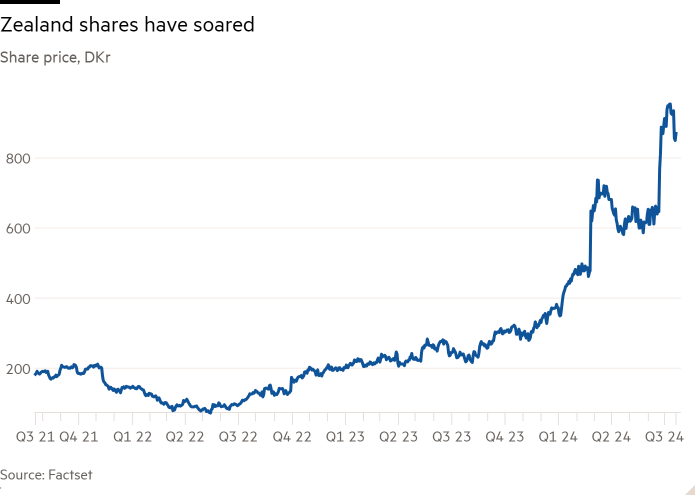

This extreme reaction to a phase 1 trial is a sign of investors’ sensitivity to news about the next generation of drugs vying for a slice of the potential $150bn obesity market. Enthusiasm for Denmark’s Zealand Pharma underlines the point. Positive early stage trial results for obesity drug petrelintide in June helped push the company’s value up by a fifth in the days that followed.

Petrelintide does deserve attention. Based on a hormone called amylin, it has a different mechanism to existing weight loss drugs, which mimic the GLP-1 hormone. Whereas the latter suppresses appetite, amylin promotes a feeling of fullness after eating. Greater enjoyment of food, relatively minor side effects and reduced muscle wastage could all be selling points.

Zealand is not alone in pursuing amylin-based treatments. Eli Lilly, AstraZeneca and Novo Nordisk are all conducting trials. To compete, Zealand needs a differentiated product and a capable partner to manufacture and supply the drug.

Given the size of the potential market, Zealand would not need a huge share to prosper. Jefferies thinks peak sales could reach $10bn. It has upped its probability of success from one in five in February to 60 per cent. It calculates to a corresponding net asset value of DKr365/share NPV, about 35 per cent of its DKr1100 price target. That compares with the current share price of DKr868. Another potential obesity drug survodutide, being developed in partnership with German pharma group Boehringer Ingelheim, could also chalk up $10bn of sales.

Backing Zealand is a volatile business. Trial results suggesting survodutide could be effective against fatty liver disease sent its shares up 26 per cent one day earlier this year. The shares gave up a good chunk of their gains over the following month, as investors took profits. That could happen again, as rivals report trial results. Indeed, after Roche’s trial results this week Zealand’s share price dipped, as did that of its compatriot Novo Nordisk.

Zealand Pharma is doubtless on the radar of acquisitive big pharma companies keen to join the obesity gold rush, although it is not a pure play stock with rare disease drugs also in development. But it is well placed among the runners and riders. Having recently tapped the equity market for $1bn for clinical trials, it has the time and cash to put potential winners to the test.