This article is an on-site version of The Lex Newsletter. Sign up here to get the complete newsletter sent straight to your inbox every Wednesday and Friday

Dear reader,

After a flurry of panicky movement in credit default swaps last week, markets are now acting as if the banking crisis is old news. Regulators are pointing blame and UBS has a new chief executive. The Lex team took this moment as an opportunity to step back and think about the strength of the global banking system.

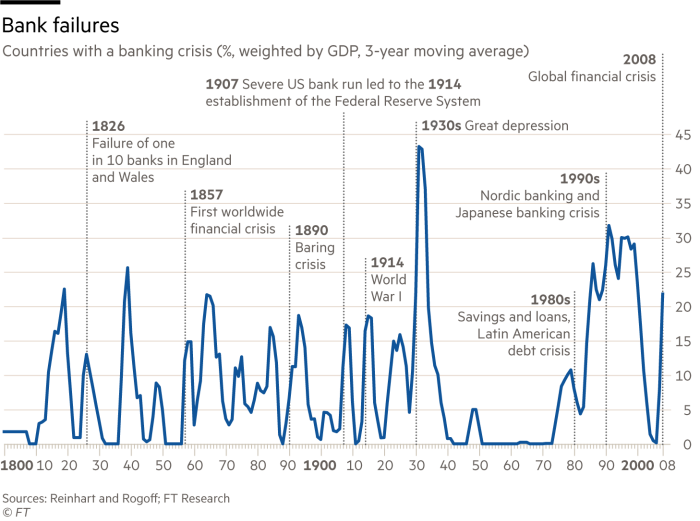

The Federal Deposit Insurance Corporation’s failed bank list shows how common banking failure is in the US. Map global failures on global economic downturns and it is clear when most occur.

None of that is a surprise. The question is whether it is possible to do something with this information. Are the post-financial crisis rules aimed at making the banking system safer still fit for purpose? Should deposit insurance be expanded? If regulators reassure all depositors that their money is safe, will it maintain faith in the system or remove any incentive for executives to act responsibly and guard against risk?

Lex readers were vocal in their view that the collapse of US regional banks and the takeover of Credit Suisse by UBS need not trigger a shift towards depositors bearing the brunt of failure. There were a few votes for greater personal liability for executives and auditors. Lex says: don’t hold your breath.

The clean-up continued this week with North Carolina’s First Citizens taking over Silicon Valley Bank. There are advantages to being one of the only suitors in town. From a $9bn market cap to taking over tech’s erstwhile favourite bank with a $72bn loan book and $56bn of remaining deposits, plus protections in case of further deposit flight and a loss-sharing deal on loan losses.

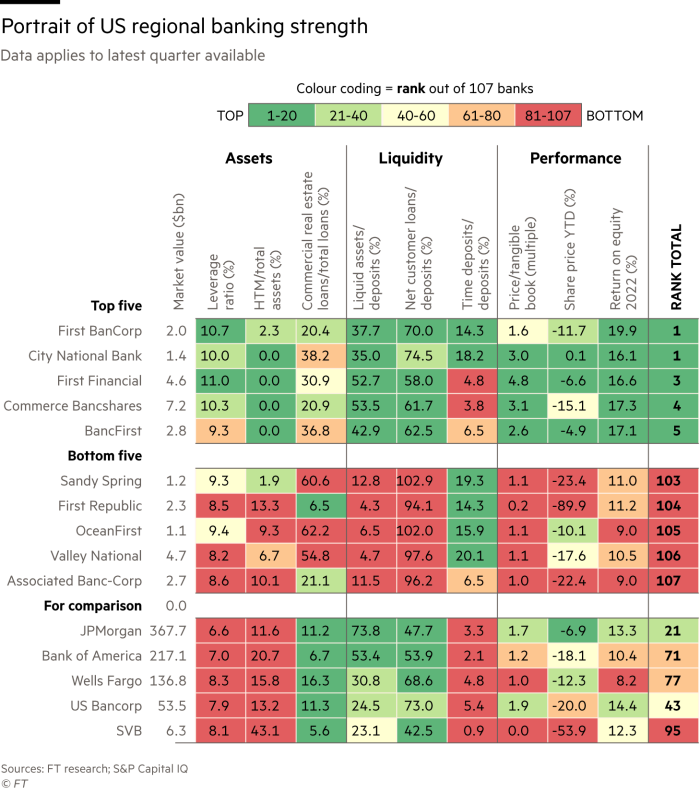

For regulators, the pressing question is which, if any, banks are at the greatest risk of failure. In the US, regional banks have less cash on hand than at any point since the crisis. Our Lex in depth shows how crucial it is that depositors feel secure enough to put their money back into the country’s broad array of smaller banks.

Lex has screened more than 150 US banks for asset resilience, deposit liquidity and investor sentiment. We found that the weakest were Wisconsin’s Associated Bank and Valley National of New Jersey.

