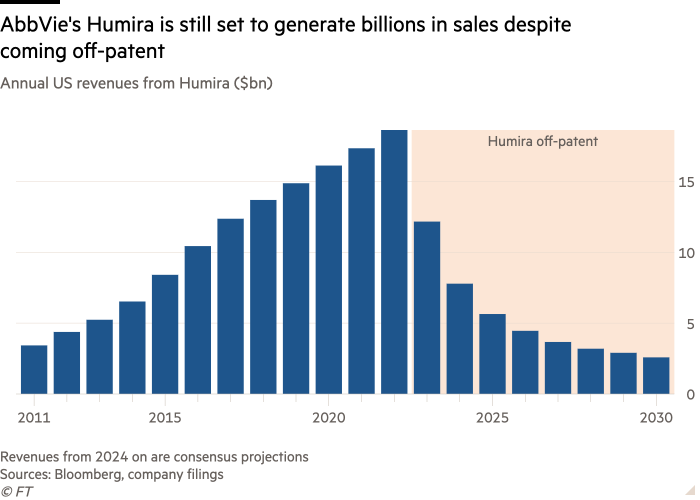

When AbbVie’s record-breaking immunology drug Humira came off-patent early last year after generating more than $200bn in sales for the drugmaker over two decades, a number of cheaper copycat products, known as biosimilars, hit the market. Yet AbbVie’s monopoly barely wavered.

US revenues from the world’s best-selling drug, which is used to treat inflammatory conditions from arthritis to Crohn’s disease, fell by a third as AbbVie offered favourable rebates to industry middlemen, called pharmacy benefit managers, or PBMs, to sustain prescription volumes. But the arrival of generic competition had gone “exceptionally well”, AbbVie’s incoming chief executive Robert Michael concluded at an investor event earlier this year.

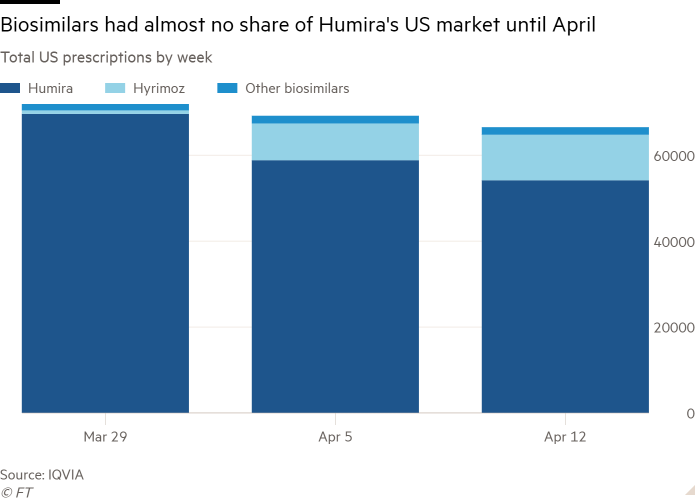

That was until this month, when CVS Caremark, one of three dominant PBMs, dropped Humira from its lists of preferred drugs for reimbursement. Biosimilars shot up from a 2 per cent share of all Humira prescriptions at the end of March to 19 per cent by mid-April, according to data provider IQVIA.

This was driven by a surge in prescriptions of Sandoz’s Hyrimoz, CVS’s preferred biosimilar, which was given to more than 10,000 patients in the week ending April 12, pushing biosimilars’ share of new Humira prescriptions up to 43 per cent.

What happens next is expected to be the biggest test yet of whether generic competition can serve its purpose of lowering steep drug prices in the US, or whether the oversized influence of the three biggest PBMs, whose powerful positions are drawing scrutiny from politicians and regulators, stifle market forces.

The outcome could have ramifications beyond the industry. US President Joe Biden has put his fight against Big Pharma at the centre of his re-election campaign, championing his efforts to lower drug prices through the Inflation Reduction Act.

“Is the biosimilar market a failure with respect to these pharmacy benefit drugs like Humira? Maybe in March it was, but in April it’s starting to look functional again,” said Alex Brill, chief executive of Matrix Global Advisors, a healthcare consultancy.

