Gold bars and $5 chickens make Costco an inflation wave winner

The no-frills retailer Costco Wholesale has emerged as one of the big winners of the US inflation wave, drawing in millions of consumers willing to pay at least $60 a year to gain access to member-only warehouses stocked with bargain-priced produce, paper towels, appliances and $5 rotisserie chickens.

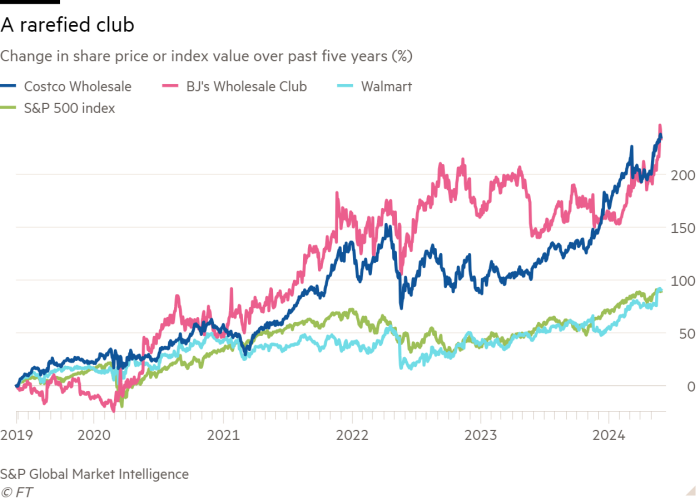

The US-based company’s shares have more than trebled in the past five years, rising at a pace that rivals some tech giants to give it a market capitalisation of $358bn.

Costco, which will report quarterly earnings on Thursday, is the oldest and most prominent of a retail subset known as warehouse clubs, which require customers to pay annual membership fees for the privilege of shopping in bulk. Others include Walmart’s Sam’s Club and BJ’s Wholesale Club Holdings.

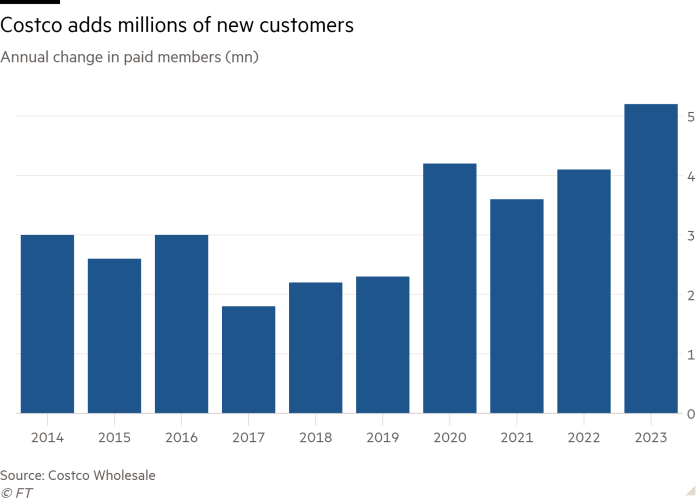

All have benefited from the surge in inflation that took root in the US in 2021 and has been slow to subside. Costco’s member rolls have risen nearly 20mn to 73.4mn since 2019, including a 2.4mn increase in the most recently reported six months.

Founded in 1976 and based in the Seattle suburbs, Costco’s footprint has grown to 876 warehouses, with more than 600 in the US and the remainder in countries including Canada, Mexico, Japan and the UK.

Sales growth accelerated to double digits in the pandemic, as consumers flush with savings splashed out on purchases. The pace has slowed but not stalled as inflation has hovered above 3 per cent, more than the years before 2021.

“Consumers are under pressure,” said Oliver Chen, a retail analyst at TD Cowen. “Costco’s point, which is the opposite of a [luxury group like] LVMH, is to offer the lowest prices humanly possible.”

Costco, which did not respond to requests for comment, deliberately keeps limited inventories inside its stores: fewer than 4,000 units of each item. The strategy builds economies of scale and enables the company to earn slim profit margins on high sales volumes. “We often sell inventory before we are required to pay for it, even while taking advantage of early payment discounts,” it says in its annual report.

