Boeing is telling airlines they will receive fewer 737 Max jets than expected this year, forcing them to trim schedules and raising the prospect of higher fares during the busy summer travel season.

Warnings have piled up from carriers in the US and Europe of fewer of the shorter-haul aircraft than they had expected this year, an unwelcome surprise that is driving up labour costs and keeping older aircraft flying.

Boeing has been building fewer 737 Maxes this year after a door panel blew out from one of the planes during an Alaska Airlines flight in January. The company this week reported burning almost $4bn in cash in the first quarter as production rates slowed.

The US Federal Aviation Administration, a regulator, has said Boeing can make no more than 38 737 Max planes a month as it works to improve quality controls. In March the plane maker delivered 24 jets to customers, compared with 52 the same month a year earlier. European rival Airbus, meanwhile, delivered 51 of the A320 and A321neo, planes that compete with the Max.

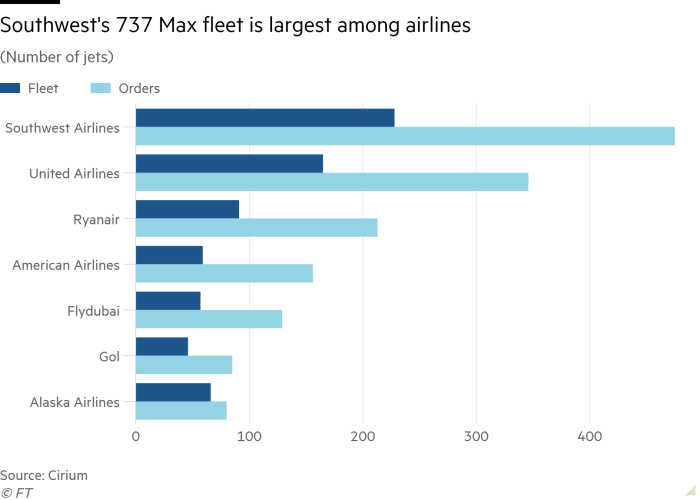

Airlines have been counting the cost. Southwest Airlines, the carrier with the most 737 Maxes in service and on order, said on Thursday it would receive only 20 of the 46 single-aisle jets it had expected this year. In January, it said it was planning to receive 79 Max aircraft, rather than the 85 that had been agreed.

With less capacity, Southwest said it now expected 2024 operating revenue to grow less than 10 per cent compared with last year. Previously it had forecast double-digit growth.

The carrier, which posted a first-quarter net loss of $231mn, announced a string of cost-saving measures. It will end operations at four US airports and reduce headcount by 2,000 employees by the end of the year. It is limiting hiring, offering voluntary time off and trimming its schedule for the second half of the year.

“We are focused on controlling what we can control,” said chief executive Bob Jordan.

American Airlines has said it expects to receive 16 of the narrow-body aircraft in 2024, according to a Securities and Exchange Commission filing, down from its January estimate of 20. Previously it had expected 25. The airline on Thursday reported a net loss of $312mn for the first quarter, compared with $10mn in net income for the same period a year ago.

Last week United Airlines said it anticipated Boeing would deliver 61 of the narrow-body aircraft in 2024, down from an expectation of 101 at the beginning of this year.

United’s chief commercial officer Andrew Nocella said: “As we entered the year, we built the business plan for a larger airline, and deliveries have fallen more than 40 aircraft short of our expectations.”

Alaska Airlines said instead of receiving 23 Maxes this year, Boeing would deliver between 10 and 20. The company had expected to expand flying capacity up to 5 per cent more than last year. Now it expects capacity to grow no more than 3 per cent.

Ryanair, Boeing’s biggest European customer, expected to receive 57 planes in time for the peak summer season, but it now awaits “towards 40”, chief executive Michael O’Leary told the Financial Times.

The low-cost airline has cut some flights and slowed its growth plans, reducing the number of passengers it expects to fly in the current financial year from 205mn to 200mn.

At the start of the year Turkish Airlines was scheduled to receive 15 737 Maxes this year and another 16 in 2025, according to aviation data provider Cirium. It currently expects to receive four this year, which it will lease from AerCap, and 31 next year, all of them coming from lessors.

Helane Becker, analyst at TD Cowen, said Boeing’s delivery delays plus the grounding of planes powered by defective Pratt & Whitney geared turbofan engines, could combine with strong demand for air travel to drive fares higher starting in mid-May.

O’Leary forecast fares would increase 5 per cent to 10 per cent year on year because of the aircraft shortage across Europe. The potential to charge more for tickets and to operate fuller flights may partially offset higher costs. Fitch Ratings analyst Joe Rohlena said higher fares were likely to show up later in the year.

“It’s a net negative for the airlines but there are some offsets,” he said.

Global capacity for United and Alaska in June is about 6 per cent lower than what they had planned on January 7, immediately following the door blowout, said Rob Morris, head of aviation data firm Cirium’s consultancy business Ascend.

“I suspect lack of 737 Max is a key driver to that,” he said.

United hired flight crews, particularly pilots, on the assumption it would have more planes for them to fly. It has since asked pilots to take voluntary unpaid time off in May.

Chief executive Scott Kirby last week said United now plans to build a hedge into its schedule. If it expects to receive 100 Boeing aircraft in a year, it will schedule for 90 or fewer.

“If everything is on time and on plan, then we’ll have a few extra spares around for a couple of months,” he said. “That will cost a little bit, but it doesn’t cost nearly as much as overstaffing by 40 airplanes.”

Turkish Airlines, which is trying to double the size of its fleet over the next decade, is negotiating with Boeing to place what is supposed to be a sizeable order, possibly about 150, Morris said. Chief financial officer Murat Şeker told investors this month that “negotiations are still continuing . . . With the Max in particular, the decisions could be a little later”.

Alaska said it still planned to operate a reliable schedule despite having fewer new planes. Chief commercial officer Andrew Harrison said it had extended the retirement of older aircraft over the next few months, while using jets across the fleet more frequently.