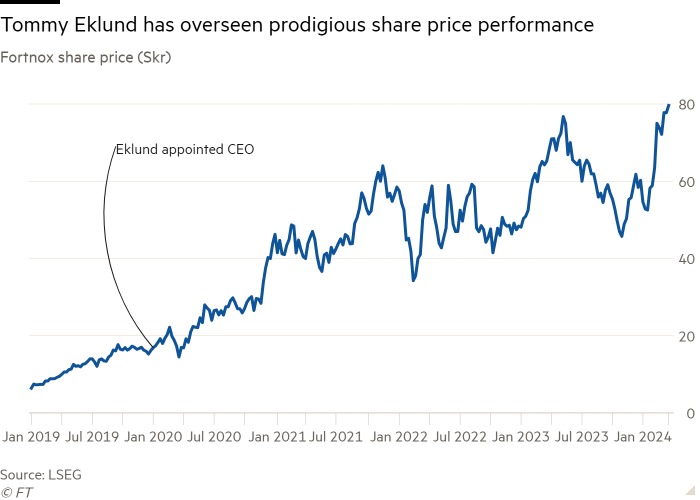

While some technology chief executives transform their industry, few have redefined it the way Tommy Eklund has at Fortnox.

Eklund has turned a niche supplier of accounting software that only operates in Sweden into a stock market sensation whose share price has risen fivefold on his watch.

Before he arrived in 2020, few predicted such stratospheric performance. The company had already signed up two-fifths of what Fortnox estimated were the country’s 800,000 small businesses comprising its “relevant market”.

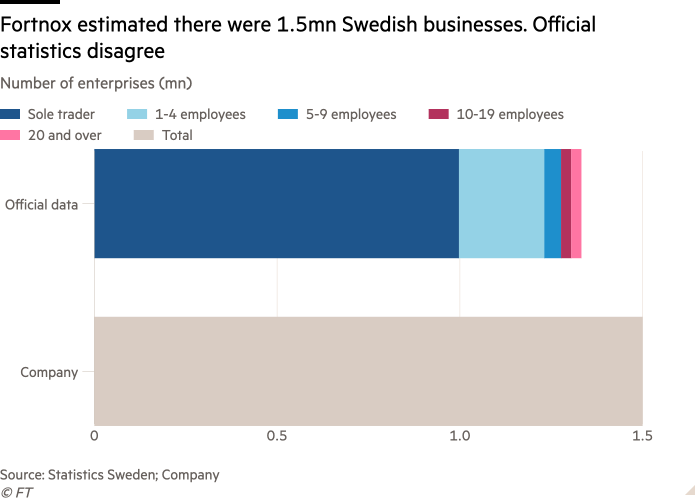

Yet after a year under Eklund, Fortnox decided its total addressable market was actually 1.5mn businesses, more than that counted by Sweden’s statistical agency.

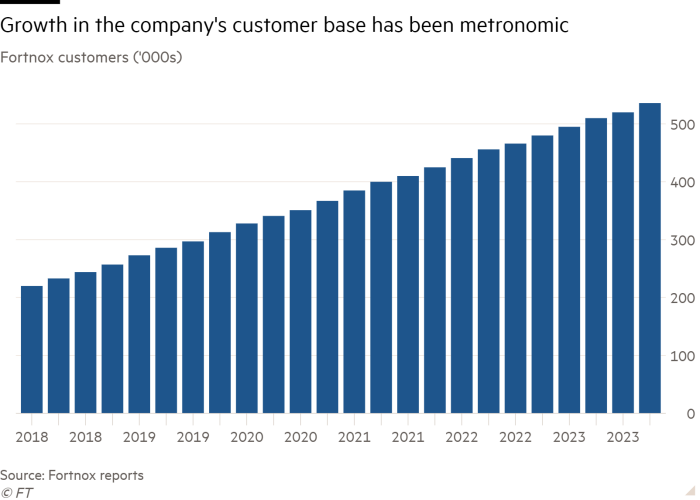

The discrepancy has attracted the attention of sceptical hedge funds and analysts, who wonder how Fortnox increased customer numbers and revenues with metronomic regularity, immune to trends in economic growth and a marked rise in bankruptcies; the firm added 10,000 customers in the third quarters of 2020, 2021, 2022 and 2023.

At stake is the company’s market capitalisation which was $4.6bn on Tuesday, a 23 times multiple of forecast sales that has made it one of the world’s most highly valued software groups, more expensive on that metric than Nvidia.

After publication of this article on Wednesday, Fortnox’s share price fell 12.3 per cent by 4pm on the Nasdaq Stockholm exchange, wiping $560mn off its value.

Asked how Fortnox achieved such consistent growth, chief financial officer Roger Hartelius told the Financial Times the figures were “rounded to the nearest thousand”.

“The number is a net number and includes except new and churned customers also new via direct sales and via accounting firms but also newly started companies, as well as companies changing to one or more of our subscription products,” he wrote in response to questions.

Sweden’s statistics agency estimates there are 1,332,598 registered enterprises, including government agencies, of which 1mn were sole traders with no employees.

Hartelius, who responded to questions sent to Eklund, said Fortnox viewed its market as 1.5mn organisations, including condominium associations and sports associations, which he said “are required to manage accounting and report to the tax office”. He said that nuance was communicated at a 2021 investor day.

During that presentation Eklund said: “There are about 1.5mn businesses in Sweden right now and with this approach we think most of them are addressable.”

Some are sceptical. A sales report from broker Redburn last year said: “If it’s a private road with 20 houses collecting annual subscriptions, does it need bookkeeping software? Does it need to send out e-invoices? Perhaps not.”

