Sarah Freedman started shopping at Abercrombie & Fitch as a 12-year-old in 2007 but by the time she was in high school the brand had fallen out of vogue with her fashionable Manhattan peers.

After a long absence, she has been drawn back to Abercrombie after seeing social media influencers tout the US retailer’s rebrand. Now 30 and a US size 16, Freedman finds that few stores carry clothes that fit her so well. Abercrombie also offers “more bang for my buck” at a time when she has become much more selective about her clothing spending, she says: “I’m telling everyone to go shop at Abercrombie.”

Freedman’s conversion helps explain how Abercrombie, a star of early-2000s malls whose preppy styles and high prices eventually fell out of favour, has pulled off the rarest of retail comebacks. Over the past year it has become one of the US stock market’s strongest performers, with its shares outpacing those of Nvidia, the chip company that has led the market rally.

“This is a whole new business,” said Corey Tarlowe, an analyst at Jefferies. “What you’re seeing now are the fruits of years of labour to reinvent that brand.”

The retailer once prided itself on being an exclusive brand that sold logo-adorned polo shirts to “cool and popular kids”, as former chief executive Mike Jeffries said in 2006. While exclusionary branding worked in the early 2000s, it soon became a recipe for a disaster, and allegations of discrimination and sexual exploitation followed.

The company officially started its turnaround when Fran Horowitz took over as chief executive in 2014 and rebranded both its Abercrombie & Fitch and Hollister labels. It now markets its namesake brand to millennial and Gen Z shoppers of a variety of sizes, offering stylish clothing they can wear at work, at home or even at weddings. Hollister, its second brand, caters to today’s teens.

“We inspected every piece of this business,” chief financial officer Scott Lipesky told the Financial Times. “We have totally transformed every aspect of the company.”

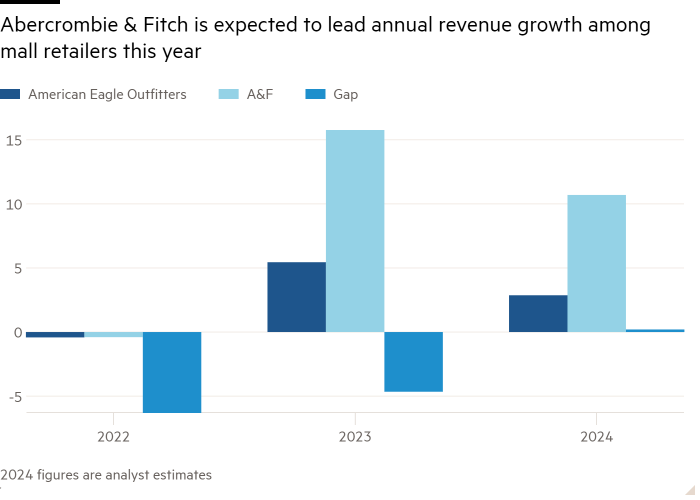

Abercrombie expects annual net sales growth of 10 per cent this year, making it an outlier among its peers. Last year, its top line grew by 16 per cent even as other apparel retailers were saying that discretionary spending had softened.

Analysts expect Abercrombie to sustain the momentum this year even as consumers tighten their belts. But its on-trend and well-fitting products are only part of the reason: they also credit management with a behind-the-scenes inventory strategy that has let it make the most of its revived popularity.

“Abercrombie and their merchants have anticipated consumer trends and met them,” said Greg Portell, a lead partner at the consultancy Kearney.

“We hear a lot about retailers looking and collecting consumer insights, investing in knowing their consumer,” Portell added. “But being able to execute on that at scale, at pace, is still the greatest challenge in retail.”

Jessica Ramírez, an analyst at JHA, said that Abercrombie now offers more tailored and “core” items, which include basics such as T-shirts, button downs and suiting separates, making it less dependent on seasonal items that are more likely to be marked down.

While Abercrombie has seen viral success with its “Sloane” tailored women’s trousers, a trend that fashion forecasting company WGSN said first emerged about five years ago, it has continued to diversify its offering rather than rely on a few popular items.

“What we want is a balanced assortment,” said Lipesky. “If you get over-pitched in a certain category . . . it can be really good if that category is performing or it can be really bad if that category pulls down.”

Abercrombie started managing its inventory more tightly after pandemic lockdowns closed stores temporarily in 2020, Lipesky noted. The company soon realised it could be more productive with less inventory by working with vendors on quickly “chasing” or ordering styles that are selling well.

Depending on the category, Abercrombie now places orders a few months or weeks in advance, compared with the traditional industry standard of about nine months ahead of time.

“The customer is moving quicker than ever, the industry moves quicker than ever and therefore your inventory process has to be as agile and nimble as ever,” Lipesky said.

Abercrombie reported fewer promotions in the first quarter that helped it raise its gross profit margin from 61 per cent a year earlier to 66.4 per cent. Rivals Aritzia and American Eagle Outfitters, by contrast, reported gross profit margins of 38.3 per cent and 40.6 per cent respectively for the quarter.

“The best merchants in this space don’t rest too long on what’s already proven to be a popular trend . . . [they] buy lightly on what will work or be popular,” said Dylan Carden, an analyst at William Blair.

Abercrombie has also focused on fit and finish, which Mark Cohen, a Columbia Business School professor and former Sears Canada chief executive, said has been a winning strategy.

“Making sure the merchandise fits . . . that has been the downfall of many brands that create good looking stuff that no one could wear,” said Cohen.

Better-fitting items have not only drawn in plus-sized customers. Sabrina Ramkhelawan, 30, said that even as a US size 0 she has struggled to find clothes that fit well elsewhere.

“If I can’t even fit it, who’s it for?” Ramkhelawan asked, adding that the fit of Abercrombie’s clothes had made it her go-to clothing store since 2021.

Joey Yu, 24, said he started shopping at Abercrombie last year for the first time since high school after noticing that it sold fashionable styles that he sees on TikTok for a reasonable price.

“Abercrombie does a good job of balancing trend and style but also quality and comfort of the clothes,” he said, adding that the brand had beaten Uniqlo and PacSun to become his primary retailer.

Despite persistent inflation, Lipesky said Abercrombie had been able to add higher priced products to its assortment that consumers have embraced.

“We’re selling dresses at prices we haven’t seen in the past but its because we’ve earned the right to sell those to our customers,” he said.

After re-establishing itself in its home market, Abercrombie is now looking to push overseas. Its business in Europe and Asia combined represented under 20 per cent of its net sales in the first quarter, but grew even faster than its US business.

It is now building teams in Shanghai and London to “localise its assortments”, Lipesky said.

“The company is in a really good place to launch global growth,” he said. “That’s what is next for us.”