Thames Water’s customers will have paid more than half a billion pounds in addition to their water bills once a new 25km sewage tunnel under London’s river Thames is operational next year, a project they will have to keep funding throughout its projected 125-year lifespan.

London’s so-called “Super Sewer” is funded by a surcharge on Thames Water customer bills, currently £26 a year per household. The utility’s 16mn customers have paid £430mn over the eight years since construction started and will have paid £540mn by March 2025 when the tunnel is expected to be operational, according to a study of the project’s accounts.

The study comes as testing on the £4.5bn tunnel — a cost that compares with the £3.5bn forecast a decade ago — is expected to start next week, with the removal of the deep underground walls that have kept it separate from the existing system while the new concrete caverns were being built.

The project, which trades as Tideway, will be the biggest improvement to the capital’s sewerage network in 150 years. It will divert most of the effluent from 34 combined sewage overflow pipes in the central section of the river to a treatment plant in south-east London.

Scrutiny of Tideway’s funding model — which serves as a blueprint for other large infrastructure projects in the UK such as the new Sizewell C nuclear plant — comes amid wider concern about a financial crisis engulfing Thames Water, the UK’s biggest water provider.

Thames Water’s parent company told bondholders earlier this month that it was in default, heightening fears that it could be renationalised. The utility wants to hike customer bills by as much as 56 per cent by 2030, making any surcharge to pay for Tideway even more controversial.

Water companies argue that higher bills are necessary to invest in new infrastructure and combat pollution, an issue that has become a lightning rod for popular anger.

David Hall, visiting professor at Greenwich University who calculated the £540mn figure, said the project “makes consumers pay three times over”.

“First they are paying almost £0.5bn up front, more than all the equity invested by Thames Tideway’s shareholders, then they are paying for the returns of shareholder loans, and then from continuing debt.”

Thames Water does not own Tideway. When the 7.2 metre-diameter tunnel was being planned — in response to a 2010 EU directive to reduce sewage outflows — Thames Water refused to inject new equity into the project. The water company’s shareholders at the time, which included Australian asset manager Macquarie, argued that its debts were too large and the risks of tunnelling near key landmarks such as the Houses of Parliament too great.

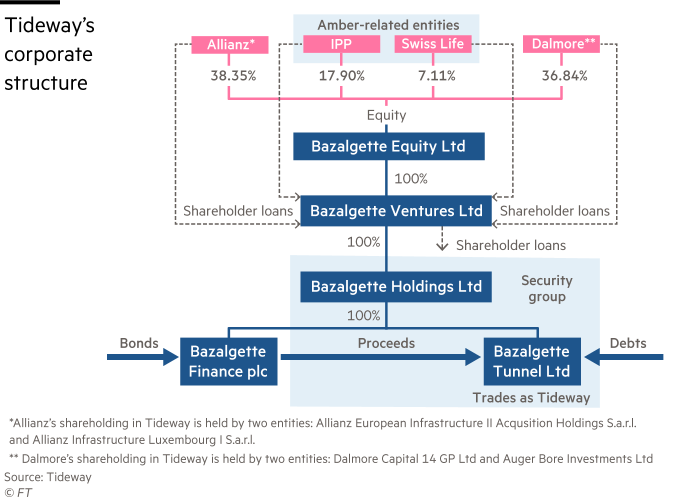

Instead, the UK government and Thames Water agreed to set up an entirely new company that would be privately financed and regulated by Ofwat. It was named Bazalgette, after the engineer who designed London’s sewage system 125 years ago. That company now trades as Tideway.

Tideway said its funding model “has proved effective, with private sector investment upfront and costs spread over many millions of households”.

To lure long-term institutional investors, the government acted as a backstop on some of the financial risks including cost overruns. However these “have not been called on and are not expected to be called on as the project reaches completion”, said Tideway.

Macquarie said: “When we first invested in Thames Water, London relied on a sewer system built 150 years ago. Recognising a desire for change, we commissioned Thames Tideway which sought the best market terms to deliver value for customers and a generational investment to meet the needs of the capital’s growing population.”

Thames Water paid around £1.1bn towards the cost of the tunnel for enabling works, while Tideway’s investors — which include Allianz, Dalmore Capital, Amber Infrastructure, and DIF, which sold its stake in 2022 — invested £509.7mn in equity and loaned the company £764.5mn when it was set up in 2015.

Since then the shareholders’ loans have increased to £836mn, for which those investors agreed a rate of 8 per cent in interest until they mature in 2064, according to the accounts.

Overall, the shareholders have received £298.1mn over the past eight years: £243.6mn of interest and £54.5mn of capital repayments up to March 2023 in lieu of dividends, according to Tideway.

The rest of Tideway’s £4.2bn debt is held with commercial banks or via other intergroup loans.

Although Thames Water will be responsible for above-ground infrastructure such as new parks created along the river, Tideway will retain ownership of the tunnel and shafts, which will be inspected every 10 years, some by drones.

Tideway’s organisation and management are expected to be reduced in line with its activities from next year and it should eventually have a smaller management team, though it declined to set a timeframe. From 2030, Ofwat will agree consumer bills for the super-sewer at regular five-year periods.

The nine directors on Tideway’s board received a total of £6.6mn in the year to March 2023; up from £2.95mn in 2022, according to Tideway’s accounts. Directors include Ruby McGregor-Smith, the former CEO of government contractor Mitie, and John Holland-Kaye, former chief executive of Heathrow airport.

Mark Sneesby, who left as chief operating officer at Tideway in September 2021, received £1.25mn from a long-term investment plan in the year ended March 2023, up from £533,000 the previous year. Sneesby — who joined Tideway from Thames Water in 2014 — did not immediately respond to a request on LinkedIn seeking comment.

Andy Mitchell, the chief executive of Tideway, was paid an additional £2.2mn last year on top of his £468,000 base salary last year, taking his total package to more than £2.7mn in the year to March 31 last year and to nearly £9mn since he started in 2014.

Tideway said the “remuneration reflects the milestones being achieved in the construction of the tunnel and reflects the complexity and significance of delivering one of Europe’s largest infrastructure projects”.

“The project is the UK’s single most significant intervention to deal with sewage pollution, ending the harmful effects of sewage pollution on the river,” it added. Despite challenges such as high inflation and the pandemic “costs to water customers have remained within the projected range set out at the beginning of the project”.

Thames Water declined to comment.

This article has been amended to reflect that shareholder loans to Tideway total £836mn