Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Subscribers can sign up here to get it delivered every Monday. Explore all of our newsletters here.

Does the format, content and tone work for you? Let me know: [email protected]

One deal to start: BlackRock has agreed to buy Preqin, a UK private markets data group, for £2.55bn in cash, as the world’s largest money manager presses harder into alternative assets and makes its first foray into financial information provision.

In today’s newsletter:

-

Supporting UK innovation with domestic capital

-

Boaz Weinstein’s campaign at BlackRock falls short

-

How private equity has shaped the UK economy

UK start-ups turn to Silicon Valley to fill void left by risk-averse pension funds

Matthew Scullion is crystal clear that the turning point for the UK software company he founded was when it won the backing of two US venture capital firms.

In 2018, Scale Venture Partners and Sapphire Venture led a funding round in Matillion, then a seven-year-old start-up headquartered in Manchester.

UK investors contributed a small amount, but Scullion credits the injection of Silicon Valley cash and knowhow for helping propel Matillion into a select club: one of the UK’s unicorns, or private companies worth at least $1bn.

“[The US venture capital firms] want me to build the biggest company I can and to die trying,” explains the 45-year-old entrepreneur.

Scullion is part of a group of City executives, business leaders and investors pursuing a radical reboot of Britain’s capital markets to reverse a multiyear decline in listings and turn start-ups into global champions.

In this deep dive, Michael O’Dwyer and I explore how the entrepreneur’s experience growing Matillion exposes many of the challenges they face.

They include convincing often wary domestic pension funds to back start-ups and developing more investment funds with the nous, record and ambition to help entrepreneurs build their businesses.

For Sir Jonathan Symonds, chair of FTSE 100 drugmaker GSK, lifting investment in high-growth private companies is a prize worth fighting for.

“We have a wonderful life sciences industry and one of the largest pools of capital in the world with our pensions industry, but they’re parallel universes,” says Symonds, who fears that future generations of retirees will be denied the financial rewards of UK innovation.

“We’ve got to support UK innovation with UK capital,” he adds. “What we want is the UK, in its broadest form — individuals, companies, regions, universities — benefiting from or participating in the success of UK science and innovation.”

Read the full story here in which we explore how fixing the listed markets, transforming the UK pension industry and growing more unicorns are all connected.

“You can have as good a public market set-up as you like,” says Scullion. “But if you don’t have companies to take public in the first place, then all of that’s for zip. The single most important thing we need to do is to learn how to build consequential companies as a matter of course.”

In case you missed it, here’s our earlier piece on the club of City executives plotting a revival of the UK’s capital markets, and our FT Film on what is being done to improve the City’s competitiveness as an international capital market.

Boaz Weinstein vs BlackRock

Hedge fund manager Boaz Weinstein has been on the warpath against BlackRock, the world’s largest asset manager, and the wider $250bn closed-end fund industry.

Weinstein’s Saba Capital put forward candidates this spring to join the boards of 10 closed-end funds managed by BlackRock, with a combined market value of about $10bn, write my colleagues Brooke Masters and Costas Mourselas.

But he has suffered multiple setbacks in his effort to take charge of the series of BlackRock closed-end funds, as shareholders rejected his director nominees and voted to retain the funds’ manager.

Saba argued they had underperformed competitors and managers failed to close the gap between the funds’ prices and the value of its underlying assets. The New York-based hedge fund had also sought to terminate BlackRock’s management contract at six of them.

But BlackRock on Friday announced that shareholders at eight of the funds had retained the BlackRock directors and five termination attempts had failed. Two funds have delayed their voting deadline to July 16 to try to reach a quorum.

Closed-end funds issue a fixed number of publicly traded shares and use investor capital to buy assets. Unlike traditional mutual funds, they do not allow investors to redeem at the funds’ net asset values, meaning that discrepancies can open up between the share price and the value of the underlying assets.

New York-based Saba has $5.8bn invested in 200 closed-end funds and often pushes managers to shrink valuation gaps by buying back shares or converting funds to an open-end structure that allows redemptions.

Saba has also bought up stakes in UK investment trusts, including Baillie Gifford’s Scottish Mortgage Investment Trust.

This is a type of investing vehicle that is structured as a public company, with similar features to US closed-end funds.

Investment trusts are struggling with a slump in investor interest because of the proliferation of alternative options and the increased attractiveness of cash products as interest rates have risen.

Last week, UK-listed investment trust Alliance Trust announced a merger with its smaller rival Witan Investment Trust, creating one of the largest domestic investment trusts with assets of £5bn and marking the latest in a number of consolidations in the sector.

