A legal exodus to start: More US law firms are closing their offices in Shanghai as a dearth of financial activity and depressed business sentiment force them to reassess their presence in mainland China.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an onsite version of the newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday to Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters. Get in touch with us anytime: [email protected]

In today’s newsletter:

BHP’s bid for Anglo falls apart

The Royal Mail’s new owner

Who’s next in the oil M&A frenzy

How a £39bn mining takeover fell apart

After six weeks of tortuous negotiations between Australian mining behemoth BHP and London-listed rival Anglo American, the £39bn tie-up between the two has collapsed.

The past 24 hours have been full of drama. On Wednesday, the last day of the back-and-forth, BHP called for an extension to the talks, which Anglo rebuffed. Fed up, BHP abandoned the bid minutes before a UK deadline to make a binding offer or walk.

BHP’s chief executive Mike Henry said: “While we believed that our proposal for Anglo American was a compelling opportunity to effectively grow the pie of value for both sets of shareholders, we were unable to reach agreement.”

Ultimately, the deal was “highly complex and unattractive”, according to Anglo’s board. Although the price tag had inched up in recent weeks — from £31bn to £39bn — the real issue came down to how it was structured.

Since BHP was really only interested in its copper operations, the plan included spinning out Anglo’s South African subsidiaries: its Anglo American Platinum and Kumba Iron Ore businesses.

The board deemed that too risky, and thought it would come at the expense of shareholders.

Now, the question is whether Anglo will actually be able to restructure. On Wednesday, Gwede Mantashe, South Africa’s influential minerals minister, said he agreed with Anglo’s decision to refuse BHP’s latest offer.

But “they must now restructure and respond to the demands of the times”, he said, in a reference to Anglo’s alternative plan to break up the London-listed miner.

Shareholders’ attention will now be on Anglo chief executive Duncan Wanblad: as an alternative to the BHP deal, he’s promised to simplify the miner into a copper/iron ore/fertiliser producer, according to Lex.

“Shareholders will need to keep the heat of urgency on him to finish the task,” Lex writes.

Billionaire to put stamp on Royal Mail

It’s Czech, mate, for the UK’s former postal monopoly.

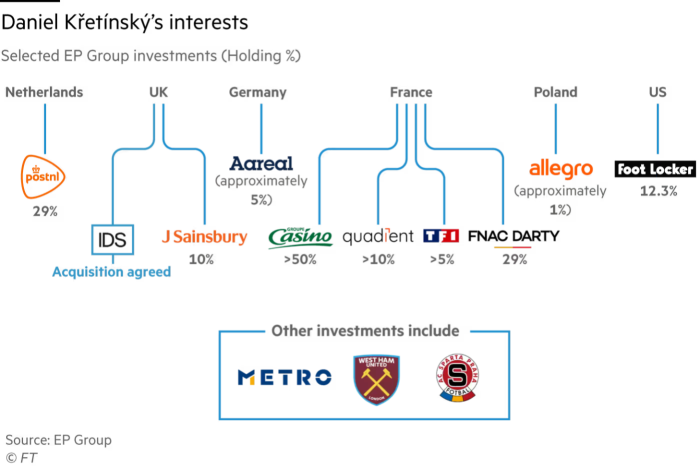

On Wednesday, Czech billionaire Daniel Křetínský sealed a £5.3bn takeover for the group that owns Royal Mail after weeks of negotiations.

The dealmaking tycoon’s EP Group surprised the UK market last month with a proposal to acquire London-listed International Distribution Services, the parent company of Britain’s Royal Mail and the international parcel business GLS.

Křetínský told the FT that taking the former state-owned monopoly private could be the cure for a company synonymous with labour disputes and falling letter deliveries.

“What has changed now, and the reason why we’ve taken the view that this is the right moment, is really the dynamic of the market,” Křetínský said in an interview shortly after sealing the deal.

The company needs to defend its market share, he added — and fast. If it doesn’t, it could fall prey to a “deadly downward spiral”.

