Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Simplicity does not always feature in mergers and acquisitions. But it should. BHP’s approach to buy Anglo American lacked this attribute and that explains why the deal’s energy quickly withered.

A plea on Wednesday morning by the Australian miner for another extension to the deadline set by the UK’s Takeover Panel for later that day was rejected by Anglo within hours. BHP could not convince stakeholders that its convoluted break-up made more sense than just buying the company outright.

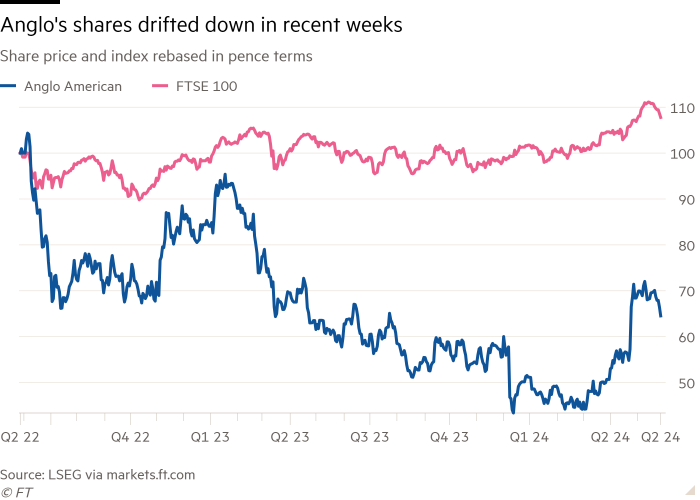

BHP boss Mike Henry’s valiant efforts notwithstanding, the slow drift downwards in Anglo’s share price spoke volumes about this deal’s chances. Even before the target laid out its defence plan in mid-May, Anglo’s share price had already begun its descent. Since then it has slipped over 4 per cent. That may not say much about the Anglo restructuring but it does point to flagging investor enthusiasm for any combination.

Shareholders of BHP, too, will have wondered to what lengths Henry would go to prove his Anglo project made sense. In the end he even offered to negotiate a reverse break fee should his plan come to nothing with regulators. This, plus offers to share costs of retained employment for any affected South African workers, felt very last-minute and last-gasp.

Henry’s extension request played to his shareholders as well. He did not wish to exit the poker room quietly, but has kept his chips for another tournament. This was an earnings per share dilutive deal, unless somehow the copper price arced towards $13,000 per tonne in the next couple of years.

What of the suggestions that Anglo’s shareholders wanted a deal? Maybe some did, but few made themselves known publicly. Indeed, top ten investor Legal & General instead backed Anglo’s restructuring.

While many ears tuned into what top shareholder BlackRock might whisper, it eschewed megaphonic appeals. Rightly so. Its 128mn shares, according to Bloomberg data, are held by many internal funds and overseen by a plurality of portfolio managers, active and indexed. Expecting BlackRock to push a monolithic view did look optimistic.

Henry asked repeatedly to be heard by Anglo’s team. But when that finally happened he still could not convince them of his plan. Instead, the board has stuck with boss Duncan Wanblad’s offer to simplify the miner into a copper/iron ore/fertiliser producer. This job is not done, though. Shareholders will need to keep the heat of urgency on him to finish the task.