Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. It’s the beginning of a new era in Japan — the country’s central bank raised borrowing costs yesterday for the first time since 2007 in a historic pivot away from negative interest rates.

Following a 7-2 majority vote, the Bank of Japan said it would guide the overnight interest rate to remain in a range of about zero to 0.1 per cent, making it the last central bank to end the use of negative rates as a monetary policy tool. Its benchmark rate was previously minus 0.1 per cent.

The BoJ turned to negative rates in 2016 to encourage banks to lend more and stimulate economic activity. With yesterday’s decision, it is aiming to put decades of deflation behind it as signs emerge of broader change in the Japanese economy — including big pay rises that have given BoJ governor Kazuo Ueda enough confidence that mild inflation will continue.

Despite the policy shift, Ueda signalled that borrowing costs would not increase sharply since inflation expectations have not yet met its target.

With few signals of further rate rises, the yen weakened to a four-month low of ¥150.96 against the US dollar in Tuesday afternoon trading in New York. Our Tokyo bureau chief Kana Inagaki has more on the market reaction.

Opinion: Does Tuesday’s decision mean Japanese monetary policy will be boring from now on? Perhaps for a little while, but a little while only, writes Robin Harding.

Go deeper: The FT global inflation and interest rates tracker provides a regularly updated visual narrative of consumer price inflation and central bank policy rates around the world. See how your country compares.

Premium subscribers can sign up for our Central Banks newsletter by Chris Giles for more on interest rates, inflation and what policymakers are thinking. Don’t have a premium subscription? Upgrade here.

Here’s what else I’m watching on a busy day of monetary policy:

China: The People’s Bank of China is widely expected to leave loan prime rates unchanged. (Reuters)

US: The Federal Reserve is expected to keep interest rates at their current 23-year high.

Indonesia: The country’s central bank has its interest rate announcement. Last month Bank Indonesia said it would keep rates on hold “for a while”. (Bloomberg)

Economic data: The UK publishes February inflation figures while the EU reports consumer confidence data.

Companies: Chinese internet giant Tencent and US semiconductor maker Micron Technology report results.

Five more top stories

1. Hong Kong has passed a tough security law after fast-tracking it through the legislature. Critics say the legislation, which imposes life imprisonment for crimes such as treason, will further erode civil liberties in the Chinese territory. The wording has also stoked concern among investors, auditors and financial analysts fearful of having their work branded as criminal.

2. Adani Green, the renewable energy business owned by Indian billionaire Gautam Adani, said it was aware of a US government probe into a “third party” following a report that alleged his conglomerate was subject to a bribery probe. Here’s what we know about the investigation.

3. Microsoft has hired Mustafa Suleyman, the co-founder of Google’s DeepMind and chief executive of artificial intelligence start-up Inflection, to run a new consumer AI unit. The FT’s Tabby Kinder reports on Microsoft’s latest move to capitalise on the boom in generative AI.

4. The Abu Dhabi Investment Authority is seeking to capitalise on western investors’ retreat from China by offering to buy at a discount their stakes in funds managed by Hong Kong-based PAG. The move from Abu Dhabi’s main sovereign wealth fund is a sign of how some Gulf investors are looking to snap up bargains as US-based investors cut their China exposure.

5. Chinese pharmaceutical group WuXi AppTec has said it is lobbying hard in Washington against a proposed bill that threatens its business in the US, where it generates 65 per cent of its revenues. US lawmakers have put the sector under scrutiny in relations with China and are seeking to restrict companies with federal funding from contracting with “foreign adversary” biotech groups deemed a national security threat.

The Big Read

Since late July, when US regulators unveiled plans that they say will make banks safer, the issue of bank capital rules has been forced into the mainstream like never before, with adverts opposing the rules popping up in podcasts and television shows. Critics warn of dire consequences for “everyday Americans” if authorities push ahead with what they have apocalyptically termed “Basel Endgame”, while advocates of the new rules, which are stricter than globally agreed standards, say the concerns are overblown.

We’re also reading . . .

Nowruz: The festivities preceding the Persian New Year, which begins today, have brought people out on to the streets in a defiant show of freedom, writes Najmeh Bozorgmehr.

Trump’s betrayal of Ukraine: If elected president in November, Donald Trump may hand Vladimir Putin victory over Ukraine. It will only hurt the US, writes Martin Wolf.

Artificial intelligence: Too little attention is being paid to how AI could transform the state, writes Stephen Bush. While it might never be cheap enough to replace you at work, it is already changing how you are governed.

Chart of the day

Google DeepMind has developed a prototype AI football tactician in collaboration with Premier League club Liverpool. The computerised coach’s suggested improvements to players’ positions at corner kicks mostly won approval from human experts, according to a paper published in Nature Communications.

Take a break from the news

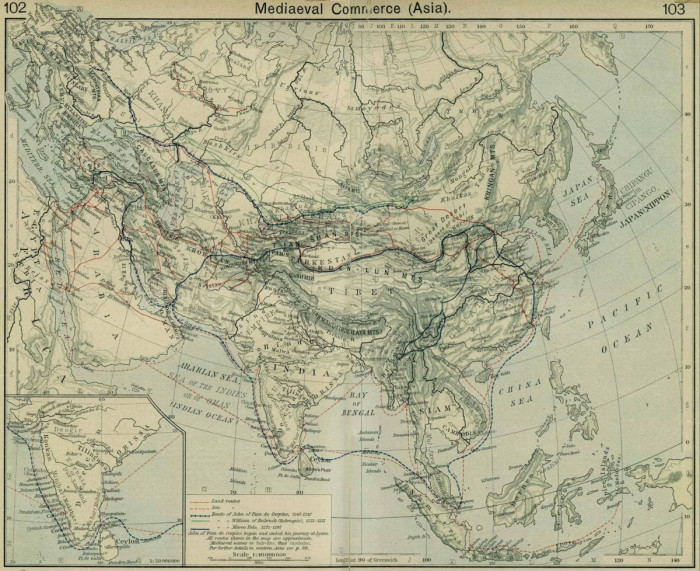

A group of writers and popular historians argue that the ancient and medieval worlds were more closely linked than we used to think. Taken together, their books are bringing Asia to the centre of the map of global history, writes Nilanjana Roy.

Additional contributions from Grace Ramos and Gordon Smith

Recommended newsletters for you

Working It — Everything you need to get ahead at work, in your inbox every Wednesday. Sign up here

One Must-Read — The one piece of journalism you should read today. Sign up here