This article is an onsite version of our Cryptofinance newsletter. Premium subscribers can sign up here to get the newsletter delivered every week. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Hello and welcome to the FT Cryptofinance newsletter. This week we’re taking a look at a fast-growing new trend in decentralised finance.

The excitement over the arrival of stock market funds investing directly in cryptocurrencies this year has obscured the rapid changes taking place in the world of decentralised finance, or DeFi.

The hottest thing in the market at the moment is the emergence of EigenLayer, a new network that lets holders of the ether cryptocurrency simultaneously lend out the same coin multiple times.

Underscoring its appeal, its Seattle-based parent company Eigen Labs in February raised $100mn from Andreessen Horowitz’s a16z, one of the most influential crypto venture capitalists.

The concept behind EigenLayer is “restaking”, a new concept for the crypto market. At present holders of ether can earn interest, in the form of more tokens, if they deposit or “stake” their ether on ethereum, allowing the system to secure and validate transactions on the blockchain.

They earn a reward for it but that keeps their coins locked up and immobile. EigenLayer takes the staked ether and allows it to be reused in other applications that are also built on ethereum — earning them further yield in the process.

It may well sound familiar. That’s because, fundamentally, it is rehypothecation, or the practice of lending the same asset over and over again. It’s something global financial regulators have clamped down on since the 2008 collapse of Lehman Brothers, when it emerged that the US bank had used collateral posted by clients to help fund its own trades. It took years for customers to be reunited with their assets.

In the world of crypto, this vice is turned into a virtue. Other services such as Lido Finance also rehypothecate assets but hand out tokens that represent the value of the staked ether.

The twist with EigenLayer is that it is trying to extend the security that underpins the ethereum network to other applications that are also being built on ethereum. EigenLayer sits in the middle, connecting people who want to use their staked tokens to lend with new applications that are being built. EigenLayer uses automated algorithms and smart contracts to manage the process.

The advantage of EigenLayer is that, at least in theory, it solves a major issue for the ethereum network. Every application built on ethereum has to sort out its own security with its own validation, and that makes it a highly inefficient, fragmented and costly system that is difficult to scale. EigenLayer can help the network grow by piggybacking on the complex and effective system that validates it.

From a standing start in December there are now just under 5mn ether coins, valued at $18.6bn, locked up in EigenLayer, according to data provider DefiLlama. That makes it the second-largest application in the DeFi market, between longtime players Lido on $36bn and AAVE on $13bn.

But in a research paper this week, Carol Alexander, professor of finance at the University of Sussex in the UK, argued that restaking was creating a major, new risk in the market.

She said the $18.6bn figure was “vastly overestimated” because some of the numbers had been counted multiple times. The true figure backing the activity is closer to two-thirds of that, she thinks.

That matters because, she said, each new application needs to rely on highly leveraged tokens backed by very little in a thin market.

The EigenLayer system is designed to punish bad actors such as hackers by confiscating a portion of staked tokens or deposits as a penalty. It relies on algorithms that unilaterally decide when malicious activity is happening.

That leaves the leveraged staking market exposed if there are deliberate attacks to steal funds, if prices are manipulated or if lenders simply have poorly coded algorithms, light borrowing standards or poor risk controls. And all built on an IOU of ether, she says.

“Because the vast majority of staking is on ethereum, any stress events . . . have the potential to spread credit contagion throughout the DeFi ecosystem, and this could precipitate another DeFi winter,” she concluded.

Already the multiplication of layers is dizzying. Applications such as Renzo restake staked ether tokens on EigenLayer — and mint another token to represent that transaction. Applications such as Renzo “are taking on a very large credit risk”, Alexander warned.

That could lead to a cascade of liquidations in the market and tokens could depeg from other tokens whose value they are supposed to track, she said.

It has happened before. The collapse of the terra stablecoin, which triggered the crypto market crash of 2022, began with staked ether tokens in the DeFi market and spread because bigger traders and lenders were interlinked with other markets.

However some have argued that introducing layers of applications on top of staked ether is “financialisation” of the ethereum network.

Either it can be a protocol for open innovation, more akin to a commodity, or it can be an investable asset that will deliver a yield for investors, said the head of research at one staking service who declined to be identified.

“It’s not really possible for them to do both. If you optimise ether as the financial asset . . . you’re encouraging the creation of this kind of layers and going further out in the risk curve to maximise yield.”

Yet market demand is potentially pushing ether and ethereum towards it being an investable asset, just when US lawmakers and financial regulators are leaning towards ether being a commodity.

If the Commodity Futures Trading Commission becomes the main US regulator for crypto as expected, then the agency may find itself going down a very deep rabbit hole when piecing together the aftermath of the next market crash.

What’s your take? Email me at [email protected]

Weekly highlights

Former FTX senior executive Ryan Salame was sentenced to more than seven years in prison after pleading guilty last year to election fraud charges and conspiring to operate an unlicensed money-transmitting business while at Sam Bankman-Fried’s failed cryptocurrency exchange.

BlackRock’s IBIT became the world’s largest bitcoin exchange traded fund even though it only launched in January. Its holdings of just under 300,000 bitcoin pipped those of Grayscale, even though its rival held more than 619,000 at the start of the year.

Users of Gemini’s Earn lending programme will get nearly $2bn of their crypto that was stuck at Genesis, following the digital asset trader’s bankruptcy in January 2023.

Soundbite of the week:

Elon Musk dismissed stories that he had talked to Donald Trump about digital assets. He wrote on his X social media site:

“Pretty sure I’ve never discussed crypto with Trump, although I am generally in favor of things that shift power from government to the people, which crypto can do.”

Data mining: the rise of ethena

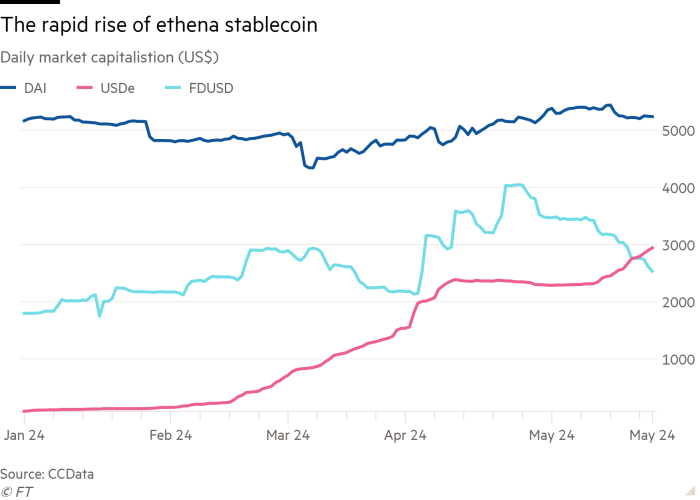

Among the signs of soaring optimism in DeFi is the emergence of a stablecoin called ethena. It is pegged to the ether cryptocurrency rather than the US dollar, and offers buyers a yield of 36 per cent. From nothing in January, it is now the world’s fourth-largest stablecoin with nearly $3bn in circulation. Its backers argue that it is fully decentralised — pegged to the price of ether so there are no deposited assets sitting in a bank. Instead it uses derivatives to keep the value in balance. This week it overtook First Digital USD, which has $5.29 in circulation and now sits behind Dai, which has $5.3bn in circulation.

Cryptofinance is edited by Laurence Fletcher. To view previous editions of the newsletter click here.

Your comments are welcome.