Pixelcatchers | E+ | Getty Images

It’s not an easy time to be a small business in search of financing. For LGBTQ owners, the struggle has been even harder.

LGBTQ-owned businesses reported more rejections than non-LGBTQ businesses that applied for funding, according to a 2022 report from Movement Advancement Project, a nonprofit think tank that focuses on equality and opportunity, and the Center for LGBTQ Economic Advancement & Research (CLEAR).

With the tightening of lending standards, they could be at even more risk of falling behind, said Spencer Watson, president and executive director of CLEAR.

“The tighter economic conditions, the higher interest rates, the collapse of these smaller community banks and the resulting constriction of lending is certainly more detrimental for the LGBTQ community than non-LGBTQ community,” Watson said.

Concerns about the economy and lending conditions aren’t only on the minds of LGTBQ entrepreneurs. Overall, small business owners are skeptical about their future business conditions, said Holly Wade, executive director of the National Federation of Independent Business’ Research Center.

“The small business economy is being hindered by inflation, supply chain disruptions, and labor shortages,” she said. “While financing isn’t a top problem for small businesses, owners have expressed concerns about the health of the banking system for their business purposes in light of the banking turbulence in March.”

Yet, data show that when it comes to financing, LGTBQ small business owners are being left behind. In 2021, 46% of LGBTQ-owned businesses said they didn’t receive any of the financing they had applied to in 2021, according to the MAP/CLEAR report. In comparison, 35% of non-LGBTQ businesses that applied for funding were rejected, the report found. Much of the funding sought was through the Covid relief programs offered, Watson said.

“Those businesses were frequently smaller in size and they were also frequently younger and they had smaller revenues,” Watson explained. “They were struggling with those additional pressures because they were already in a weaker financial position to start with.”

Watson said there are similar themes emerging in the analysis of the 2022 Federal Reserve’s small business credit survey, which hasn’t been fully released yet.

While LGBTQ small business owners are very optimistic, they are also still more likely to report more kinds of financial challenges than non-LGBTQ businesses. Some six in 10 reported difficulties affording operating expenses over the last year, according to Watson, who prefers a gender-neutral pronoun. Most of the businesses are owned by people who identify as LGBTQ but their businesses aren’t necessarily oriented towards or servicing the LGBTQ community, they said.

