On July 9, Anne-Sophie Chassagnou will judge whether the skies are clear enough for Europe to launch its first new rocket in almost 30 years.

Aged just 26, the chief weather forecaster for Ariane 6’s first flight holds enormous influence over the continent’s space ambitions. Last year, just minutes before ignition, the meteorologist for France’s CNES space agency called off the first attempt to launch Europe’s €1.6bn mission to explore Jupiter’s icy moons,

“My body was shaking when I had to push the red button,” she said from Europe’s spaceport in French Guiana, between Brazil and Suriname, but if conditions are not right for Ariane 6, she will not hesitate to do it again. “I don’t want to, but if I have to I will,” she said.

This time, far more is at stake than a deep space mission. The first flight of the heavy-lift Ariane 6 rocket will test whether Europe can rebuild credibility in the commercial launch market once dominated by Ariane 5 and now by Elon Musk’s SpaceX.

Europe is also counting on Ariane 6 to restore its independent access to space — an increasingly contested domain where global superpowers are fighting for economic and strategic supremacy. For the last year, the bloc has had to rely on SpaceX to launch some of its most sensitive satellites.

It is an uncomfortable position. In the 1970s, the US attempted to bar some European satellites from competing commercially in return for providing launch services. “The Ariane programme was triggered by not having commercial access to space,” said Eric Dalbiès, chair of ArianeGroup, the French-owned joint venture that manufactures Europe’s heavy-lift Ariane rockets. “It revived the need for Europe to have sovereign access.”

Now Europe is again without its own launch capability after Ariane 5 was retired last July. Technological challenges, pandemic lockdowns and skills shortages caused a costly four-year delay to Ariane 6. Co-operation with Russia ended after its invasion of Ukraine, and problems on Italy’s new midsized launcher Vega-C have left that rocket grounded since 2022.

Josef Aschbacher, head of the European Space Agency, has described the situation as a “crisis” for Europe. The EU’s new space strategy for security and defence made restoring autonomous access to space a priority.

At the Guiana Space Centre, situated near the coastal town of Kourou, teams from the ESA, CNES and ArianeGroup have been working hard to achieve that goal.

