Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

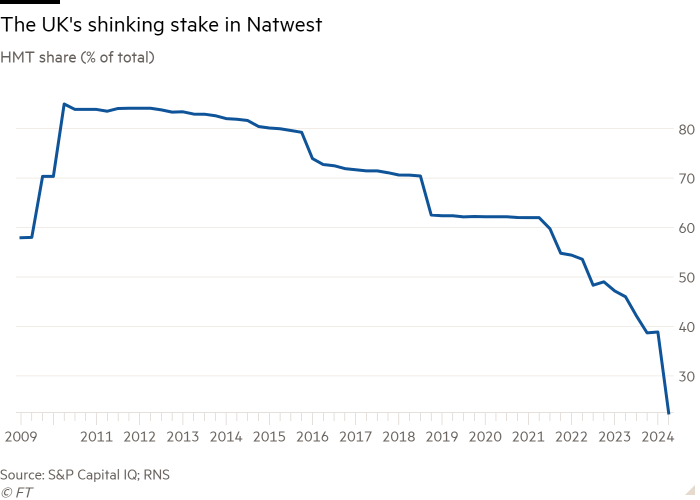

Regardless of who wins July’s general election, Britain’s next government will want to finish the job at NatWest. The bank, once called RBS, is one of the last vestiges of direct state intervention during the financial crisis more than 15 years ago. The government’s holding in the bank has shrunk from more than 80 per cent since then.

NatWest announced on Friday the purchase of £1.2bn worth of shares equal to 4.5 per cent of the total. With the government stake now just 22.5 per cent and fair winds supporting the UK banking market, there should be little to prevent the next government from finishing the job.

Confidence is returning to European banks. Investors are coming around to the idea that regulatory reforms put in place since the sector was bailed out are working. The financial sector has survived higher interest rates without any catastrophic damage. The returns generated in this environment have underlined a perception by investors that they are priced too cheaply to overlook.

All the above has contributed to the rally in bank share prices. The Stoxx Europe banks index is up more than 15 per cent since the start of the year, Lloyds has performed similarly. Re-rating is driving performance, with the index multiple at 0.8 times book value, the highest since 2018.

NatWest is outperforming. Its shares are up 44 per cent since January. As the most sensitive UK bank to interest rates, the shares were hit hard last year by fears about rising deposit costs. The shares have since recovered all those losses and more, as deposit rates peaked ahead of a fall in borrowers’ costs. Their performance has been helped by expectations that the Bank of England will cut rates just twice at most this year, from the five cuts that were expected back in January.

Earnings estimates for NatWest have risen almost a tenth over the same period. Further ahead in 2025 and 2026 interest rate hedges will support net interest margins and earnings per share growth. If bank stocks can hold on to the confidence of markets, there is little reason to think that shares will not keep rising as well.

The election also derailed plans for a discounted retail offering of NatWest shares later this year. Labour has said that, if elected, it will review the proposal. Expect it to push ahead with selling down the public stake, whether or not it embraces the retail offer idea as its own.