Receive free Personal Finance updates

We’ll send you a myFT Daily Digest email rounding up the latest Personal Finance news every morning.

Retailing, once a straightforward business of selling goods in shops, is now on the front line of an assault from online competitors. Some traditional UK retailers attempt a hybrid strategy, keeping some shops while pursuing an online sales strategy. Others have found new niches to maintain revenue growth.

UK investors may find they own companies with divided fortunes, their successful, faster growing components coupled to a caboose of less glamorous, sluggish divisions in managed decline.

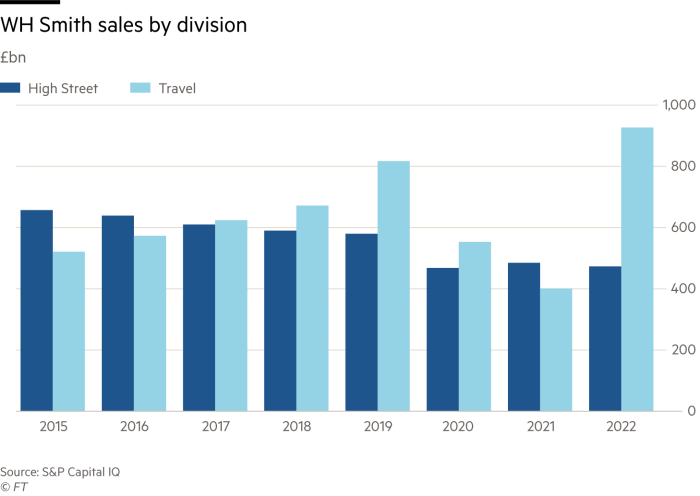

WHSmith, the 231-year-old books and newsagent chain, offers a pertinent example. Its success in fast-growing travel outlets — particularly at airports including in the US — contrasts with its stagnating high street shops.

Sales in the travel divisions, where pricey Bose headphones are a top seller, rose by 42 per cent in the past year. This area makes up two-thirds of operating profits. But on the high street sales fell again, a company update said this week.

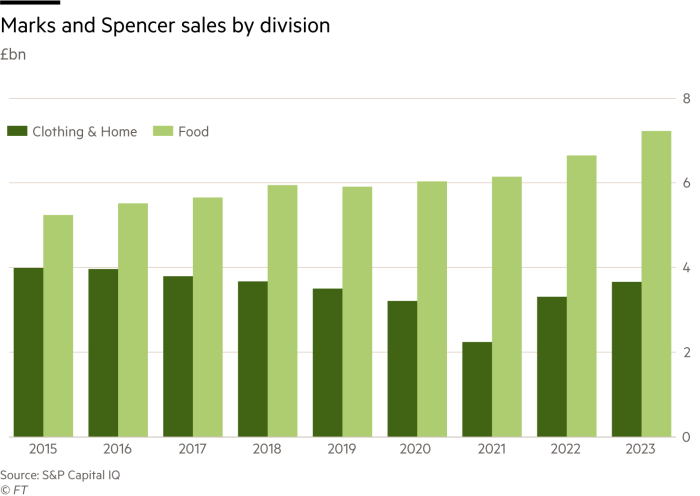

A similar divide exists at another British stalwart, Marks and Spencer. Its performance splits down product lines. Customers adore its food, but its clothes fail to excite. This is hardly a recent concern for investors. A decade ago, its clothing and food divisions contributed almost equal proportions of M&S revenues. Today, food provides twice the sales, according to data from S&P Capital.

Such combinations bring challenges for managers and shareholders who must balance the winners and losers housed under the same roof. Management may choose to keep sluggish businesses for their historical legacy or because these units still throw off useful cash flow for investment elsewhere.

Shareholders may not tolerate this sort of cross-subsidisation as it can depress the valuation of the shares. Activist investors will press a company’s board to sell off sluggish divisions. New owners or dedicated management teams can inject new life into the newly independent business with cost cuts or fresh investment.