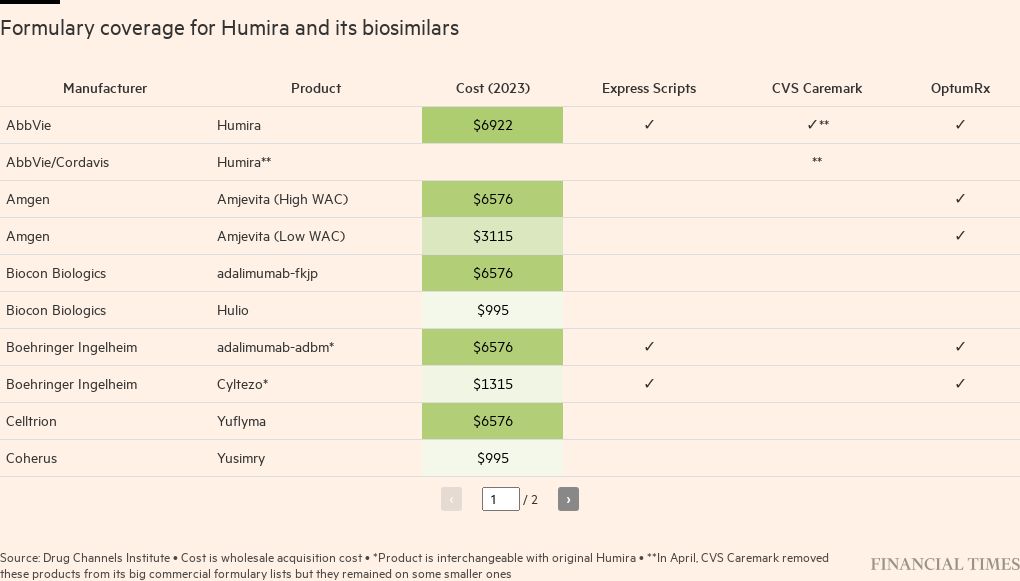

The slowness of PBMs to promote some of the nine approved Humira biosimilars and pharmacists’ reluctance to prescribe them had cost patients and health plans $6bn as biosimilars are priced at a fifth of the level of the original drug, according to a report published this month by the Biosimilars Council, an industry body. Full uptake of biosimilars would lose PBMs 84 per cent of the $2.1bn in net profits they were making from Humira, it estimated.

In a statement, Sandoz called AbbVie’s continued dominance “the epitome of a dysfunctional market”. “Misaligned incentives across the US healthcare system have led to meaningful delays and barriers to biosimilar adoption, resulting in significant missed opportunities for healthcare savings,” the Swiss generics manufacturer said.

UnitedHealth Group’s OptumRx and Cigna’s Express Scripts, the two other large PBMs, have continued to give Humira preferred placement on their formulary lists as AbbVie has offered them bigger rebates. The insurer-owned benefit managers argue that these rebates are passed on to patients in the form of lower premiums, but they pocket some of the discount for themselves.

OptumRx told the Financial Times it offered three biosimilars “at parity” to Humira, “including adding both high and low list price options, allowing clients to choose what works best for their plan designs and members”.

Whether other large PBMs adopt biosimilars will determine how quickly competition for Humira grows. Along with striking a co-brand deal with CVS to offer Hyrimoz at a discounted price of $1,315 a month, Sandoz has a higher list price version of the biosimilar, priced similarly to Humira at more than $6,000 a month, on which it then offers a large rebate to attract OptumRx and Express Scripts to promote the drug.

“We are hopeful that the market will further open up in 2025 and we will see others displace Humira as well,” Sandoz said.

AbbVie said the incursion by rivals to Humira “was anticipated and contemplated” in its financial guidance.

PBMs face increasing pressure from the Federal Trade Commission, the US antitrust regulator, and bipartisan legislation in the works aimed at encouraging the uptake of biosimilars.

“[PBMs] are acutely aware of their situation: everybody in the world hates them and they are looking for friends,” said Douglas Holtz-Eakin, president of the American Action Forum, a right-leaning think-tank. But the groups “would prefer to solve their own problems, as opposed to have politicians solve it”, he said.

Despite Sandoz’s incursion into Humira’s territory, generics manufacturers remain cautious in their optimism. “It is too early to hang up a ‘mission accomplished’ sign,” said Craig Burton, executive director at the Biosimilars Council. “The large PBMs make money every step of the way when they stick with the brand and it will take a lot to shake them from that mindset.”

“CVS has put their stake in the ground that they’re going to create a marketplace where one [biosimilar] manufacturer is rewarded,” said Jon Martin, head of Organon’s US biosimilar arm, which produces Humira competitor Hadlima. “I think that you’re going to see other PBMs gradually get to that place because if they want competitive market dynamics, they have to start to reward biosimilars.”

A Humira biosimilar from Teva Pharmaceuticals working with Alvotech earlier this year became the first drug that the US Food and Drug Administration granted interchangeable status, which lets pharmacists substitute it for Humira without consulting patients. Another biosimilar from Organon in collaboration with Samsung Bioepis has a pending application to be granted interchangeable status.

If interchangeable biosimilars were added to the formularies of the big PBMs next year, that would boost competition, Martin predicted.

“You would think that any PBM would want to offer all the biosimilars available; creating that true competition would move the market,” said Mark Cuban, the US billionaire whose pharmaceutical discounter Cost Plus Drugs has a deal with manufacturer Coherus to sell its biosimilar for $995 a month.

Cuban is targeting the 38 per cent of private sector employers who self-insure at least one of their health plans. “The real inflection point is when self-insured employers require . . . other biosimilars be included in their formularies,” he added.

Nonetheless, James Shin, a biopharma analyst at Deutsche Bank, said the sharp increase in biosimilar prescriptions in recent weeks would be “alarming” to AbbVie. “I think a lot of people are now expecting pretty meaningful erosion of AbbVie’s US Humira business this year,” he said.

This story was updated to reflect that the biosimilar from Organon has a pending application to be granted interchangeable status.