Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an onsite version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. I dislike writing about politics, and doubt there is much geopolitical alpha to be had in markets, which are very good at discounting political information. But between what we learned last week about Biden’s mental capacity, and what we learned about France’s political transformation yesterday, I may have to write something about the repercussions of politics for markets before long. Send me a good angle: [email protected]

Apple gets an AI halo

Since May 1, Apple shares are up 24 per cent, adding over $600bn of market value. Only Nvidia has risen more in value; Microsoft ranks a distant third. It looks like what has happened is that Apple has become — perhaps in reality, or perhaps only in appearance — an AI stock.

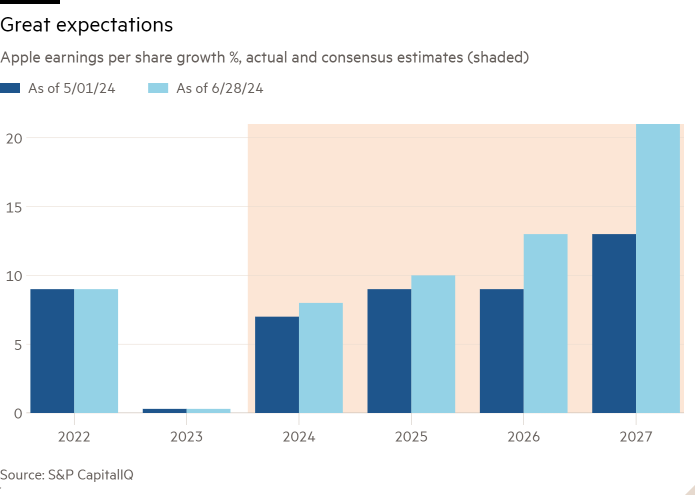

Over that past two months, expectations for Apple’s financial results have increased, but not expectation for the near- or even medium-term future. There has been basically no change in estimates for this year or for 2025, either for revenue or for earnings. You have to look out to 2026 and 2027 to see a change in analysts’ expectations. For 2027, expectations for revenue and earnings growth have increased by four and eight percentage points, respectively, since the start of May. This is a lot. The chart below shows 2022 and 2023 earnings growth for Apple, and growth expectations for the years to come, both as they were two months ago and as they are today:

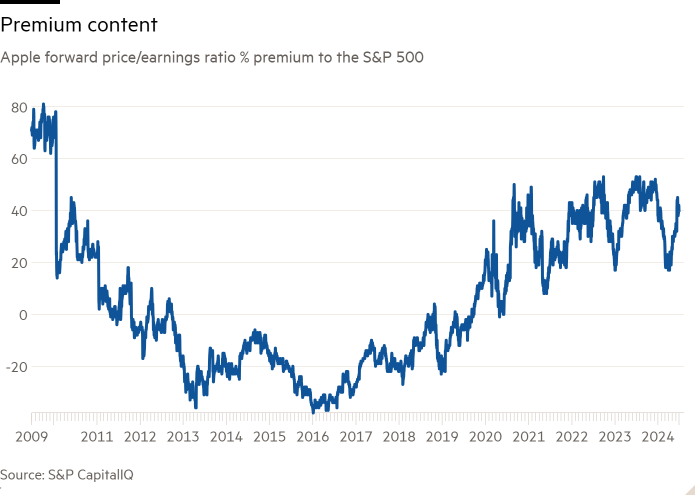

I’m not sure how seriously to take analysts’ estimates for results in three years’ time, as anything other than hand-wavy expressions of enthusiasm or the opposite. Note, however, that even the big jump in out-year estimates is not in itself enough to explain the move in Apple’s price. There has been a meaty increase in valuation on top of the increase in estimates. Expectations are high in all respects, as reflected in the fact that Apple’s valuation premium to the S&P 500 has climbed back to the top of its recent range (even as the S&P’s own valuation has risen steadily).

What events over the past two months might explain the changes in prices, estimates, and valuations? There are two candidates. One was the first-quarter earnings report that came out on May 2, which was better than expected and was followed by a rally in the share price. Revenue fell in the first quarter, but not as badly as feared. The dividend and share buyback announcements were larger than hoped. Solid financial news, but not much more than that.

Then there is the June 10 announcement of a partnership with OpenAI, which will support a new feature, “Apple Intelligence,” on iPhones and other devices. Linking Apple’s name to the company that produced ChatGPT, first of the really impressive general-use large language models, is a big deal. The announced capacities of Apple Intelligence, as distinct from what we know LLMs can do already, are not. Proofreading and editing tools; emoji customisation, image building, better language interpretation for the Siri digital assistant, all with the usual Apple-y promises about privacy. Nothing here seems likely to drive a device upgrade cycle among consumers.

Perhaps all that mattered was showing that Apple is in the game, integrating AI technology into its devices so that it will be ready when that killer app does appear. Apple’s strength, after all, is perfecting rather than pioneering new technologies. It makes sense that when and if consumer applications for AI blossom, Apple might make some of the most useful versions of them, given its strength in user interfaces and its huge captive user network.

Apple is parallel to Meta, Microsoft, and Alphabet in this respect. All three are linked by the assumption that the economic might and market position of their legacy businesses guarantees them a strong position in what is fundamentally a new and potentially very different industry, AI.

We have seen evidence that AI can do very impressive things in information processing. From the point of view of profits, however, all we have seen is huge chip sales for Nvidia (and a few others to a lesser degree) and a bunch of companies that have seen their valuations improve in virtue of wearing an AI halo. We do not know what AI-based businesses — outside the business supplying the computer power which AI requires — will look like. So the fact that merely throwing its hat in the ring can add hundreds of billions of dollars to Apple’s value is a very good indication that we are in a bubble.

There are two types of bubbles. One is a speculative frenzy around an idea or technology the value of which is fundamentally overblown. Tulips and, I would argue, cryptocurrency fit in this category. Then there are bubbles that form around very valuable things, before the financial and competitive structure around those things is understood. The railroad, telecoms, and Dot.com bubbles fit in this latter category. AI does, too.

One good read

CLOs are running out of things to buy.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Swamp Notes — Expert insight on the intersection of money and power in US politics. Sign up here

Chris Giles on Central Banks — Vital news and views on what central banks are thinking, inflation, interest rates and money. Sign up here