Barely one year ago, Czech billionaire Daniel Křetínský said he had no plans to acquire the owner of Britain’s Royal Mail.

On Wednesday, in the middle of an election campaign, the dealmaking tycoon dubbed the “Czech sphinx” confounded the UK market by clinching a £5.3bn deal to take over London-listed International Distribution Services.

In doing so, Křetínský has forged ahead with an investment that is set to hand him the former state-owned postal monopoly synonymous with labour disputes and falling letter deliveries.

But the lawyer-turned-energy tycoon, who has become one of Europe’s most prolific dealmakers, says the highest-profile takeover of his career has a distinctly clear business rationale with Royal Mail facing growing competition in the vital parcels market.

“What has changed now, and the reason why we’ve taken the view that this is the right moment, is really the dynamic of the market,” Křetínský said in an interview with the Financial Times.

“Royal Mail is going strategically in the right direction, but not with the right speed,” he said. “If Royal Mail is not capable of defending its market share, it starts a deadly downward spiral.”

To survive and grow, IDS had to live outside short-term public markets, he argued, so that Royal Mail could make necessary investments to defend its position.

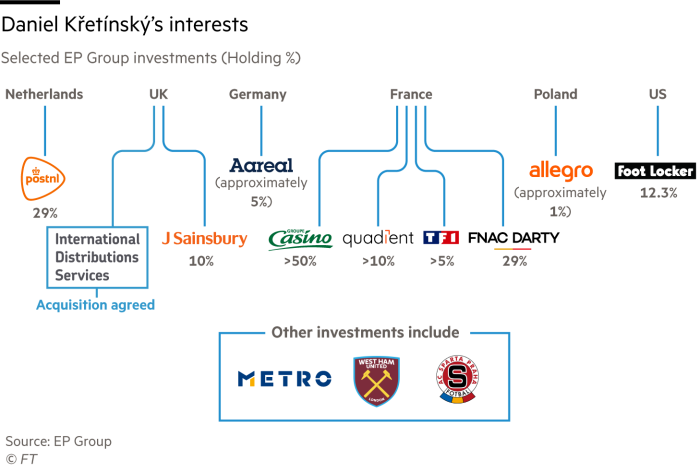

Křetínský, whose fortune stems from investments in coal, power and gas businesses, has already built up a stable of UK holdings including stakes in supermarket chain J Sainsbury and English Premier League football club West Ham United.

He first took a punt on Royal Mail four years ago, acquiring a 5 per cent stake in IDS that he eventually built into a 27.5 per cent share, triggering a national security probe in the process. It is set to form the core of Křetínský’s logistics holdings, which also include about 30 per cent of the Netherlands postal operator PostNL.

Buying IDS will bring heightened scrutiny on Křetínský as he prepares to take ownership of the group founded as a postal service for King Henry VIII. Today it employs 130,000 and is recognised domestically by its red postboxes.

In an effort to appease politicians and postal workers, EP Group has committed to protecting key principles at IDS during the first five years of ownership.

As well as keeping its UK tax residency, these binding commitments include maintaining Royal Mail’s costly obligation to deliver mail everywhere in the UK at the same price and recognising the postal workers’ union.

One closely watched commitment was to keep the company together for three years, with further restrictions on any potential separation of IDS’s profitable international parcel business GLS from the lossmaking Royal Mail in the two years that follow.

“Our goal would not be to dispose of GLS but rather it would be to see if we can acquire additional companies,” he said. “Without us, the businesses perhaps would have been already split.”

The move by Křetínský comes amid other deal activity in the UK logistics sector. Evri, owned by the private equity group Advent International, is also exploring options including a sale.

Křetínský has built up his EP Group into a business with an enterprise value topping €50bn and annual earnings of around €8bn before taking into account factors such as taxes.

The group generates roughly €2bn-€3bn in cash per year that can be further invested, allowing Křetínský to target numerous high-profile but struggling brands outside his native Czech Republic.

In France, he has made a particularly strong push, including the acquisition of food retailer Casino this year. He is also currently in the running to take over IT services group Atos.