That has happened less in UK retailing. Failed formats can end up as distressed assets sold at bargain basement prices. Following the recent collapse of the Wilko general store chain, discount retailer B&M will acquire some of its stores out of administration. Mike Ashley’s Frasers Group has sucked up failed retailers, such as Debenhams, and brands for pennies on the pound.

That suggests limited options for WHSmith and M&S. The former seems to have accepted an inevitable run-off of its high street business. Even with stagnant sales in these shops, cost savings mean high street annual operating income of between £40mn and £45mn is expected over the next five years, according to Visible Alpha. While that is better than the losses during the pandemic, it trails a pre-pandemic average around £60mn.

Those profits may well get ploughed into geographical expansion. In the US, airports have been a lucrative niche following WHSmith’s acquisition of the Marshall Retail Group. It hopes to increase its US travel market share from a percentage in the low teens to a fifth in the next few years.

For M&S, stagnation describes its clothing business more accurately than a managed decline. Repeated attempts at revitalisation have not yet boosted its clothing sales.

Recent signals, though, are promising. Clothing, footwear and general merchandise sales last year were at the highest level since 2017. Less discounting and lower amounts of older stock too help cash flow. Operating margins moved above their pre-pandemic lows to 8.5 per cent last year. Its share price has rebounded this past year, while its forward price earnings multiple at 12 times has recovered to its five-year average.

Neither of these retailers can easily shed their slow coach businesses. One may have more success than the other. WHSmith’s efforts to invest in travel will eventually be rewarded with a higher valuation, think bulls at Peel Hunt. Its shares trade at 16 times forward earnings in line with its long term average.

M&S shares continue to be supported by the success of its food retailing business, itself intensely competitive. It is taking market share at the expense of profits. It still needs its clothing sales to come back into fashion. That suggests its repeated restructuring efforts have further to go.

Investors in such dual track UK retail businesses must decide the merits of the company’s strategy for promoting growth. Otherwise, the struggling division will weigh on the group’s long-term prospects.

Disney/Charter: for millions, Iger vs Malone is a can’t-watch contest

Another example of different growth paths in an industry may be seen in the US TV industry. A fashion for video streaming at media companies faces opposition from some legacy cable groups, previously the main source of TV in American homes. This pits Disney boss Bob Iger against John Malone at Charter Communications.

Disney channels, including sports broadcaster ESPN, have gone dark on the screens of around 15mn Charter Communications’ pay-TV customers. Such “carriage” disputes occur sporadically. But this one may be existential. “Cord-cutting”, as the cancellation of cable subscriptions is called, has accelerated. Cable and satellite TV have lost their shine for the likes of Charter. These boast booming broadband businesses.

For Disney, the Charter relationship is a cash cow that generates more than $2bn annually in high margin fees. Such returns have subsidised the billions of continuing losses in streaming.

Charter argues that Disney wants it both ways — charging high prices for traditional cable TV rights while creating a cheap streaming product. Disney claims that its content remains the centrepiece of the cable bundle.

There must be a creative solution. But the collective action conundrum is sufficiently complex to ensure no one has identified it over the tail-end of the US summer holiday period.

In 2018, Charter had 16.6mn video customers. That figure has eroded to just 14.7mn. The company still generates several billion dollars of free cash flow annually.

Charter shares are up 40 per cent in the past five years for an enterprise value of more than $150bn. Disney’s stock has fallen a quarter. The House of Mouse blames its partner for supposedly charging too much.

The days of plentiful profits for content makers and distributors are over.

Iger vs Malone is a clash over which conduit should dominate viewers’ lives: cable or internet. But the audience for that fight is niche. The pair need to resolve their differences and bring sports back on offer fast — for the sake of both their businesses.

Lex is the FT’s concise daily investment column. Expert writers in four global financial centres provide informed, timely opinions on capital trends and big businesses. Click to explore