The Federal Reserve is expected to announce its fourth interest rate increase of 2022 on Wednesday as it races to tamp down rapid inflation. The moves have a lot of people wondering why rate increases — which raise the cost of borrowing money — are America’s main tool for cooling down prices.

Senator Elizabeth Warren, the Massachusetts Democrat, wrote an opinion piece in The Wall Street Journal on Sunday arguing that the Fed’s demand-crushing rate increases are not the right policy to fight today’s inflation as fuel costs and supply chain turmoil push up prices. The policies will hurt workers, she said, and “it doesn’t have to be this way.”

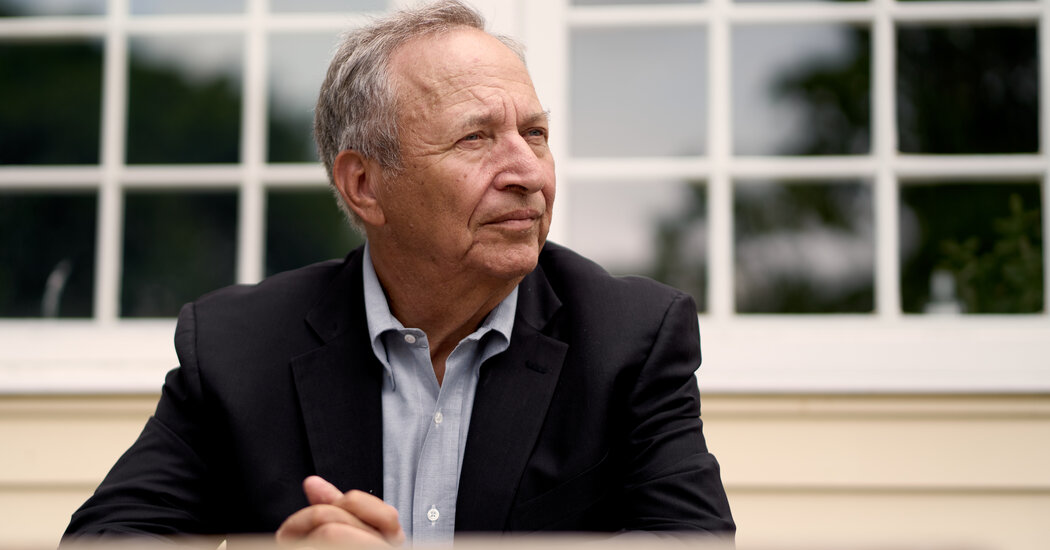

Others have argued that the Fed should continue to be forceful. Lawrence H. Summers, the former Democratic Treasury secretary, argued during an interview on CNN this week that the Fed needed to take “strong action” to control inflation and that allowing inflation to gallop out of control would be the “bigger mistake” than causing a recession.

Onlookers could be excused for struggling to make sense of the debate. Fed officials themselves acknowledge that their tools are blunt, that they cannot fix broken supply chains and that it will be difficult to slow the economy enough without causing an economic downturn. So why is the Fed doing this?

America’s central bank has for decades been what Paul Volcker, its chair in the 1980s, called “the only game in town” when it comes to fighting inflation. While there are things that elected leaders can do to combat rising prices — raising taxes to curb consumption, spending more on education and infrastructure to improve productivity, helping flailing industries — those targeted policies tend to take time. The things that elected policymakers can do quickly generally help mainly around the edges.

But time is of the essence when it comes to controlling inflation. If price increases run fast for months or years on end, people begin to adjust their lives accordingly. Workers might ask for higher wages, pushing up labor costs and prompting businesses to charge more. Companies might begin to believe that consumers will accept price increases, making them less vigilant about avoiding them.

By making money more expensive to borrow, the Fed’s rate moves work relatively quickly to temper demand. As buying a house or a car or expanding a business becomes pricier, people pull back from doing those things. With fewer consumers and companies competing for the available supply of goods and services, price gains are able to moderate.

Unfortunately, that process could come at a hefty cost at a moment like this one. Bringing the economy into balance when supply is constrained — cars are hard to find because of semiconductor shortages, furniture is on back order, and jobs are more plentiful than laborers — could require a big decline in demand. Slowing the economy down that meaningfully could tip off a recession, leaving workers unemployed and families with lower incomes.

Economists at Goldman Sachs, for example, estimate that the probability of a recession over the next two years is 50 percent. Already, signs abound that the economy is slowing as the Fed begins to push rates higher, with overall growth data, housing market trackers and some metrics of consumer spending showing a pullback.

But central bankers believe that even if the risks are difficult to bear, they are necessary. A downturn that pushes unemployment higher would undoubtedly be painful, but inflation is also a major impediment for many families today. Getting it under control is critical to putting the economy back on a sustainable path, officials argue.

“It is essential that we bring inflation down if we are to have a sustained period of strong labor market conditions that benefit all,” Jerome H. Powell, the Fed chair, said at his news conference last month.