Given sensitivities around the deal including from politicians and postal workers, EP Group has committed to protecting several principles at IDS during the first five years of ownership in order to secure an agreement.

One closely watched commitment was to keep the company together for three years, with further restrictions on any potential separation of IDS’s profitable international parcel business GLS from the lossmaking Royal Mail in the following two years.

Royal Mail is the latest addition to Křetínský’s stable of companies, which includes stakes in supermarket chain J Sainsbury and English Premier League football club West Ham United.

It’s the culmination of a years-long interest in the mail carrier, with the billionaire first taking a swing at the company four years ago, acquiring a 5 per cent stake in IDS that he eventually built into a 27.5 per cent share.

Yet stock market trading indicates there is lingering scepticism from investors over whether the deal can pass, and the transaction still faces obstacles to completion.

Křetínský must now prove he can deliver.

Big oil M&A: who’s next?

Back in February, when ConocoPhillips lost out to Diamondback Energy in the race to buy Endeavor Energy Resources, DD tried to predict who would be its next target.

We’re pleased to remind you that we got one of the names right: Marathon Oil.

On Wednesday, Conoco agreed to buy Houston-based Marathon for $22.5bn, including debt, in an all-stock deal that will give one of the world’s biggest independent oil and gas producers a suite of prolific shale fields stretching from North Dakota to Texas.

Given DD’s success the last time round, it seems fair to ask whether we had actual insight or we just got lucky. What’s certain is that this industry isn’t going to stop consolidating — although the number of options are shrinking fast.

Just like in February for Conoco, the most obvious next buyer is the loser in this race: Devon Energy.

The Oklahoma-based company, which has a market value of $30bn, had been trying to win over Marathon for several months, according to DD’s James Fontanella-Khan and the FT’s Myles McCormick, who were the first to report about the Conoco-Marathon tie-up.

So, who are Devon’s sights? A smaller rival. Chesapeake Energy, which agreed to buy Southwestern Energy in a $7.4bn all-share deal in January, could be a potential candidate given its market value of $12bn.

The other options: Apache ($11bn market cap) or Matador Resources ($8bn market cap), which we had named back in February.

There’s also Double Eagle, a $6.5bn market cap Permian player, which Reuters reported on Wednesday is up for sale. Or alternatively, Devon could become the one that gets eaten next.

Who would be its potential suitors? Maybe Conoco itself.

Job moves

The Cleveland Federal Reserve has appointed Beth Hammack as its next president and chief executive. Most recently, she was the co-head of global financing at Goldman Sachs and a member of the firm’s management committee.

Linklaters has appointed Christian Storck, head of finance in Germany, as its global head of capital markets. The firm also appointed Pam Shores, a partner of US capital markets, to global head of US capital markets.

Sidley Austin has hired Ben Thompson for the firm’s global finance practice in London, where he’ll focus on energy and infrastructure. He previously worked for Travers Smith.

Nardello has hired David Fox as a member of its advisory board. He formerly worked as a senior partner at Kirkland & Ellis and was a member of its executive committee.

Smart reads

Saudi’s wealth fund While Saudi Arabia’s Public Investment Fund plans to increase spending, global investors are worried that much of it will stay close to home, Bloomberg reports.

Time’s up Conglomerates are largely a dying breed, but there are still a few behemoths in the consumer sector, Lex writes. That might not last much longer.

Elon’s world From heirs to Murdoch’s empire to the All-In Podcast, the Tesla billionaire has an eclectic mix of promoters as Tesla faces another big test, reports Bloomberg.

News round-up

Goldman Sachs pulls in more than $20bn to invest in private credit (FT)

Sony Music in talks to buy Queen’s music catalogue for $1bn (FT)

How Boeing’s troubles are affecting its suppliers (FT)

Clifford Chance joins peers in raising pay for junior lawyers to £150,000 (FT)

Inside Donald Trump and Elon Musk’s growing alliance (WSJ)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, William Louch and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard and Maria Heeter in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to [email protected]

Recommended newsletters for you

Full Disclosure — Keeping you up to date with the biggest international legal news, from the courts to law enforcement and the business of law. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here