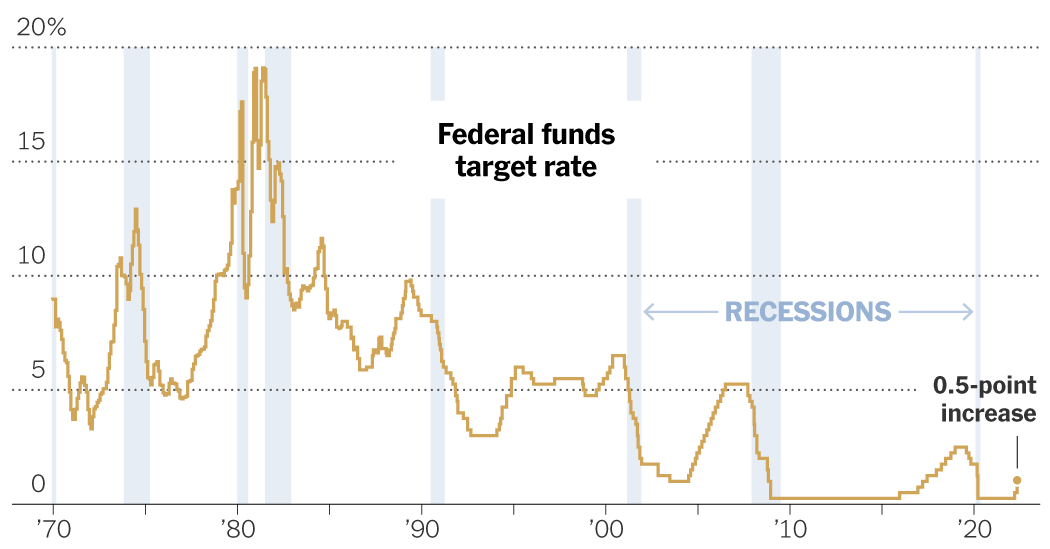

The Federal Reserve raised interest rates by a half percentage point and announced a plan to shrink its massive bond holdings, decisive measures aimed at tamping down the fastest inflation in four decades.

Wednesday’s move marked the Fed’s largest interest rate increase since 2000, and Chair Jerome H. Powell signaled at a news conference following the meeting additional half percentage point increases will be “on the table” at the Fed’s upcoming meetings.

By shrinking its nearly $9 trillion balance sheet at the same time as it is substantially raising rates, the Fed has charted a course for rapidly withdrawing support from the economy. The twin policies are likely to ricochet through markets and the economy as money becomes more expensive to borrow.

The quick pullback is a sign that the central bank is getting serious about cooling down the economy and job market as rapid inflation persists and as officials grow nervous that it could become more permanent. Prices have been climbing at the fastest pace in 40 years for months now.

“Inflation is much too high, and we understand the hardship it is causing, and we’re moving expeditiously to bring it back down,” Mr. Powell said at his news conference on Wednesday.

Understand Inflation in the U.S.

“There is a broad sense on the committee that additional 50 basis point increases should be on the table at the next couple of meetings,” he later added.

Policymakers spent much of 2021 hoping that inflation would ease on its own as supply shortages moderated and as the economy evened out following early-pandemic disruptions. But normalcy has yet to return, and inflation has only accelerated. Now, fresh pandemic-related lockdowns in China and the war in Ukraine are further elevating prices for goods, food and fuel. At the same time, workers are in short supply and wages are rising rapidly in the United States, feeding into higher prices for services as consumer demand remains strong.

The “lockdowns in China are likely to exacerbate supply chain disruptions,” and the invasion of Ukraine “and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity,” the Federal Open Market Committee statement for May said.

As shocks continue to roil global supply, Fed officials have decided that they no longer have the luxury of waiting for inflation to moderate on its own. Still, Mr. Powell shot down the idea of more aggressive rate increases. While some officials had signaled that a 0.75 percentage point move could be possible, Mr. Powell said Wednesday that such a big increase is “not something the committee is actively considering.”

Stocks on Wall Street rallied after Mr. Powell’s remarks, which calmed investors who had begun to worry that the fight against inflation might push the economy into a recession. The S&P 500 jumped more than 2.3 percent in afternoon trading.

Inflation F.A.Q.

What is inflation? Inflation is a loss of purchasing power over time, meaning your dollar will not go as far tomorrow as it did today. It is typically expressed as the annual change in prices for everyday goods and services such as food, furniture, apparel, transportation and toys.

“Market observers over the last week were starting to think that a 75 basis point increase was a possibility, even though it was a remote,” said Emily Bowersock Hill, the chief executive of Bowersock Capital Partners, a financial management firm. The “euphoria” in the stock market on Wednesday, Ms. Bowersock Hill said, also reflected the fact that the Fed didn’t say anything that investors weren’t already expecting.

Deciding how quickly to remove policy support is a fraught exercise. Central bankers are hoping to move decisively enough to arrest the pop in prices, without curbing growth so aggressively that they tip the economy into a painful recession. Yet engineering a so-called soft landing is likely to be a challenge.

Mr. Powell nodded to that balancing act, saying “I do expect that this will be very challenging, it’s not going to be easy.” But he said “I think we have a good chance to have a soft or soft-ish” landing.

He noted later in the news conference that he believes the Fed has “a good chance to restore price stability without a recession.”

The Fed plans to shrink its balance sheet starting in June by allowing securities to mature without reinvestment. It said on Wednesday that it will ultimately let up to $60 billion in Treasury debt expire each month, along with $35 billion in mortgage-backed debt. That plan will have phased in fully as of September.

The Fed’s plan to reduce its holdings is likely to take steam out of financial markets and could help to cool the housing market as it lifts longer-term borrowing costs, reinforcing the effect of the central bank’s interest rate increases. The Fed’s anticipated moves have already begun to push mortgage rates higher.