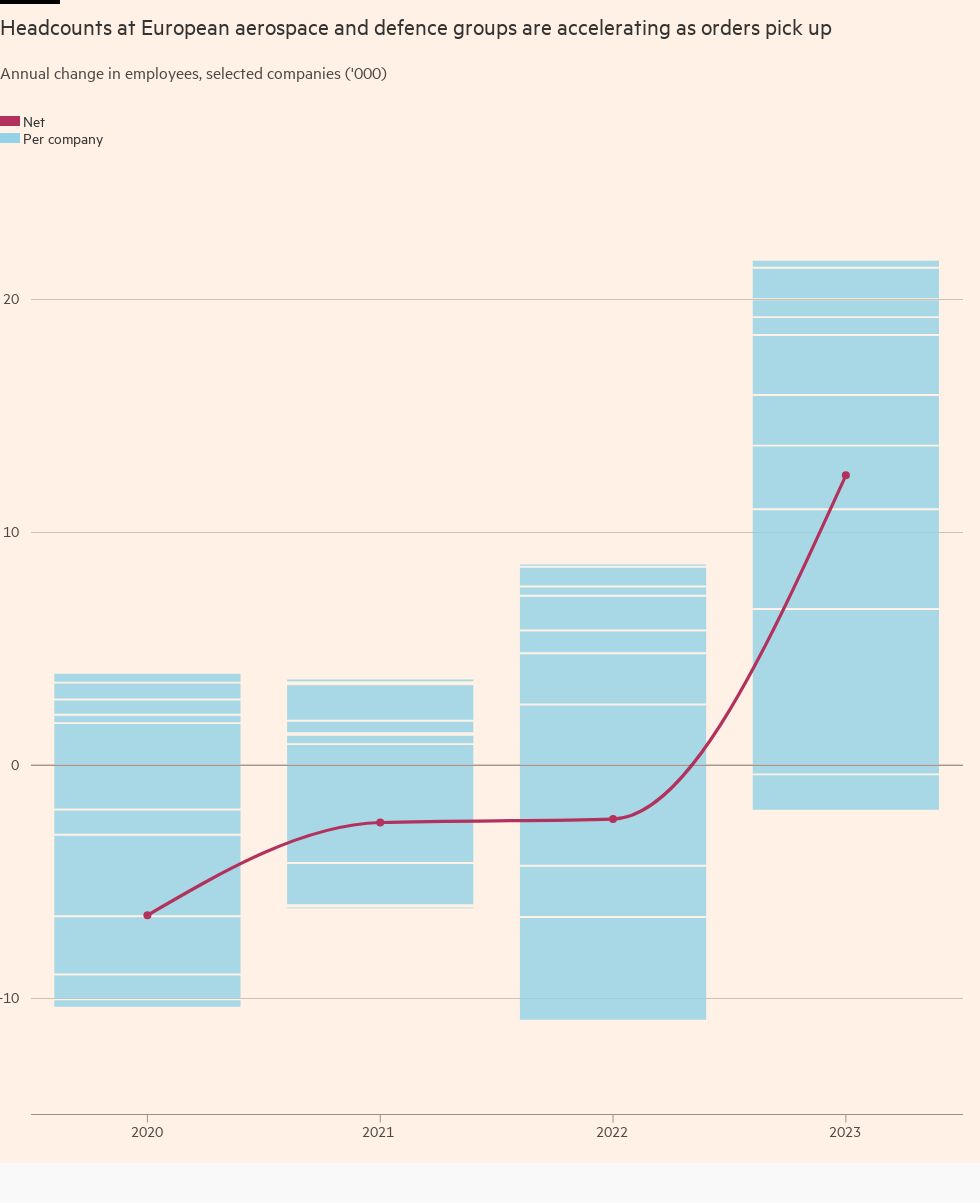

Global defence companies are recruiting workers at the fastest rate since the end of the cold war as the industry seeks to deliver on order books that are near record highs.

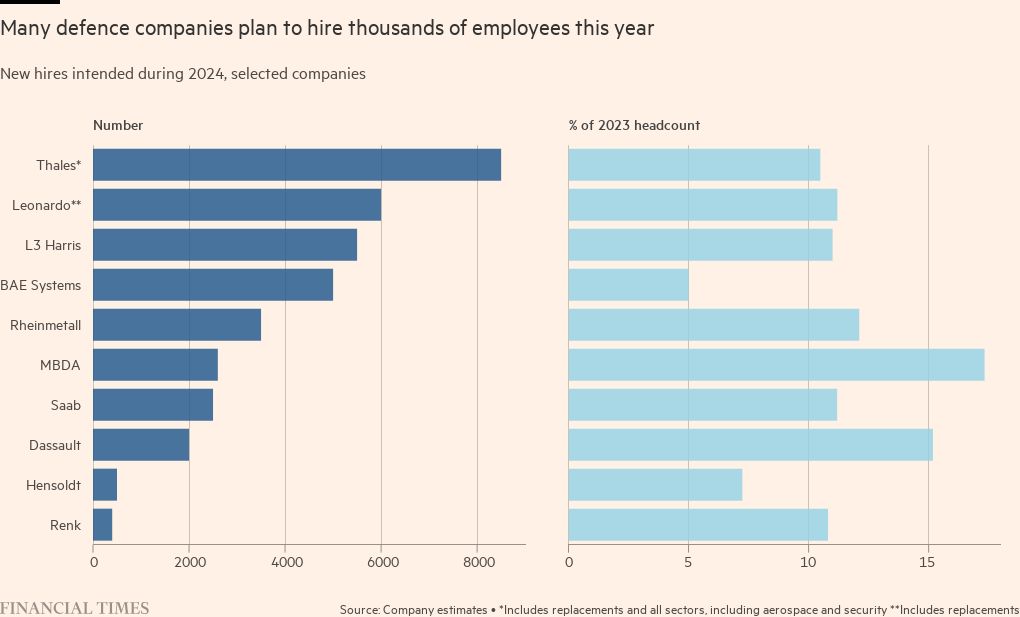

A Financial Times survey of the hiring plans of 20 large and medium-sized US and European defence and aerospace companies found they are looking to recruit tens of thousands of people this year.

