Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Avant Homes, the housebuilder controlled by the New York hedge fund Elliott, has made a bid to combine with Crest Nicholson, setting up a potential duel for the FTSE 250 company after an earlier offer from rival Bellway.

The board of Crest Nicholson, which builds about 2,000 homes a year, received an offer from private rival Avant in June for an all-share combination, according to people familiar with the deal.

The proposed deal would see Avant — led by former Persimmon boss Jeff Fairbairn — rolled into Crest Nicholson, which would retain its listing with Elliott as its largest shareholder.

Crest Nicholson has put off Avant’s offer, which was first reported by Sky News, after rejecting a £667mn takeover bid from larger-listed Bellway last month. Crest’s board said Bellway’s all-share bid “undervalued” the business and its “future standalone prospects”.

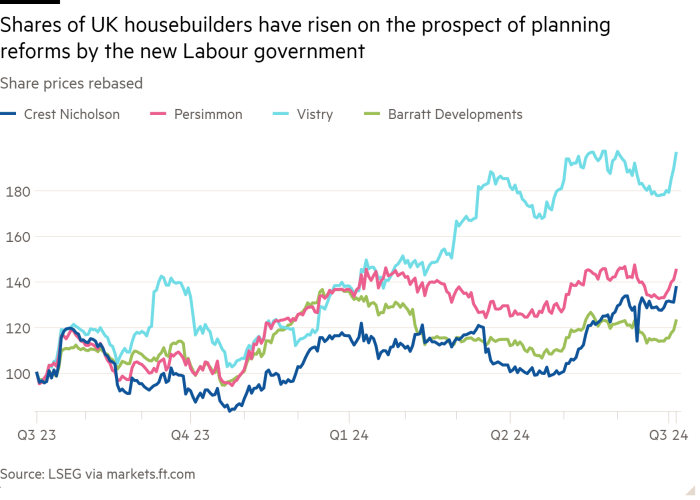

News of the two-way contest for Crest Nicholson comes on a day when housebuilder shares have rallied on optimism that Labour’s substantial election victory will bring swift changes to planning policies and a boost to home building.

The sector has suffered over the past two years as rising interest rates have made it much harder for people to buy their homes. Companies across the industry have slashed their output and made cuts.

Avant has proposed combining the companies on the basis of their net asset value, with current Crest Nicholson shareholders ultimately owning 70 per cent of the combined group.

Elliott has backed Fairburn to run Avant. Fairburn is a well-known figure in the industry. Chief executive of Persimmon from 2013 to 2018, he left the company after controversy over a proposed £110mn bonus, which was ultimately reduced.

“We see the logic for Avant Homes’ interest given that it would facilitate a public listing,” said Aynsley Lammin, analyst at Investec. But he said: “There is room for Bellway to come back with a higher offer.”

A deal with Bellway would result in a larger combined group at a time when housebuilders are increasingly seeking scale to weather the market downturn and absorb higher overheads from the slow planning process.

Barratt made a successful bid for Redrow earlier this year, in a £2.5bn deal that would consolidate its position as the UK’s largest housebuilder. Persimmon is in the running to acquire another private group, Cala Homes, which is being marketed by L&G.

Bellway has until late next week to make a fresh bid. Bellway, Crest Nicholson, Avant and Elliot declined to comment.