Receive free JPMorgan Chase & Co updates

We’ll send you a myFT Daily Digest email rounding up the latest JPMorgan Chase & Co news every morning.

Back in the halcyon days of . . . a few years ago, one of the biggest global investment themes was how Chinese financial markets were becoming increasingly investible and attractive for international investors.

Economic growth, financial liberalisation and inclusion in a bunch of big influential bond and equity benchmarks run by the likes of MSCI, FTSE Russell and Bloomberg meant that everyone was predicting torrential long term inflows.

As Bridgewater’s co-CIO Greg Jensen wrote in 2018:

. . . these developments highlight the fact that going forward Chinese assets will play a significant role in most investor portfolios. While today foreigners have a tiny share of their portfolios invested in Chinese assets, particularly relative to the size of the Chinese financial markets and economy, we expect this to change dramatically in coming years.

The narrative shifted from ‘investing in China is probably smart’ to ‘not investing in China is dumb’. In fact, how could anyone with a fiduciary duty refrain from having exposure to the world’s second-biggest economy and second-biggest capital markets? As a result, China received record inflows of $576bn in 2020 despite the debilitating impact of Covid-19, according to a JPMorgan note at the time.

But a new report from Joyce Chang, chair of research at JPMorgan, lays bare just how fickle those flows have actually proven. The numbers are pretty staggering.

The combination of a Chinese slowing economy, higher rates in the US, reshoring and rising political tensions (and fears that any Chinese invasion of Taiwan might trigger a Russia-style exclusion from the US-led global financial system) has triggered a massive reversal in flows.

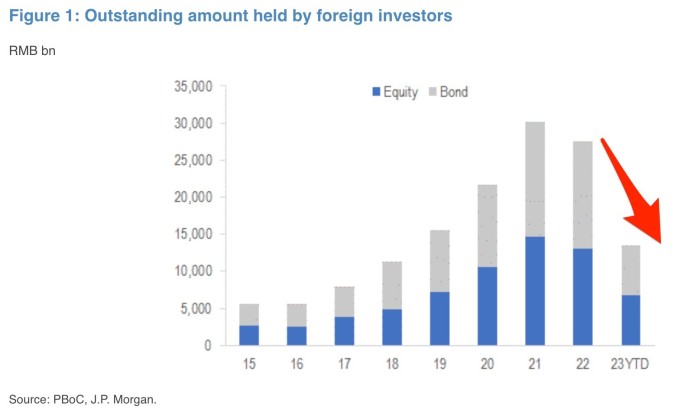

JPMorgan estimates that half of the roughly $250bn-300bn of international money that flowed into Chinese bonds because of their inclusion in various indices since 2019 has now exited. Foreign ownership of Chinese equities has declined by over $100bn.

The private market trends are similar. JPMorgan estimates that Chinese investments by international private equity and venture capital firms — which have played a major role in developing a lot of important Chinese tech companies — has collapsed by more than 50 per cent.

Some of that is almost certainly linked to the broader venture capital miasma — funding is down everywhere — but it is likely to fall further in China, according to JPMorgan.

US investment in private equity and venture capital has fallen sharply since 2021 and will likely decline further with the release of the Biden administration’s long-awaited Executive Order (EO) targeting outbound investment on August 9, 2023. The “Addressing United States Investment in Certain National Security Technologies and Products in Countries of Concern” EO and the accompanying Advanced Notice of Proposed Rulemaking (ANPRM) issued by the Treasury Department target a small number of Chinese strategic sectors — semiconductors and microelectronics, quantum information technologies, and certain artificial intelligence systems — as the advancement and indigenization of these sectors with China would affect US national security.

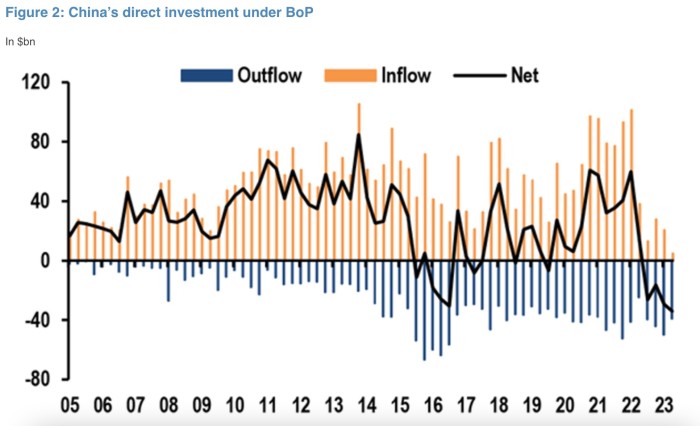

Even more tellingly, foreign direct investing is also shrinking. In the second quarter of 2023, FDI inflow stood at $4.9bn, the lowest in the past 26 years, according to JPMorgan.

You’d expect more fickle capital markets flows to wax and wane according to investor sentiment — and China is clearly not in a great spot economically right now — but the fact that FDI is also turning down so dramatically is eye-catching.

As JPMorgan writes, with the bank’s own emphasis below:

Trade flows respond much more slowly to changes in foreign engagement with China’s economy, and there is clear recognition that “de-coupling” from China is neither possible nor desirable . . . China’s importance in global trade remains undisputed, as it remains the #1 trading partner for 120 countries as global supply chain conditions have normalized back to pre-pandemic levels . . . However, we are seeing the first signs of a downward trend in foreign direct investment (FDI) flows to China, raising concerns about the potential for accelerated global supply chain relocation.