Beverage sector serves up cheap drinks for all

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Remember the “eyeballs” underpinning the dotcom craze? Investors are no strangers to innovative valuation metrics. Those in the beverage sector now have a new — and less egregious — one to look out for: enterprise value to “maturing liquids”.

With drinks companies trading at record lows compared with their stock of gently ageing cognacs, brandies, tequilas and champagnes, this is yet another indication that the sector may be oversold.

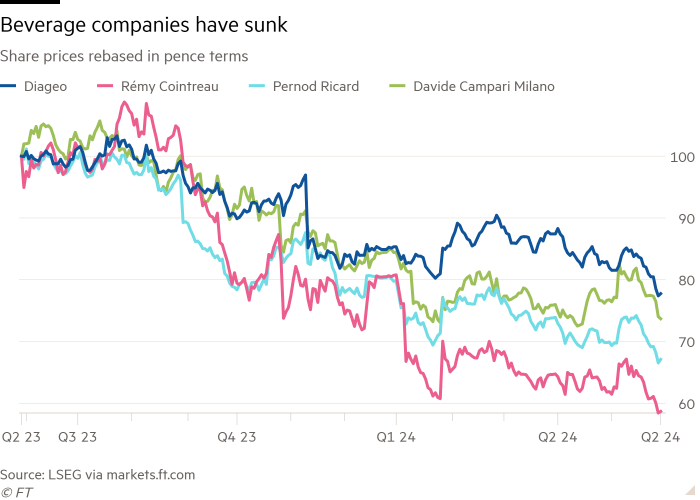

Purveyors of alcoholic beverages have clearly had a terrible time of late. Shares in Diageo, Campari, Pernod Ricard and Rémy Cointreau are down between 20 and 40 per cent in the past 12 months. There is no shortage of good reasons. Diageo’s stumble is in part home-grown, given its stocking troubles in Latin America. Rémy Cointreau and Pernod Ricard have been hit by fears that China might impose tariffs on brandy. Most worrisome of all for companies across the sector is the fact that the US — the world’s most lucrative alcohol market — has gone into reverse, with spirit volumes down 3.3 per cent in 2023.

This uninspiring cocktail means that European beverage companies are now looking relatively cheap on almost any measure one cares to consider. Diageo’s historic premium on a p/e basis relative to the MSCI Europe Index has compressed from about 100 per cent in 2022 to 33 per cent. The same holds true when one compares the value of beverage companies to that of their portfolio of maturing liquids, as Trevor Stirling at Bernstein has done. This is accounted for at historical cost adjusted for evaporation, or — in charming sector parlance — the angels’ share.

Stocks are not equally relevant for all companies, of course. Those whose business relies to a greater extent on ageing spirits, like Rémy Cointreau, hold inventory in excess of annual sales. Campari, at the other end of the spectrum, holds less than a fifth. Yet, directionally at least, valuing companies on this metric tells a similar story. Diageo, Pernod and Rémy Cointreau are all trading at 10-year-plus lows.

That looks overly despondent. Despite current wobbles, selling drinks remains a good business. When the Covid-era hangover finally clears, this will be a sector in which annual volumes grow by perhaps a couple of percentage points a year, prices rise and consumers increasingly choose premium drinks. With the whole sector on Happy Hour discounts, it may be time for investors to approach the bar once more.