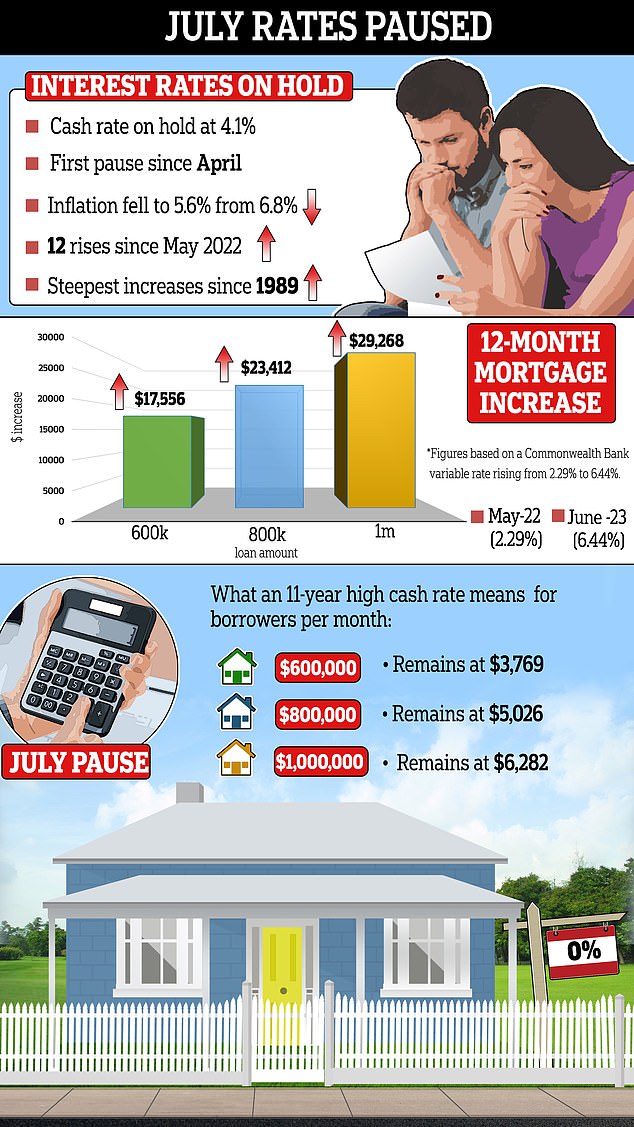

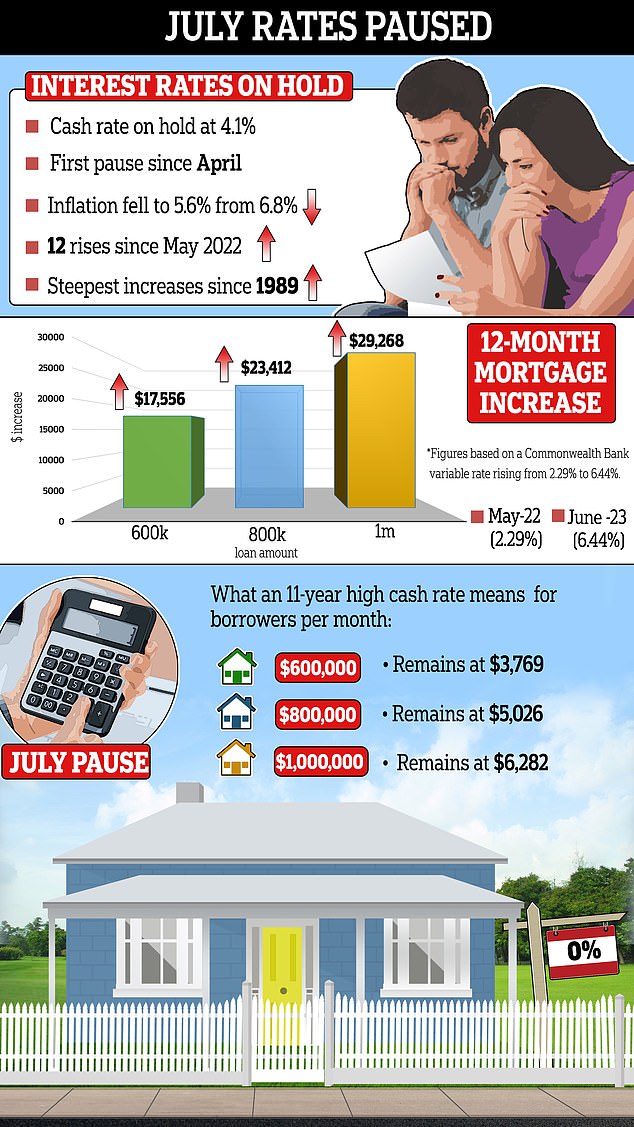

The Reserve Bank has paused the rate hikes for only the second time this year but the relief is likely to be short-lived because inflation is still too high.

The cash rate was left on hold at an 11-year high of 4.1 per cent.

This marked only the second pause since April, with interest rates since May 2022 surging at the most aggressive pace since 1989 with 12 increases in 13 months.

Reserve Bank of Australia Governor Philip Lowe, whose seven-year terms ends on September 17, hinted this pause was only likely to be temporary after a peak in the consumer price index or headline inflation.

‘Inflation in Australia has passed its peak and the monthly CPI indicator for May showed a further decline,’ he said on Tuesday afternoon.

‘Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve.’

The Reserve Bank has paused the rate hikes for only the second time this year but the relief is likely to be short-lived

Inflation in May moderated to 5.6 per cent, down from 6.8 per cent in April, but the annual pace was still well above the RBA’s 2 to 3 per cent target – with the RBA expecting the CPI to remain high until mid-2025.

Annual repayments on an average, $600,000 mortgage are still $17,556 higher than they were 14 months ago when the cash rate was still at a record-low of 0.1 per cent.

Since then, variable mortgage rates have risen from levels starting with a ‘two’ to a zone where even a borrower with a 20 per cent deposit will now be paying 6.44 per cent with the Commonwealth Bank.

In 2023 so far, borrowers have only had a reprieve in January – a month when the RBA doesn’t meet – and April.

Reserve Bank of Australia Governor Philip Lowe (pictured right with deputy Michele Bullock), whose seven-year terms ends on September 17, hinted this pause was only likely to be temporary after a peak in the consumer price index or headline inflation

The latest pause surprised the big four banks, which had all expected a July increase.

But Westpac senior economist Matthew Hassan said the RBA was still likely to hike rates two more times, taking the cash rate to 4.6 per cent.

‘We think there’s still another two interest rate hikes,’ he told Sky News.

Dr Lowe said the 12 rate rises since May 2022 were squeezing some borrowers.

‘The combination of higher interest rates and cost-of-living pressures is leading to a substantial slowing in household spending. While housing prices are rising again and some households have substantial savings buffers, others are experiencing a painful squeeze on their finances,’ he said.

Source: | This article originally belongs to Dailymail.co.uk