Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

European airlines should be flying a little higher. After much to-ing and fro-ing, the EU this week gave the green light to Lufthansa’s bid for 41 per cent of troubled Italian airline Ita. The sector’s long, slow and necessary journey towards consolidation has accelerated ever so slightly.

True, between them they will need to dispose of slots and routes to preserve competition on key European and international routes, and the EU will need to verify that this has been done. But, at least on the face of it, such remedies look manageable. For instance, Lufthansa will need to sell 15 daily landing and take-off slots at Milan’s business airport of Linate. That is out of a current total of about 85 flights a day, according to data collected by Bernstein. All in all, remedies affect about 1 per cent of Ita’s revenues, said its chair Antonino Turicchi.

That the EU decided not to throttle this deal is good news for other legacy flag carriers seeking consolidation. IAG, for instance, is awaiting clearance to complete its purchase of Spain’s Air Europa. It has proposed shedding slots equivalent to about half the target’s flights. Air France-KLM has agreed the acquisition of 20 per cent of SAS. Portugal’s TAP is seen as a potential candidate for tie-ups.

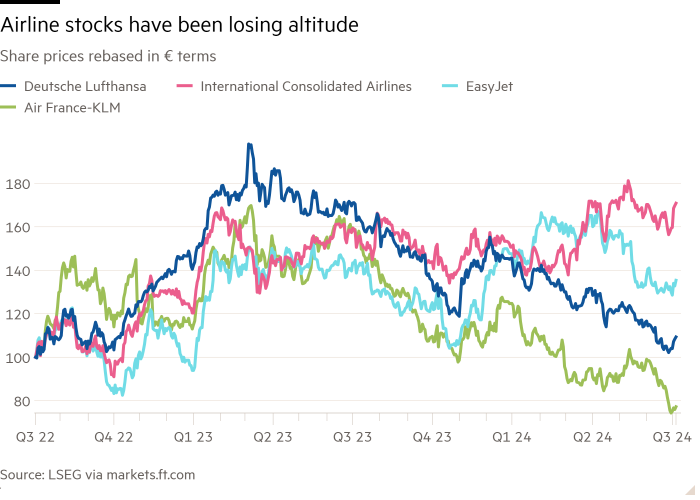

For long-suffering shareholders in legacy airlines, consolidation is desperately needed. The value lies not so much in cost savings, although Lufthansa references aircraft and fuel purchases among potential benefits. It lies in the ability to feed more passengers into hub airports — like Heathrow, Frankfurt or Rome — and from there on to the US, Asia or destinations in the southern hemisphere.

Regulators are, of course, keen to preserve competition in European skies. But it is hard to accuse local airlines of benefiting from a dominant market position. The European market remains more fragmented than in the US, with the top four carriers flying 46 per cent of the flight schedules compared with 72 per cent stateside. Indeed, even at this time of resurgent demand and high fares, operating margins at KLM and Lufthansa remain in the mid single digits. US airlines such as United Airlines and American Airlines are faring slightly better, with high single-digit operating margins.

European skies are a lot less crowded for airline groups today than in 2003, when the continent had 180 operational carriers. But, for sector investors, there is still a way to go.