Not all of Křetínský’s ventures in France have gone smoothly, attracting scrutiny from officials and politicians at times wary of foreign interests.

“He’s not an ideological person, he’s very pragmatic in the way that people who have known real hardship can be,” said an adviser in France, referring to Křetínský’s upbringing in Soviet-era Czechoslovakia. “He follows a pattern when looking for investment opportunities, and it’s always: find undervalued [assets], buy for cheap, hold and don’t sell.”

But questions have been raised over Křetínský‘s chances of overhauling Royal Mail while keeping his commitments over the next five years, as well as his plans for after that period.

Last week, regulator Ofcom said it would investigate Royal Mail after the company failed to meet its delivery targets for yet another year.

Alexander Paterson, analyst at Peel Hunt, said Křetínský “will have to get very comfortable with the risk that” Royal Mail is not able to convince regulators to reform the requirement to deliver letters six days a week, amid declining demand for these deliveries.

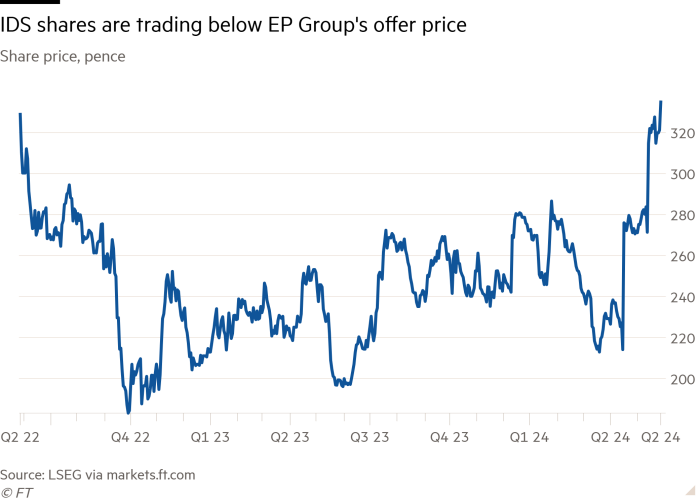

Two IDS shareholders said the bid undervalued IDS and its prospects, with one describing it as a “disappointment”. However other investors, some of whom initially resisted Křetínský’s bid, indicated they would be receptive to his latest offer in the face of Royal Mail’s mounting challenges.

One top investor said they were “minded to accept” the deal, partly “to relinquish political risk associated with the stock”.

Křetínský said that a key plan for Royal Mail was to invest in parcel lockers that store online shopping deliveries. The increasing popularity of these facilities, offered by rivals like Polish group InPost, has eaten into Royal Mail’s market share as consumers opt to collect purchases at their own convenience.

The deal still faces obstacles to completion from regulators, while the Labour party and the postal workers’ union have already vowed to protect the future of the group. Labour is widely expected to win the UK general election on July 4 and be in government by the time Křetínský aims to close the deal by the first quarter of next year.

Shares in IDS rose 4 per cent to 335p on Wednesday, significantly below the offer price of 370p, suggesting lingering scepticism over whether the deal can pass.

The deal values IDS’s shares at £3.6bn, and taking debt into account sets an enterprise value of £5.3bn. The transaction will be financed with £1.2bn of equity from EP Group, with debt arranged by banks BNP Paribas, Citibank, Société Générale and UniCredit.

“From here on in, the one thing that is going to worry whoever is in the next government is” the strength of Křetínský’s commitments and the limits on their duration, said Paterson, who also pointed to a time-limited commitment not to raid Royal Mail’s pension surplus.

Křetínský stressed that although investors typically only give commitments for up to five years in company takeovers, he intended “most of these commitments [to be] super-long-lasting”.

“I can tell you that as long as I am alive . . . you can call me on those,” he added.

He intends to maintain IDS’s investment-grade credit rating, and said the postal group’s finances would be fully supported by EP Group.

Referring to the debt load challenging UK water utility Thames Water, he said: “The destiny of our group and its credit is interlinked and interdependent with the credit profile of IDS . . . The ‘Thames Water case’ can only happen if we go bankrupt.”

Additional reporting by Raphael Minder in Prague and Adrienne Klasa in Paris