Receive free Media updates

We’ll send you a myFT Daily Digest email rounding up the latest Media news every morning.

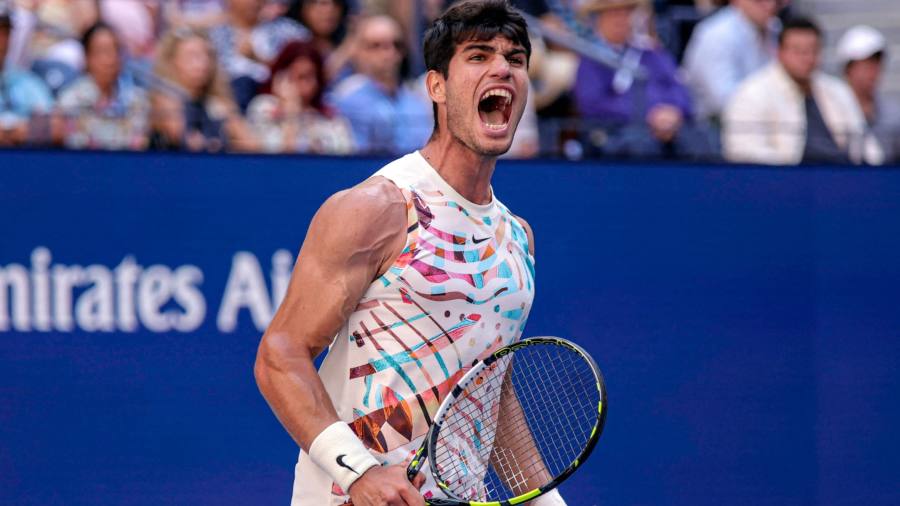

The hottest rivalries in sport right now include Novak Djokovic versus Carlos Alcaraz in tennis and Aaron Rodgers against Josh Allen in the National Football League. For millions of American fans those face-offs are inaccessible because of another star showdown: “Battlin’” Bob Iger taking on John “Cable Cowboy” Malone.

Disney channels including ESPN have gone dark on the screens of around 15mn Charter Communications pay-TV customers. Such “carriage” disputes occur sporadically. But this one may be existential. “Cord-cutting”, as the cancellation of cable subscriptions is called, has accelerated. Cable and satellite TV have lost their shine for the likes of Charter. These boast booming broadband businesses.

For Disney, the Charter relationship is a cash cow that generates more than $2bn annually in high margin fees. Such returns have subsidised the billions of continuing losses in streaming.

Charter argues that Disney wants it both ways — charging high prices for traditional cable TV rights while creating a cheap streaming product. Disney claims that its content remains the centrepiece of the cable bundle.

There must be a creative solution. But the collective action conundrum is sufficiently complex to ensure no one has identified it over the tail-end of the US summer holiday period.

In 2018, Charter had 16.6mn video customers. That figure has eroded to just 14.7mn. The company still generates several billion dollars of free cash flow annually.

Charter shares are up 40 per cent in the last five years for an enterprise value of more than $150bn. Disney stock has fallen a quarter. The House of Mouse blames its partner for supposedly charging too much.

The days of plentiful profits for content makers and distributors are over.

Iger vs Malone is a clash over which conduit should dominate viewers’ lives: cable or internet. But the audience for that fight is niche. The pair need to resolve their differences and bring sports back on offer fast — for the sake of both their businesses.