Chart of the week

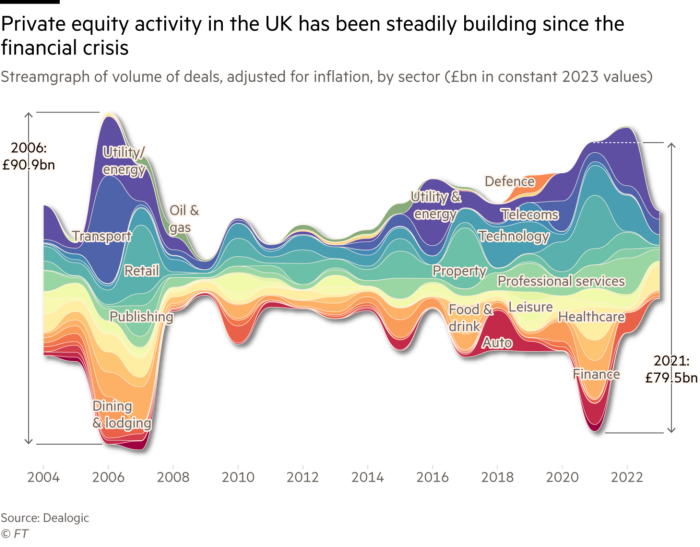

Nowhere in the world have private equity firms found a more welcoming playground than in the UK: the volumes of buyouts have over the past two decades weighed more in the overall economy than in any other advanced market, including the US, where the industry was born, according to Dealogic.

Private equity firms have snapped up high street names from grocers Asda and Morrisons to sandwich chain Pret A Manger, and invested in sectors ranging from insurance to nursing homes and infrastructure.

Now their record, and relatively lower taxation, are once again coming under heightened scrutiny ahead of this week’s elections. The Labour party, which is leading in the polls, wants to increase taxes on the performance fees that fund managers receive from asset sales (“carried interest”), prompting worries these dealmakers may be tempted to relocate elsewhere.

In this fascinating article, my colleague Ivan Levingston explores who are the largest players in UK private equity (think Blackstone and KKR), the sectors that they’ve targeted, and the men in charge. He delves into the top private equity deals in Britain over the past 20 years and — crucially — looks at how much “carry” Britain’s buyout executives have received.

UK-based private equity groups followed in the footsteps of US buyout pioneers, including KKR, in the 1990s, and aggregate value of private equity transactions peaked in 2006. The global financial crisis around 2007 and 2008 cooled activity, but private equity deals have grown as a share of the UK economy since then.

A potential clampdown on carried interest comes on top of fresh challenges to the private equity business model, which must continue to justify its hefty fees by delivering market-beating returns. This is getting more difficult with higher interest rates, because it limits the ability to fund buyouts with debt. A slowdown in deals and listings, owing to political uncertainty in Europe, has also made it harder to return capital to investors.

Can private equity continue its march? Email me: [email protected]

Five unmissable stories this week

A hedge fund has named a former Segantii Capital Management employee, Robert Gagliardi, as the person it believes was linked to several trades at the centre of US probes into Morgan Stanley’s block trading business.

Financial markets will keep France’s far-right Rassemblement National “on a very tight leash” if the party wins upcoming parliamentary elections, limiting its scope for a big spending push, according to fund manager Édouard Carmignac. France’s wealthy are already making contingency plans for a far-right or leftwing government.

The economic future of the world’s major democracies depends on decreasing public debt, increasing its GDP and making its workforce more productive, writes BlackRock chair and chief executive Larry Fink in this op-ed. The infrastructure sector may be able to accomplish all three.

Some investors sense an opportunity in Venezuela, where its revolutionary socialist President Nicolás Maduro is likely to win re-election next month. But investors betting on a normalisation of relations between Maduro and the west may be disappointed, argues Latin America editor Michael Stott.

JPMorgan Chase has attracted more than $15bn in assets from wealthy clients to its nascent business of tax-loss harvesting, which allows investors to lower tax bills, as the US bank seeks to win market share from Goldman Sachs and Morgan Stanley.

And finally

Here’s the FT’s guide to the best books to read this summer — from politics, economics and history to art, food and, of course, fiction. On my own list are Orlando Whitfield’s All That Glitters, the sensational story of Inigo Philbrick, an art dealer who flew too close to the sun; and The Garden of Eden, a (posthumously published) Ernest Hemingway novel that I discovered recently. If you’re dreaming of the French Riviera, I highly recommend Living Well is The Best Revenge by Calvin Tomkins, the story of the American couple who inspired F. Scott Fitzgerald’s Tender Is the Night.

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at [email protected]

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Working It — Everything you need to get ahead at work, in your inbox every Wednesday. Sign up here