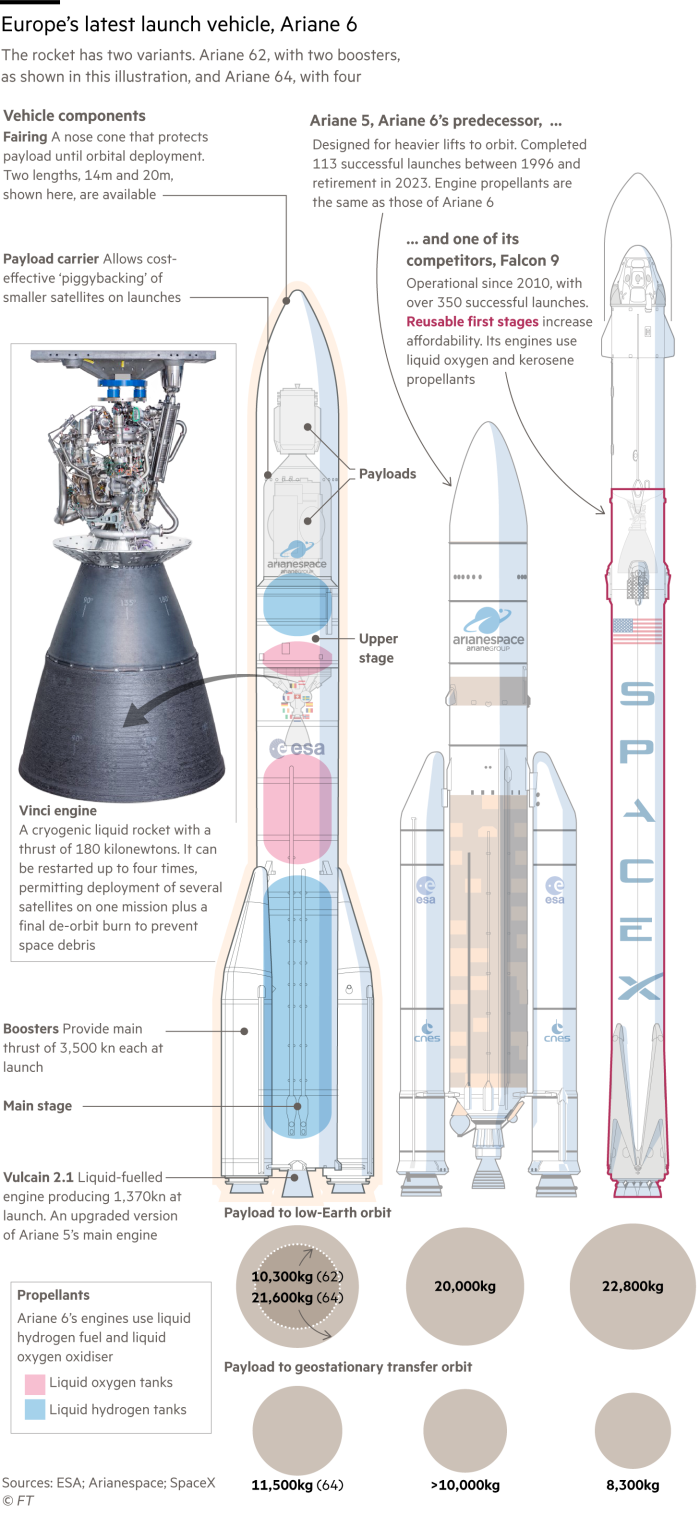

In April the rocket’s core was transferred to the launch pad and two boosters carrying 140 tonnes of solid propellant were attached. On June 20 Ariane 6 was fuelled and drained in the last rehearsal. Sixteen satellites and experiments have been loaded on to the rocket.

Almost 50 per cent of rockets fail on their first flight, according to Aschbacher, but officials at Kourou hope repeated tests and rehearsals have mitigated the risks. The focus is “making everything right first time”, says Lucia Linares, ESA’s head of strategy.

Even if the first flight fails, Europe’s strategic needs will keep the programme alive. Less certain is whether the rocket can compete in a market that has changed radically since Europe opted in 2014 to build a conventional launcher.

SpaceX’s reusable Falcon 9 has slashed prices, making it the clear leader for low-cost, reliable launches. SpaceX expects Starship, the world’s most powerful rocket which completed its fourth test flight this month, to be reusable too — unlike Ariane 6.

Europe’s decision not to invest in a reusable rocket is widely seen as a mistake. Germany had been reluctant to pay for a new rocket programme, according to former ESA chief Jan Wörner. “The German idea was to continue with Ariane 5 but to have a new upper stage. This was the cheap solution,” he said.

But France, which has long dominated Europe’s launcher industry, wanted to retain the jobs and skills of rocketmaking with a new programme.

A compromise was reached. ArianeGroup, a merger of the Franco-German rocket businesses of Airbus and Safran, promised to design an expendable launcher that was at least 50 per cent cheaper to operate than Ariane 5, would be flying in five years and would require no subsidy, Wörner said. The programme has failed to deliver on all those counts.

Last autumn ESA member states agreed to inject a further €1bn, on top of an estimated €4bn development cost, to enable Ariane 6 to compete with SpaceX.

Some experts defend Europe’s decision to reject reuseability in favour of an expendable launcher with a highly flexible upper stage that can take satellites to different orbits on a single mission. A reusable rocket would have required significant, sustained demand that was not available, they say.

“It was the right decision,” said Linares. “It’s true that if you reuse the first stage . . . normally you lower the cost. But it depends on how many times you are able to launch.”

Yet even for a conventional rocket, demand matters and Ariane 6 enters a tougher commercial market than its predecessor.