Inventories are piled on towering metal racks and can be quickly moved around the warehouse based on supply and demand and the season. At a Costco store visited by the Financial Times in New Jersey this week, canisters of chlorine swimming pool tabs were displayed across an aisle from rainbow assortments of French macaroons.

Customers’ $60 annual memberships grant entry to warehouses. An extra $60 gives them an “executive” membership that provides a 2 per cent annual rebate on purchases. Renewal rates top more than 90 per cent. Once they have paid the fees, members are inclined to visit stores more often, said Joe Feldman, retail analyst at Telsey Advisory Group.

The company’s senior executives have also stuck around. Richard Galanti retired as chief financial officer this spring after nearly 40 years in the job. Craig Jelinek was replaced as chief executive by Ron Vachris at the start of 2024 after a dozen years in the role.

Esson Noel, a custodian and deacon at a Baptist church, said going to Costco was worth it. He and an associate were loading a van parked adjacent to the New Jersey store with 16 heavy cases of bottled water, aluminium roasting pans and boxes of salty snacks for an anniversary celebration of his congregation.

“If you buy a lot, it’s better to be buying at Costco,” he said. “Prices are coming up everywhere, but higher outside, so it’s better coming here.”

Across the parking lot, Alan Ianuzzi, a self-employed engineer, was visiting to buy a new television and return a non-stick skillet he purchased a decade ago that came with a lifetime warranty. Costco gave him a store credit, he said.

“They asked what was wrong with it, and I said now it sticks,” he said. “They’re very good with taking stuff back.”

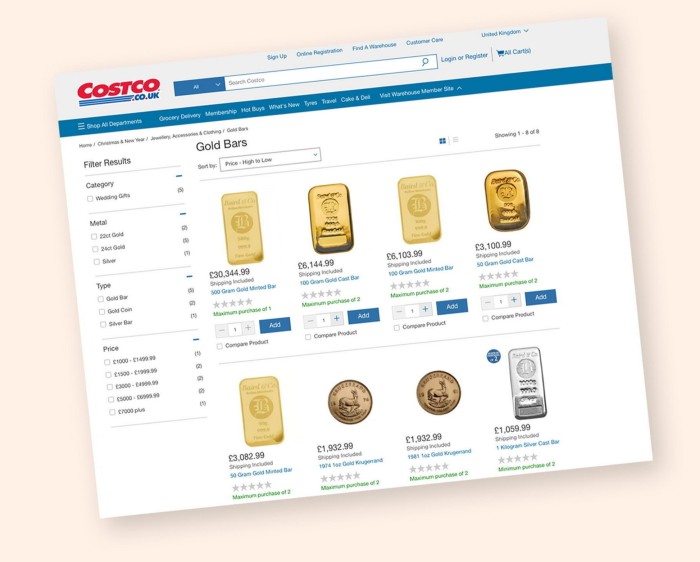

Costco tends to attract a slightly wealthier range of consumers able to pay annual fees and make bulk purchases, such as for 3lb bags of broccoli florets and 12-packs of paper towel, in shopping trips that can easily total hundreds of dollars. Gold bars — often marketed as a hedge against inflation — have been offered online and occasionally inside some warehouses.

Wholesale club stores have been increasing their share of the US retail market. In April, Costco’s net sales of $19.8bn were up 7.1 per cent year on year. Its same-store sales were up 5.2 per cent year on year in the US, excluding the effects of petrol sales and foreign exchange — far above the pace of total US retail sales.

Analysts polled by Bloomberg predict Costco to report quarterly revenue of $58bn on Thursday, which would be a record for its third fiscal quarter, and earn net quarterly profit of $1.6bn.

Walmart’s Sam’s Club, which has 599 locations in the US, reported same-store sales growth without fuel of 4.4 per cent in the quarter that ended in April, driven by an increase in the number of transactions rather than prices. BJ’s, which operates 244 club stores in 20 US states, reported a 0.6 rise in comparable sales in its first quarter last week.

“People are looking for value right now, and these are places to get it,” said Steven Shemesh, an analyst at RBC Capital Markets.