How politics might help Legal & General’s housebuilding sale

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Britain’s undersupplied and overpriced housing market is an obvious political target. With a UK election imminent, opposition leader Keir Starmer has promised to roughly double the number of homes built yearly. Housebuilding targets have been promised before, and fallen short. Even so, renewed efforts to boost activity should be good for the industry.

With that in mind, Legal & General’s decision to sell the top-ten housebuilder Cala Group now might seem odd. Persimmon is reportedly readying a £1bn bid. However, a deal would make sense for all involved.

L&G’s new chief executive António Simões wants to make the insurer simpler and clearer to shareholders. He is expected to outline a shift in strategy at a capital market day in mid-June. Cala is part of L&G’s alternatives business LGC, which had set bold targets for housebuilding under the leadership of former CEO Nigel Wilson.

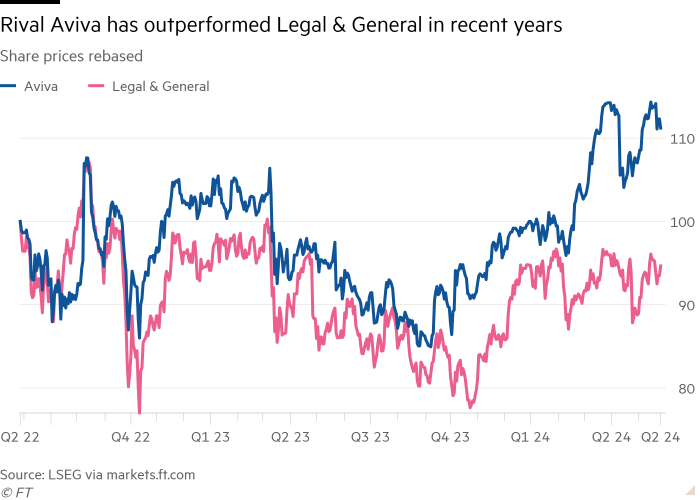

Shareholder returns are likely to gain higher priority under Simões. L&G is already generating significant surplus cash. The sale of Cala would bolster the pot for dividend payments or buybacks. These have helped shares in peer Aviva outperform in recent years following its own more radical streamlining plan.

At the right price, Cala would support Persimmon’s margins with cost cuts and product diversification. Similar logic underpins the all-share tie-up of Barratt and Redrow announced earlier this year.

True, Persimmon does not need the land a deal would bring. It already has about 8 years worth of both owned and controlled land in its bank — the same again in strategic reserve. Cala would add about a quarter more plots. Other risks persist: further industry consolidation could well attract competition scrutiny.

The £1bn mooted price tag for Cala might be too good an opportunity to pass up though. At a multiple of around book value, according to RBC, it would be sold at a discount to the 1.2 times that Barratt offered for Redrow.

Falling volumes have hit Persimmon hard in recent years. Its shares have underperformed the wider sector by a quarter since the end of 2022. A deal for Cala would probably be done at least in part with shares, meaning an overhang for shareholders may loom.

But Persimmon would also be one of the biggest beneficiaries of an expansion of low-cost housing, a target for the Labour party. An increase in activity at that end of the market would help reverse Persimmon’s recent fortunes. For L&G, which could be handed Persimmon shares at a good time for the sector, this might help make up for any price discount for Cala.