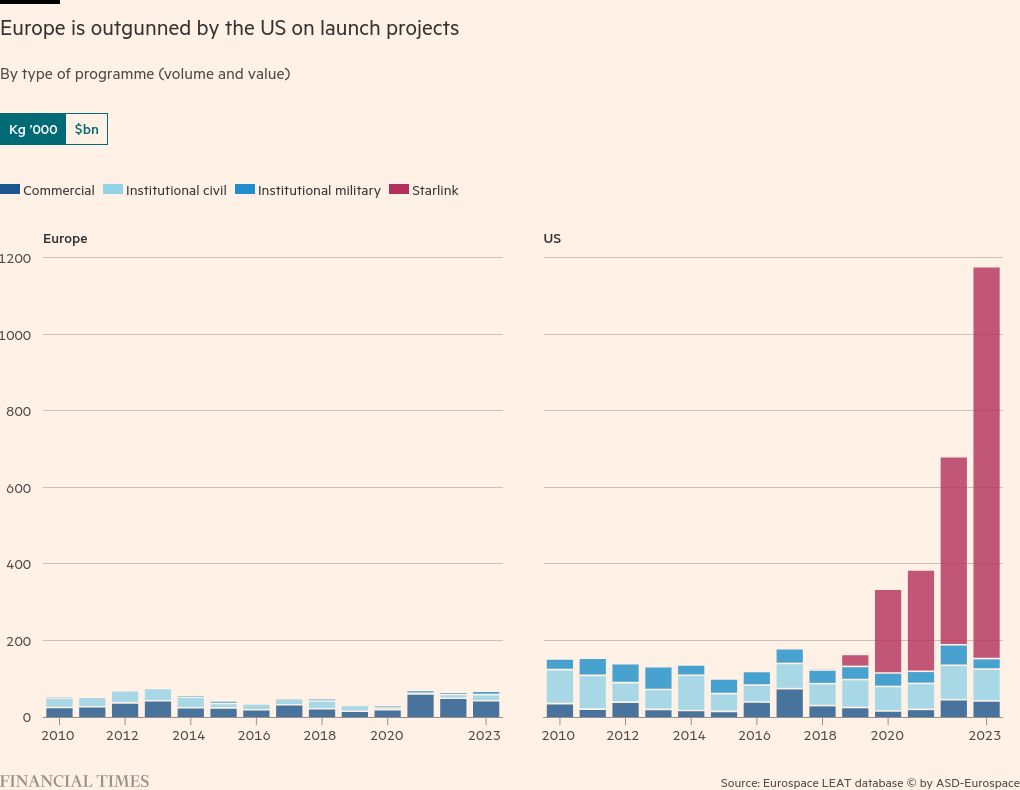

Over the next decade the US will launch roughly three times as many satellites as Europe for governments, universities and other institutions, and almost 10 times as many commercial spacecraft, according to analysts Novaspace. The Pentagon, Nasa and Musk’s own Starlink satellite broadband service are likely to turn to SpaceX before Ariane.

Meanwhile, a rash of launcher start-ups around the world are eyeing the booming market for satellite services from low Earth orbit.

“Ariane previously launched two non-institutional satellites for every institutional satellite. But today new launchers are capturing that demand,” said Pierre Lionnet, head of research at trade body ASD-Eurospace.

Novaspace estimates that some 2,800 satellites will be launched annually to 2033. Much of that business will be covered by domestic launchers, but Linares believes enough will still be open to competition — and Ariane’s flexibility will be an advantage.

Ariane 6 is already booked for 30 launches, including 18 for Amazon’s forthcoming Project Kuiper broadband constellation. Customers want a diversity of launch providers beyond SpaceX, Linares said.

But even those involved in the European programme admit the system that produced Ariane 6 — which awards supply contracts by nationality rather than competitiveness — will have to change. This year ESA launched a competition for the development of small commercial launchers, from which it will buy services.

The move was an “electroshock” to the corporate and political complacency that had hindered Ariane 6, one insider said.

Still, the hefty price tag of a heavy-lift rocket means Europe cannot avoid collaboration and compromise, which may further hamper competitiveness.

“I am not convinced that in Europe we will be able to offer launch services at prices as low as SpaceX,” said Carine Leveau, head of space transportation systems at CNES. “But we can be more competitive than we are today and more than we will be with Ariane 6.”

For now however, the priority is ensuring Europe’s access to space. “It is very important that this inaugural flight is a success,” she added. “It will reassure everyone.”

Illustration by Ian Bott