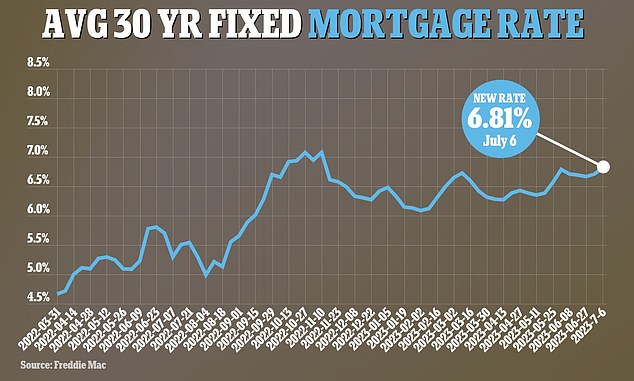

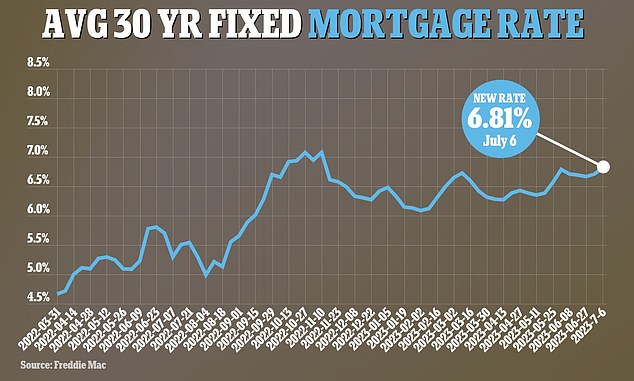

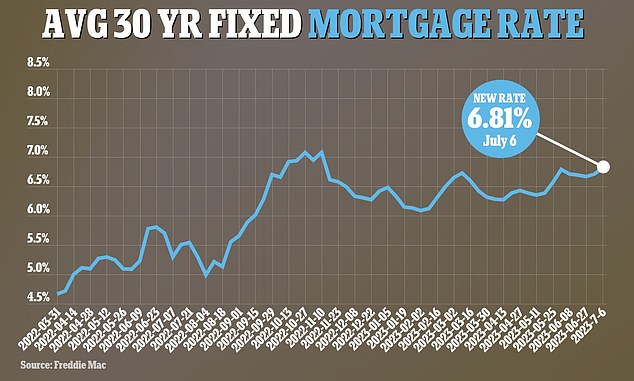

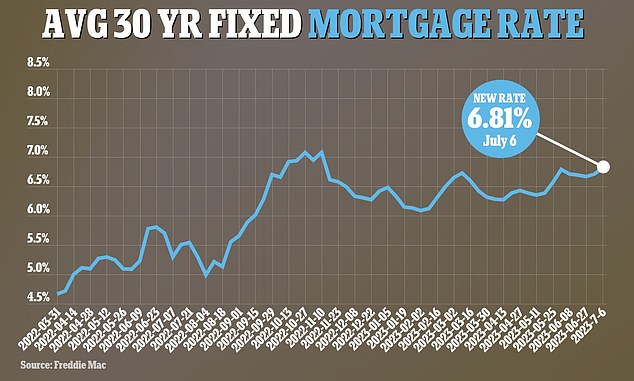

Mortgage rates have reached their highest level this year and are now more than double what they were in 2021, new figures show.

Data from lender Freddie Mac found that the average rate on a 30-year home loan is now hovering at 6.7 percent, up from 2.9 percent two years ago.

