Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

For DS Smith shareholders the packaging may matter more than the paper when comparing competing efforts to buy the company.

The British boxmaker said on Wednesday it had received a second all-share offer, this time from International Paper. The US pulp and paper manufacturer has proposed paying 0.1285 shares for each in DS Smith, worth about 415p as of Monday’s close. That valued DS Smith at £7.5bn ($9.5bn) including net debt, with a per-share price about a tenth above UK rival Mondi’s approach in February.

But a fall in International Paper’s shares has cut its pitch to just under 400p. Mondi’s shares rose slightly. The gap between the two deals on Wednesday was closer to 4 per cent. And the contrasting reactions in the would-be buyers’ share prices reflect the options on offer to DS Smith.

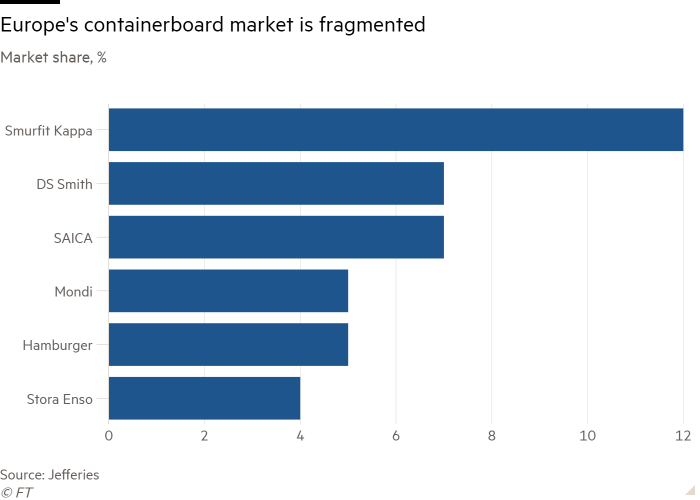

Both deals are defensive, rooted in the need to consolidate given excess industry capacity and peaking demand for cardboard and paper. But a tie-up with Mondi would create a European champion, and with it cost savings. The pair have a mismatch in containerboard production: DS Smith consumes more of this raw material than it makes and the opposite is true for Mondi. Putting them together should mean reduced reliance on market prices and lower earnings volatility.

Mondi has not provided details on the cost savings from a tie-up. Jefferies puts these at £350mn annually or some 4 per cent of DS Smith’s sales. Taxed and capitalised these are worth about £2.5bn — a large chunk of which has already gone to DS Smith shareholders with shares trading at a £1.4bn premium to their undisturbed price. Mondi may not have much room to bump (unless it can find bigger cost savings) but it may not need to.

In a sector under pressure, the question is how International Paper justifies its higher offer. The group has a European operation but its smaller size suggests more limited opportunity for savings.

Ireland’s Smurfit Kappa, which International Paper tried to buy in 2018, expects to generate savings of $400mn in the first year from its $20bn tie-up with US group WestRock — about 2 per cent of the target’s sales, with a bigger overlap than DS Smith and International Paper.

The US paper maker may not want to be left alone as the world of cardboard couples up. A Mondi/DS Smith combination would be too big for a subsequent deal. DS Smith shareholders should be wary of a suitor willing to overpay simply to stay in the game.