Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The private capital manager’s best friend these days has become the bank regulator. Tightening standards on capital requirements and risk-weighted assets is forcing deposit-taking institutions to make tough choices on their balance sheets.

Waiting in the wings are the Masters of the Universe. Private capital firms have, for example, been acquiring loan books or injecting equity directly into banks in order to take advantage of the turmoil in the banking sector.

Alternative asset managers have another more exotic trick up their sleeves — “significant risk transfers” (SRT). In an SRT, a bank earns capital relief by shifting the risk of some set of loans to a private capital counterparty. Often, in a “synthetic” deal, the underlying loans stay on balance sheet but through the use of derivatives the loss risk is shifted.

In one such SRT, Blackstone’s hedge fund unit has taken on exposure to so-called “subscription lines” — borrowings that temporarily fund the equity portion of leverage buyouts.

While risk is being transferred in SRTs, so is reward. Private capital firms then get the upside of these lending activities, perhaps enhanced by leverage. In benign environments, the returns that these opportunistic private capital firms earn get the attention. What is less understood for now is how any ultimate losses will filter through the financial system.

Banks should be wary of carrying risk due to their high leverage (assets to equity of 10:1 or more) and deposits that are unstable in times of stress. Asset managers theoretically solve those two challenges, albeit with a higher cost of capital.

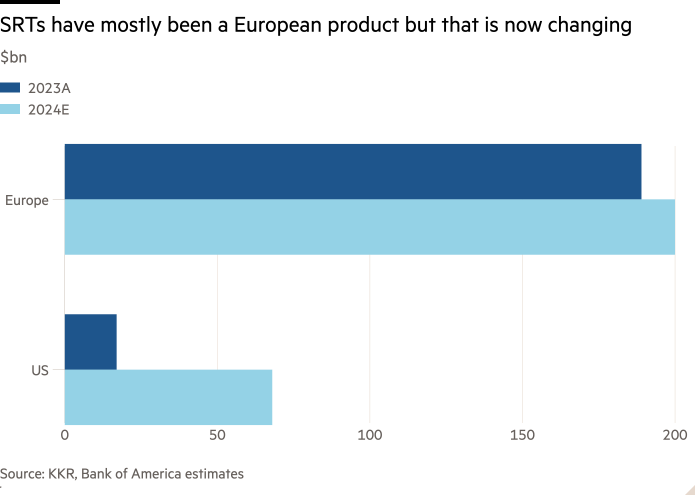

SRT trades have traditionally been more popular in Europe, according to data from Bank of America compiled by KKR. But the US is catching up quickly, amid unease among regional banks and the effects of the Basel endgame reforms which could boost capital requirements for US banks.

These deals, at small volumes, have happened for years in Europe, where each transaction is vetted by regulators to ensure there is a genuine transfer of risk.

But the US market is developing at speed. If banks themselves are offloading assets to meet heightened risk weights, the question becomes why are they even originating credit when the ultimate holder is some third party not facing similar constraints. Banks can still generate fees from customers but it is unclear if that is enough to generate a healthy return on equity capital without net interest income.

Policymakers are directly or inadvertently fuelling the rise of the asset manager lender, the consequences of which are not known.