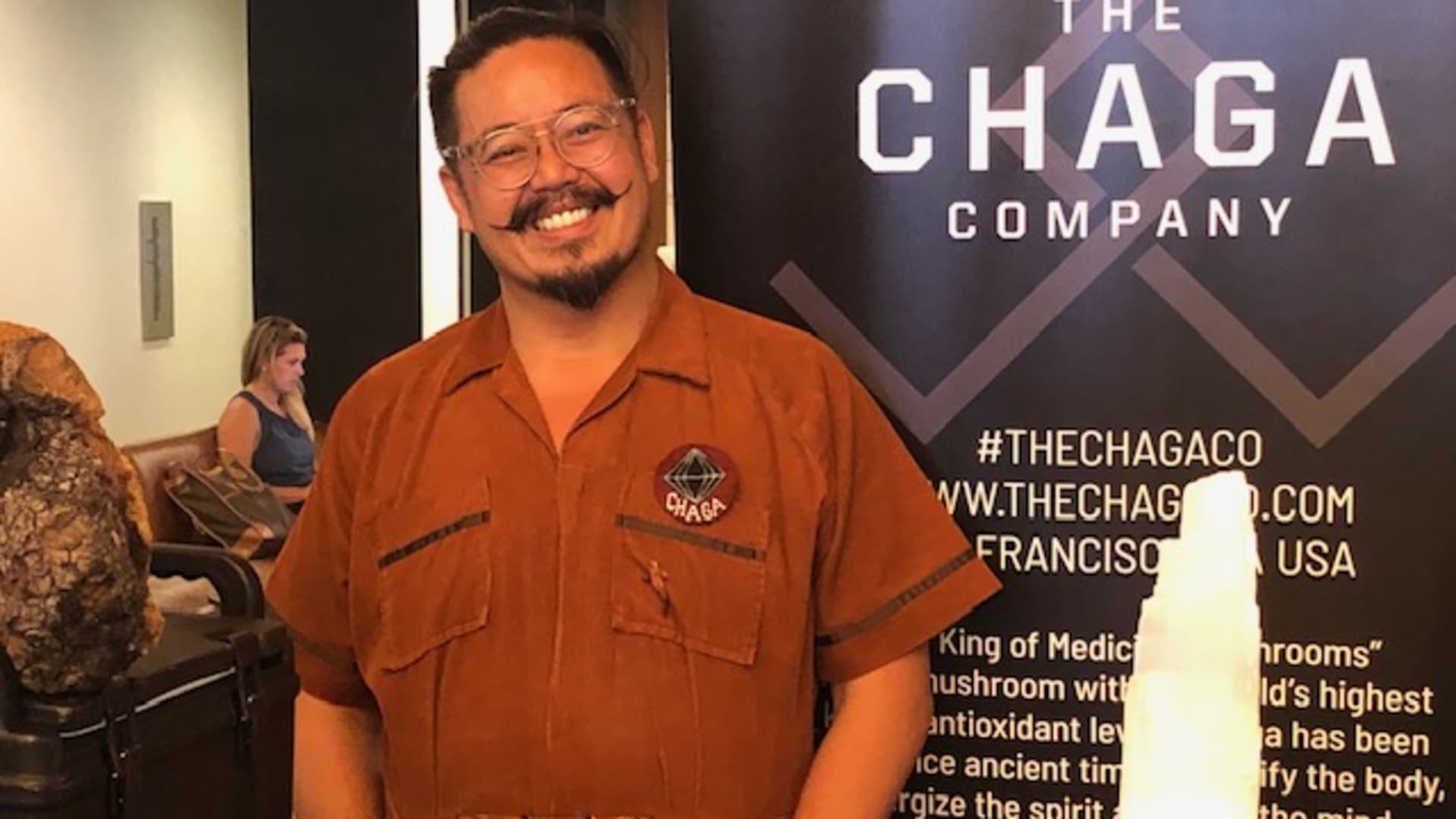

Gavin Escolar

Courtesy: Gavin Escolar

Gavin Escolar, owner of The Chaga Company in San Francisco, is one of those small business owners that has had troubling finding financing. The 47-year-old gay man started his business, which makes products from chaga mushrooms, in 2018 by using his savings and credit cards. While he hasn’t been rejected for any loans he’s applied for, he has been only offered high-interest bridge loans from lenders to hold him over until a lower-interest small business loan becomes available, he said.

“They’re like, ‘oh yeah, you’re pretty much approved for this particular SBA loan, but it’s going to take like around six months for you to get it. But we have this other loan that you can bridge right now, that is 29.75%,’ or whatever exuberant cost,” Escolar said.

Right now he’s using loans from Square and PayPal and is hoping to figure out his next step so that he can pay down his credit card debt, buy inventory and do marketing. Escolar feels like the community needs more education on how to get the right financing.

“I’m only getting the higher [interest loans] because I feel like I don’t have established business credit,” Escolar said. “I’m fluctuating between my business credit and my personal credit. I don’t even know where to start on how to build a business credit.”

Forging her own path

Sarah Scala

Source: Sarah Scala

For 43-year-old Sarah Scala, going into debt wasn’t an option when she started her business, Sarah Scala Consulting. The Massachusetts company is an LGBT-certified business enterprise that provides leadership development, public speaking and leadership coaching.

Scala wanted to stay debt free, so she used her own savings and looked for opportunities elsewhere. Other than a Paycheck Protection Program loan during the Covid-19 pandemic, her only other external source of funding has been two grants from the Massachusetts Growth Capital Corporation. Those grants have helped her with digital marketing and capital expenses.

“There’s a number of wonderful associations that are really helpful if people are looking for support around funding,” said Scala, who operates the business out of her home.

One is SCORE, a network of volunteer business mentors, which Scala is involved with. She also has a strong partnership with the Massachusetts LGBT Chamber of Commerce, which can help open doors, she said.

Discrimination at play

Anti-LGBTQ bias and discrimination against LGBTQ small-businesses can arise during the loan process in a number of places, Watson said.

“If the lender discerns the applicants’ LGBTQ identity, they may choose to deny that loan or charge the applicant a higher cost for the credit they are approved for,” they explained. “This is particularly the case for highly visible members of the LGBTQ community — such as transgender or nonconforming gender presentations.”

It can also show up in other ways, like if a creditor doesn’t understand the business’s market opportunity, like not seeing the benefit or market need for an LGBTQ-serving establishment, Watson said.

Businesses oriented explicitly toward individuals of sexual minorities and that create sex-positive spaces are also frequently excused because Small Business Administration guidelines forbid loans for businesses of a “prurient sexual nature,” they said.

However, Watson cheered the recent rule from the Consumer Financial Protection Bureau that increases transparency in small business lending and includes demographic information, allowing small businesses to identify as women-, minority-, or LGBTQ-owned.

“Implementing that data collection would be an incredible boon to combating discrimination in the private lending market for small businesses,” they said.

The success of these businesses matter — not only for the owners but for the community at large, Watson said.

“There is a need for more small businesses owned by all types of marginalized communities so that those entrepreneurs can support themselves, their fellow community members, and create more inclusive spaces that are authentically by and for those communities,” they said.