Under Eklund, who describes the two-decade-old company as a start-up, it has expanded in a number of business areas, including invoice financing, the purchase of a “marketplaces” division that connects consumers with professional contractors, and most recently corporate credit cards.

From 2mn users of its services in 2020, Fortnox aims to hit 4mn by 2025, roughly two-thirds of Sweden’s working population.

The Rule of Fortnox

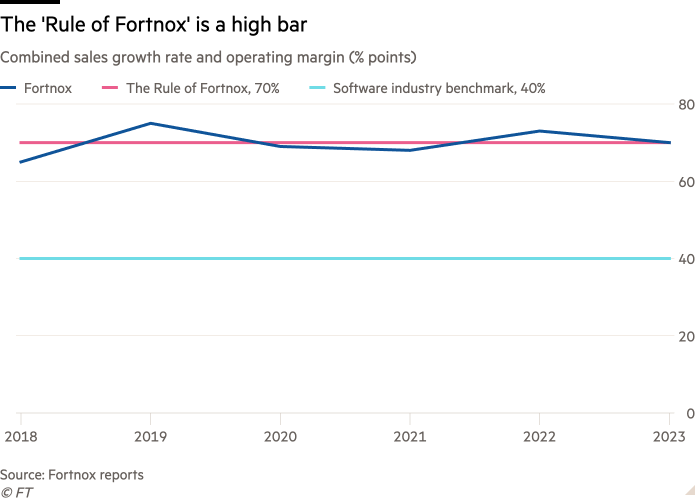

A popular benchmark for software-as-a-service firms is a combined revenue growth rate and profit margin of at least 40 percentage points. If the company grows rapidly, profit margin theoretically becomes less important, but as it matures, executives need to make sure margins make up the shortfall.

A metric at the heart of Eklund’s vision, which the company calls the “Rule of Fortnox” is a more ambitious 70 per cent. The company says it broadly achieved this for the past five years, and that it has been above 60 per cent for the past 11 quarters.

Fortnox stock was a popular short for hedge funds over the past year, although some cut their positions after the share price jumped 18 per cent on Valentine’s Day, following the announcement of full-year results that beat market expectations.

The only current disclosed short seller is London-based hedge fund Marble Bar. Others to recently short the stock — but which have either exited their position or are below disclosure thresholds — include London’s Kuvari Partners, CapeView Capital, Shadowfall Capital and Research and the UK arm of JPMorgan Asset Management.

Eklund told investors that hiring staff to replace external consultants was a factor behind the jump in profit margins.

As usual, Eklund took filtered questions on the earnings call moderated by an equity analyst, without the finance chief. Hartelius said Eklund, with whom he worked at a previous company, was “doing a great job on the calls” and that “our financials are well described in our financial reports”.

Some investors challenge the quality of those reports, in which the presentation of its operating segments has changed every year under Eklund.

It now has five interrelated segments — businesses, accounting firms, core products, financial services and marketplaces — that sometimes sell on behalf of each other.

Toby Clothier of Chameleon Global, which is short on Fortnox, said: “It should be incredibly simple and I can’t understand it, it looks like spaghetti junction. Who is paying who?”

Hartelius said “our main focus is on customers and products and the responsibility connected to that is how we have chosen to be organised”.

Fortnox also reduced disclosure around a business that lends to customers against the value of invoices. In the 2023 annual report released last week, details of money set aside for loan losses were reported as percentages rounded to the nearest whole number, rather than to a decimal point.

For instance, loan loss provisions were 0.6 per cent in the 2022 annual report. In the 2023 version that figure became 1 per cent. Hartelius said the change “applies to all figures in our annual report due to our growth”. That document said the Fortnox effective tax rate was 15.8 per cent last year.

Growth incentives

Prospects for growth remain a central question. Fortnox says its core customer base is small businesses with between five and nine employees. Sweden’s statistics agency counted 46,000 businesses of this size in 2023, a small fraction of Fortnox’s 536,000 customers.

“Going forward we are broadening our offer to be even better for smaller organisations, and moving into bigger organisations,” Hartelius said.

The rounded number of accountants using Fortnox was unchanged last year. “We think the Swedish market is significantly penetrated and that the remaining portion is sole traders, with revenue opportunities significantly smaller,” said one hedge fund shorting the company’s stock.

Sweden’s tax authority said that out of 750,000 registered sole traders, about 180,000 reported no revenues in 2022. Eurostat’s estimate for the number of active businesses in Sweden is similar to Fortnox’s prior to Eklund’s arrival.

His incentives have been primarily tied to the share price, via an unusual arrangement in which Olof Hallrup, chair of the board and the company’s biggest shareholder, personally paid the Fortnox chief executive.

Hallrup was convicted of insider trading in Fortnox stock ahead of a 2016 takeover bid by rival Visma. The purchase was blocked on competition grounds and Hallrup was then acquitted on appeal in 2018 and compensated for damages.

His company First Kraft issued 100,000 Fortnox call options of 10 shares each to Eklund on his appointment. First Kraft sold SKr600mn ($57mn) worth of stock early in 2023 to leave it with 18.8 per cent of Fortnox. A one-year commitment to refrain from further sales expired last month.

Hallrup also leases offices to Fortnox through another company that received SKr25mn of rent last year: more than the SKr23mn First Kraft received in dividends that year. Hallrup said he offered to build the office because he “was convinced that the development of the company would be significantly improved and that our profile in the community would be strengthened”, and that the rent was set below market value.

Hallrup’s incentive plan for Fortnox’s chief executive was a resounding success. Eklund exercised his options in 2022 at a strike price of SKr20. Had he retained them all his stake would be worth $7.4mn today, rather than the $2.6mn worth of shares he held at year end.