Receive free Companies updates

We’ll send you a myFT Daily Digest email rounding up the latest Companies news every morning.

This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

Thames Water has dominated UK business news lately. Lex titled the controversy over UK water companies “The Great Stink II” back in April when writing about United Utilities. The pong got worse this week with news that ministers had discussed temporarily renationalising overleveraged counterpart Thames Water.

The original Victorian Great Stink described both the stench from the sewage-laden Thames river and an ensuing public row that resulted in London installing proper drains.

This time it is the private equity-style ownership and financing of Thames Water that is flunking a sniff test. The business invites suspicions that it has so far failed to allay.

Several other companies or deals failed to pass the same Lex sniff test this week. To comment on them or our other coverage, please email me at [email protected].

Thames Water’s record of sewage dumping and water leakage is dire. And it is struggling with a debt crisis.

Parts of the story are clear enough. The excessive borrowings of Thames Water are a particular problem right now because £14bn of debts are linked to the retail price index. The cost is rising faster than revenues that track a consumer price index which is climbing more slowly.

But this leaves key questions unanswered:

-

Why did chief executive Sarah Bentley step down abruptly this week? Was it because she failed to raise £1bn of much-needed equity from such shareholders as the Universities Superannuation Scheme?

-

Has Thames Water’s labyrinthine network of holding companies allowed some shareholders to take a form of tax-advantaged dividend via debt interest or repayments charged at above the market rate?

-

How has Ofwat, a regulator that shows every sign of capture by its industry, allowed a public utility to get into such a mess? Which officials are to blame?

-

Why is there any talk of a taxpayer-funded rescue? Are creditors flying that kite in hopes it could reduce their potential losses? If Thames Water is in trouble, shareholders should be wiped out while a slug of borrowings should be subjected to a debt-for-equity swap.

Our graphic highlighted borrowings ripe for conversion:

Hopefully, a parliamentary select committee will wring some answers from executives next month.

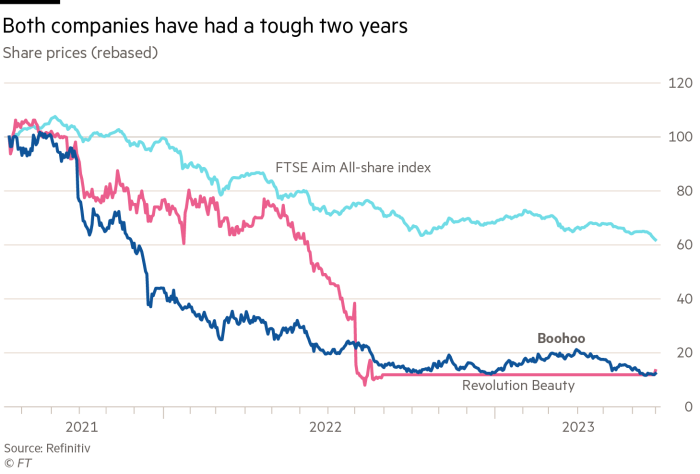

Revolution Beauty and Boohoo are two other UK businesses with whose motives require scrutiny too. Both are listed on the UK’s Aim, which is no stranger to furious boardroom bust-ups.

Fast-fashion group Boohoo owns about a quarter of cosmetics retailer Revolution. The issue for the latter is whether it can justify ignoring a majority shareholder vote led by Boohoo to remove its chair, chief executive and finance director. The concern Boohoo needs to assuage is that it is seeking to control Revolution without paying for a full takeover.

Both companies could do better for investors, as this share price chart shows:

The same may apply to US industrial company Circor International. It apparently prefers a $1.7bn takeover by KKR to a $1.8bn offer from Arcline, a smaller buyout group. In filings, Circor said KKR had greater certainty of financing. But Arcline claims it has lined up guaranteed loans from the Bank of Montreal.

Circor needs to show investors it has a solid case for favouring KKR’s underbid.

Activists are adept at conducting sniff tests — or at least implying sniff tests are necessary. Their more lurid allegations may be hard to prove. But the businesses they attack are often overvalued in the first place.

That was our take on a French internet-of-things company that has attracted the attention of Gotham City. The short seller alleges SES-imagotag overstates its revenues and profits, prompting spirited denials. Lex thinks it is just as well the shares have fallen as a result of the row. We think the company capitalises too much of its research and development costs and that its negative free cash flow chimes dissonantly with rising ebitda.

There is less intrigue surrounding French carmaker Renault. We suspect its plan for a partial demerger of its electric vehicle subsidiary Ampere may simply be a bad strategic decision prompted by short-term management ambition. Carmakers and oil companies appear desperate to spin off low-carbon divisions. That could leave these parent companies dwindling to nothing in the transition to net zero.

London brawling

Full disclosure: I’m an old City lag. So I’m hardly devastated that HSBC plans to move its headquarters back here from Canary Wharf.

I have spent the bulk of my career in and around the Square Mile. I switched jobs in the early 1990s partly to avoid a move to London Docklands. Back then you were more likely to be bowled over by tumbleweed than bump into a contact.

Canary Wharf suits a lot of people. But I don’t much like its blocky skyscrapers or Hong Kong-style shopping malls. I prefer the City’s narrow streets and rich layers of history.

The City is back in favour because reduced investment bank workforces slot more easily into its smaller office blocks. Amid steep rate rises, corporates are unwilling to do much M&A or come to the market with initial public offerings. Prospective deals from the likes of CAB Payments represent only the faintest of green shoots.

There is a widening four-way split in the London property market between the City, Canary Wharf, high-grade offices and the tattier sort, as our graphic shows:

Canary Wharf is also suffering because some tenants are tolerant of regular homeworking by staff, reducing their need for space. The same trend is giving high streets outside central London a welcome boost. Food and drink retailers such as Pret A Manger are opening new outlets to cater for locals taking a break from work for coffee or a snack.

Increasingly these customers are confronted by point-of-sale screens attempting to extract mandatory tips for servers starting at 15 per cent.

New York, new work

Recent US visitors to the FT in London complained that levels of office attendance back home were far lower than here in the UK. So much for the myth of “my way or the highway” US management.

Perhaps more Wall Streeters would be visiting the office if there were more deals to do. Independent investment bank Jefferies prophesied a revival when it announced results this week.

US finance is still coping with the after-effects of steep rate rises and banking turmoil. Troubled regional lender PacWest announced the sale of a $2.3bn loan portfolio to private asset manager Ares. The interesting wrinkle here was that Barclays provided debt financing, showing that private capital has not made big banks entirely obsolete.

Bank of America has, meanwhile, taken a $100bn bath on its portfolio of low-coupon debt securities. It bought these to cover a flood of deposits.

Stuff I have enjoyed recently

Tenacious utilities writer Gill Plimmer produced a balanced Big Read on Macquarie with FT colleague Nic Fildes. This represents useful further reading in the context of the Thames Water debacle.

Danny Leigh’s centenary upsum of Disney has plenty of sweep and highlights growing creative stagnation within the Magic Kingdom.

Beyond the business ecosystem, I relished David Scheel’s book Many Things Under a Rock which is about octopuses. These smart molluscs have a distributed nervous system which means tentacles may engage in autonomous decision-making.

I also enjoyed a jaunt to a project to introduce beavers to the swamplands of west London. But nothing beats the vast emptiness of Skye’s Cuillin mountains, which I experienced on holiday last week.

Enjoy your weekend, whatever vistas it presents you with,

Jonathan Guthrie

Head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Free Lunch — Your guide to the global economic policy debate. Sign up here