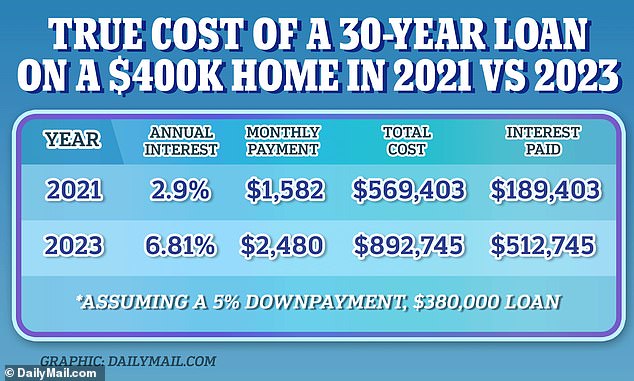

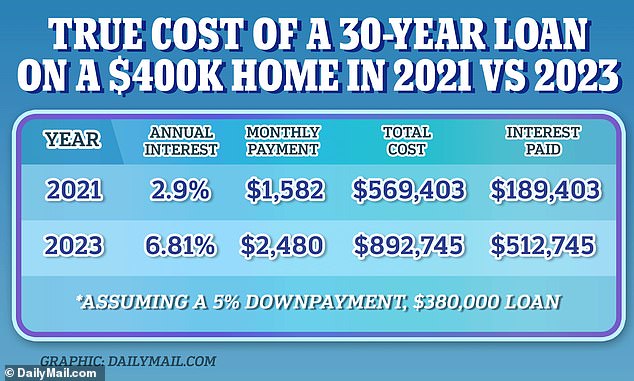

It means the standard monthly payment on a $400,000 house has shot up from $1,582 to $2,480, analysis by Dailymail.com found.

In total, the homeowner will therefore pay $892,745 in their 30-year term – $300,000 more than they would have done if they bought in 2021.

The interest they will pay in the long run has also ballooned from $189,403 to $512,745. The analysis assumes the homeowner made a 5 percent down payment of $20,000.

Dailymail.com analyzed how the cost of an average home has shot up in two years

The soaring cost of homeownership has left 82 percent of property shoppers ‘locked into’ their current homes because they fixed their deals when rates were low, officials from Freddie Mac said.

As a result they are hesitant about moving as it would mean having to swap to a mortgage with a higher rate.

One in seven homeowners who are not planning to sell their home cited their current low rate as the main reason for staying put.

The number of new properties being listed in June was subsequently 20 percent lower than the same period last year.

Meanwhile, data from the Mortgage Bankers Association revealed the average loan size on a purchase application had fallen to $423,500 – its lowest level since January 2023.

Mortgage rates shot up last year in response to the Federal Reserve’s aggressive interest rate policy.

The Fed has raised its funds rate 10 times in the last 15 months in a bid to tame red-hot inflation.

But in June, the bank announced a pause on hikes to reflect the recent cooling of inflation – after it dipped to 4 percent.

However, rates offered by lenders on homes are not directly tied to the Fed’s funds rates and are instead dictated by the yield on 10-year Treasury bonds.

This is influenced by a combination of inflation, Fed actions and the response of investors.

Mortgage rates have reached their highest level this year, according to data from Freddie Mac

Data from the Mortgage Bankers Association revealed the average loan size on a purchase application had fallen to $423, 500 – its lowest level since January 2023

This year they have been hovering between 6 and 7 percent, after they peaked at 7.08 percent last November.

In June, the average rate on a 30-year fixed rate mortgage as over 6.6 percent. By comparison, rates were 5.3 percent a year ago.

Freddie Mac chief economist Sam Khater said: ‘Mortgage rates continued their upward trajectory again this week, rising to the highest rate this year so far.

‘This upward trend is being driven by a resilient economy, persistent inflation, and a more hawkish tone from the Federal Reserve.

‘These high rates combined with low inventory continue to price many potential homebuyers out of the market.’

It comes after officials from fellow lender Fannie Mae predicted that house prices will fall at a slower rate than expected to this year.

While in February it predicted that home prices would fall by 4.2 percent this year and another 2.3 percent in 2024, it now estimates that costs will only decline by 1.2 percent in 2023 and a further 2.2 percent the year after

Doug Duncan, chief economist at Fannie Mae, said that high demand and an ongoing shortage of homes for sale means that prices will stay elevated for longer – outperforming earlier expectations.

‘Demand for housing has exceeded expectations due to Baby Boomers aging in place and Gen-Xers locking in historically low rates, both of which have helped keep housing supply at historically low levels,’ he said.

‘Homebuilders continue to add to that supply, but years of meager homebuilding over the past business cycle means the imbalance will likely continue for some time.’