Analysts we spoke to had a gloomy warning too. Commercial real estate may be the next point of pressure on bank balance sheets. “The liquidity crisis will pass,” said Thomas Simons, a money market economist at Jefferies. “But a credit crisis is coming.”

Maybe, mused Lex, borrowing activities should shift from deposit-taking institutions to the securities market. But debt markets seizure means the change is some way off.

Tweet decked

The crisis in tech stocks will ease if banking failures encourage a slowdown in interest rate rises. Meta (previously known as Facebook) is undergoing a remarkable recovery from the depths of its crash. Shares are only down 7 per cent over the past 12 months.

Alas, the same cannot be said for Twitter. Those of you who use the social media site will know that Elon Musk’s attempts to improve it have had limited success so far. The “For You” tab was supposed to drive more interactions between accounts that do not already follow one another. On mine its purpose seems to be primarily to promote Musk’s own tweets.

Twitter says that next month it will remove pre-existing verifications, meaning only those who pay a monthly subscription will get a blue tick. The number of users who have opted for this so far is estimated to be about 0.2 per cent of total users. Most are small accounts. It is unclear (and unlikely) that the politicians, celebrities and other well-known figures whose use of the site gives it prominence will choose to pay.

Confusion is coming. This is why Lex questions the company’s decision to apply a $20bn valuation. Yes, it is less than half the figure Musk paid last year. But revenue is crashing and the company is losing money. Use the same forecast sales valuation metric as social media site Snap and Twitter would be worth $12bn — $1bn less than the size of its debt.

We hold out little faith in the prospects of San Francisco ride-hailing company Lyft. The basic model of charging users to catch rides remains unprofitable. A new chief executive plucked from the board is unlikely to arrive with a plan to reverse this and catch up to bigger rival Uber. Lex thinks a sale may be the only outcome.

No big tech company is likely to step in, however, even if share prices are climbing. The size of companies such as Amazon and Alphabet remains an uncomfortable topic for regulators. In China, ecommerce giant Alibaba has opted to divide itself into six parts. It is a move US companies may one day echo.

Each part of Alibaba will have its own chief executive and the ability to list. Logistics has been tapped as one of the first likely to spin off. But Lex thinks the six may well remain under Alibaba’s umbrella. The appearance of independence would still soothe regulators.

Water rotter

Stories of sewage dumping in British rivers, lakes and canals roll on. The prospect of wild swimming grows less appealing by the day. Yet the valuation of water utilities is in line with historical averages, at a premium of 15 per cent to adjusted regulatory capital value. That seems like wilful ignorance. Costs are rising. Either companies or households will take the hit. Barclays predicts that £100bn of capital expenditure required across the industry will mean a 60 per cent increase in bills.

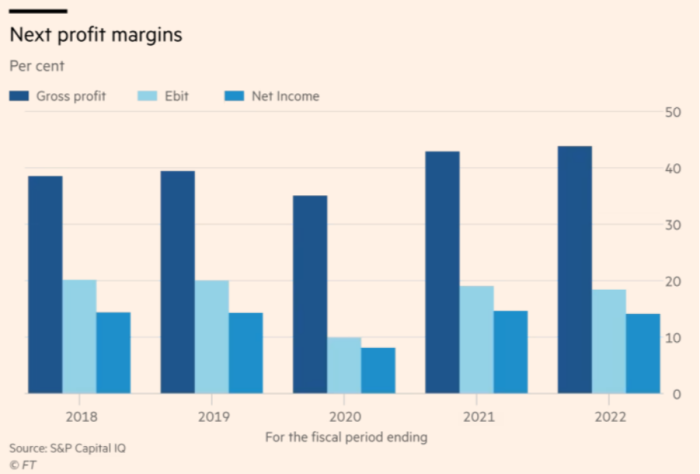

On the high street there are no such illusions. High street fashion retailer Next produced a good set of annual results. But investors hold out little hope of growth.

A service designed to host other retailers online accounts for less than 2 per cent of revenue. Opportunities for future expansion are evaporating, according to the company. That’s the sort of bracing reality water companies would do well to follow.

Stuff I liked this week

In keeping with the banking theme I saw the play The Lehman Trilogy this week. It tells the story of how Lehman Brothers evolved from a shop in Alabama to the heart of the financial crisis and is excellent (if long).

Fun headline from the Wall Street Journal on Disney and Microsoft saying “meh” to the metaverse. Though let’s keep in mind that even Meta didn’t think the metaverse was imminent. It was, and still is, a bet on the future.

Atlantic writer Helen Lewis’s Bluestocking newsletter has a nice list of writing tips. I liked the reminder to distinguish between plot and story.

Enjoy your weekend

Elaine Moore

Deputy head of Lex

If you would like to receive regular Lex updates, do add us to your FT Digest, and you will get an instant email alert every time we publish. You can also see every Lex column via the webpage

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

Free Lunch — Your guide to the global economic policy debate. Sign up here