Three of the largest US contractors — Lockheed Martin, Northrop Grumman and General Dynamics — have close to 6,000 job openings they need to fill, while 10 companies surveyed are seeking to increase positions by almost 37,000 in total, or almost 10 per cent of their aggregate workforce.

“Since the end of the cold war, this is the most intense period for the defence sector with the highest increase in order volume in a rather short period of time,” said Jan Pie, secretary-general of ASD, the European aerospace and defence trade association.

Governments around the world have ramped up military spending since Russia’s full-scale invasion of Ukraine and amid widespread geopolitical tensions. The sudden spike in orders after decades of low volumes, combined with competition for digital skills from technology groups and a labour market still dealing with Covid-era staff shortages, are some of the factors driving the industry-wide hiring spree.

Companies said they are looking to fill positions across the board, from apprentices to late-stage career executives. Engineers, software developers and cyber-security analysts as well as welders and mechanics are in demand.

Antonio Liotti, chief people officer at Italian defence champion Leonardo, said it was conducting “an intense search for new hires, even more intense than during previous conflicts such as Iraq or Afghanistan”.

The contractor, which is part of the tri-national programme with BAE Systems in the UK and Japan’s Mitsubishi Heavy Industries to build a new fighter jet, is looking to hire 6,000 new employees including replacements, by the end of 2024. It expects to recruit for 8,000 to 10,000 new positions between 2025 and 2028, notably industrial and software engineers.

The search for new hires, Liotti added, was not just driven by conflict but also by greater competition from adjacent industries such as “high-tech companies and consultancies”. Other factors, including people seeking a greater work-life balance and “quiet quitting”, were also playing a role.

Companies that produce ammunition, notably Rheinmetall and Nammo, which have had to increase output significantly to replenish government stockpiles, are among those with the most aggressive hiring plans.

Nammo said it had “never seen a situation like this before”. The company, which is part-owned by the Norwegian and Finnish governments, increased its headcount by 15 per cent from 2,700 in 2021 to 3,100 in 2023. It currently employs around 3,250 people and says a “doubling of the company size [by the end of] 2030 seems reasonable”.

Rheinmetall of Germany on Friday said it was looking to hire hundreds of employees from leading car parts manufacturer Continental, which has been suffering from anaemic auto sector demand.

France’s Thales, which makes the shoulder-fired Starstreak missile donated to Ukraine from western government stockpiles, said it has recruited 9,000 people — 11 per cent of its current workforce of 81,000 — in its defence operations over the past three years.

BAE ramped up recruitment significantly last year but had already stepped up hiring to deliver on long-term programmes such as the Global Combat Air Programme and the Royal Navy’s Type 26 frigates.

In the UK, “we’ve doubled our early-careers intake in the past five years and are recruiting around 2,700 apprentices and graduates this year as well as thousands more experienced professionals”, said Tania Gandamihardja, the company’s group HR director.

Europe’s missile champion MBDA, owned by BAE, Airbus and Leonardo, which makes the air-launched missiles Storm Shadow and Scalp, used to devastating effect in Ukraine, plans to hire more than 2,600 people this year — 17 per cent of its current workforce of 15,000.

Dassault Aviation, which builds the Rafale fighter aircraft, has seen no direct increase in orders from Ukraine, but given the length of manufacturing cycles in the sector, has been consistently hiring staff.

Manufacturers in nuclear defence, especially those involved in the trilateral Aukus submarine programme between the UK, the US and Australia, are among those seeing the highest spike in the shortage for skills.

Several companies, including Rolls-Royce and Babcock International, recently opened their own nuclear skills academies while Thales UK, which provides sonar for all of the Royal Navy’s submarines, has launched a sonar academy.

The UK government has separately launched a nuclear skills task force to train the tens of thousands of workers needed across the country’s civil nuclear and military programmes.

The hiring and training effort is “unprecedented in recent times”, said Beccy Pleasant at the Nuclear Skills Delivery Group, which forecasts that more than 30,000 additional roles will be needed in the nuclear defence sector between now and 2030.

Companies have also stepped up engagement with universities and other organisations to build a future workforce pool.

Cranfield University, which has close links with the sector, is offering new courses, notably in digital forensics to help people learn how to attribute cyber attacks among other things.

“There is a recognition that you can’t just assume academia will churn out the people that you want to recruit . . . companies are now going up the people supply chain,” said Heather Goldstraw, Cranfield’s director of defence.

One particular challenge for the industry is that some roles require additional security clearances. RTX, which owns missile and sensor maker Raytheon, said earlier this year that it was “continuing to experience challenges hiring highly qualified personnel including engineers, skilled labourers, and security clearance holders”.

Others, such as Germany’s Renk, said they might have to look abroad. Chief executive Susanne Wiegand said: “We also need other qualified good people from abroad, because in Germany we cannot find, all of us together as the defence industry, sufficient people for the jobs.”