Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Just when BYD seemed to have no more records left to break in China, it has hit another high. China’s biggest maker of electric vehicles sold a record number of electric and hybrid cars in the second quarter, closing in on the sales of the world’s top EV maker, Tesla.

Investor focus has been on whether BYD can overtake Tesla by sales once again, as it did in the last quarter of 2023. But the more important question is how the rising competition between BYD and the rest of its Chinese rivals plays out this year.

BYD’s EV sales grew more than a fifth in the June quarter, a period when Tesla is expected to report a drop in deliveries. For the month of June, Tesla shipments from its factory in Shanghai fell, according to data released by China’s Passenger Car Association on Tuesday, adding to declines in May.

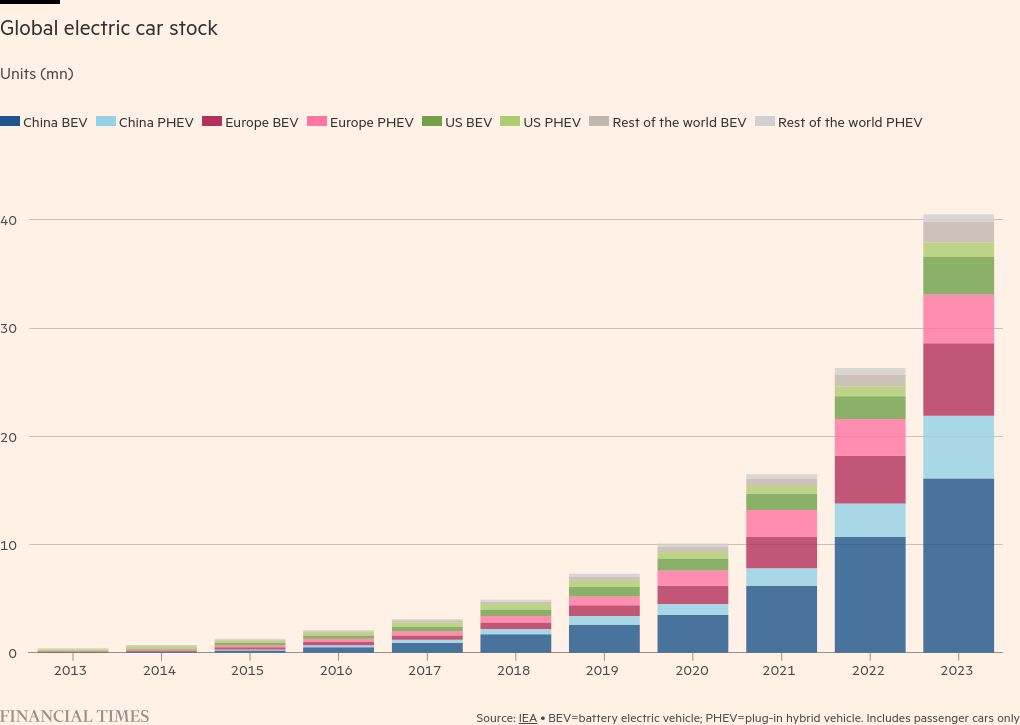

This tells a slightly different story from the general market narrative: that EV sales were slowing globally and all EV makers would be hit.

Sales in China of new energy vehicles, which includes battery EVs and plug-in hybrids, have been growing, accounting for nearly half of total car sales in May, hitting a monthly record. That means China, which accounts for 60 per cent of global EV sales, is becoming an increasingly important market for the world’s automakers. Here, BYD is not the only one that is increasing market share. Domestic battery EV makers Zeekr and Nio are also catching up much faster than expected.

The latter’s vehicle deliveries more than doubled in the second quarter, outpacing rivals. The common theme is that these two makers had a head start in equipping their EVs with intelligent driving technologies. That highlights growing preference for smart EVs, adding another element to the competition that until now has been mostly about price and battery capacity.

Shares of BYD are up 27 per cent this year, outperforming global peers. Still, shares trade below 18 times forward earnings, at a steep discount to Tesla’s 76 times, in part reflecting concerns that EV sales growth was running out of steam around the world.

The latest sales figures show that, even as demand slows, not all makers will be hit equally. And for BYD, Zeekr and Nio may turn out to be the bigger threat to the group holding its market position than Tesla.