Personal finance columns are now full of suggestions that mortgage holders with a bit of spare cash should pay down their loans in the face of higher interest rates. Not least this week when the Bank of England raised rates another notch.

Certainly, you’re guaranteed to save on the interest when you overpay. Scores of wealth coaches extol clearing your mortgage outright and becoming “free” of house debt.

But I believe overpaying your mortgage can seriously harm your future wealth. This is particularly true for younger people, with decades of time ahead to earn, save and invest.

First, let’s deal with the obvious: overpaying your mortgage when you have higher-rate loans elsewhere (such as credit cards) doesn’t make financial sense. Before you even think about overpaying on your mortgage make sure that you’ve eliminated higher-cost debts first.

But my main point is more fundamental: don’t overpay your mortgage without at least considering the alternative of investing the money.

Let’s assume your mortgage carries a 5 per cent interest rate — that means for every £1 you overpay you save five pence. It’s billed as a “risk-free investment”. And though you don’t lose money by overpaying your mortgage (unless you get hit with overpayment charges — always check first before you overpay) the reality is you’re not investing. You’re saving.

If you were to invest that money in assets it’s not unlikely you could earn more than 5 per cent over the long run. For example, the FTSE 100 has achieved an average annual total return of 6.35 per cent from 1996 to 2021.

The total return on FTSE All-World index — global equities — was an average of 9.9 per cent annually from 1994 to 2021. If you were invested in the FTSE All-World over the whole period you would have significantly outperformed interest rates.

But note that the past 20 years have seen exceptionally low loan rates. These greased the wheels of borrowing and spending, lowered the cost of capital and boosted equities.

Equities are volatile. Asset manager Vanguard notes the annual performance was only within 5 per cent of the average — above or below — in seven of those years.

The truth is we are now in quite different financial conditions: anyone who decided at the start of this year not to overpay their mortgage in favour of a low-cost tracker fund is likely to be worse off. For example, the S&P 500 was down 23.9 per cent for the year at the end of October.

“You should only invest in equities if you have at least a five-year horizon”. This is the traditional advice wheeled out in risk disclaimers worldwide.

Indeed, five years may not be enough to see a return in an era where rates are high. You may not see a return even in a much longer period.

But, historically, betting on stocks has seen higher rates of return than interest costs when the investments are made for very long periods. Twenty years for example. That sounds like a very long time, but it’s much less than the time between starting work and retirement for most people.

If you overpay your mortgage you are indeed guaranteed to save the interest costs. But you will also miss out on the opportunity to build wealth using that capital in the stock market.

Clearly interest rate levels matter. If your mortgage is fixed at 0.8 per cent then saving 0.8 per cent isn’t appealing. But if your mortgage rate moves to 5 per cent, suddenly saving 5 per cent isn’t such a bad deal.

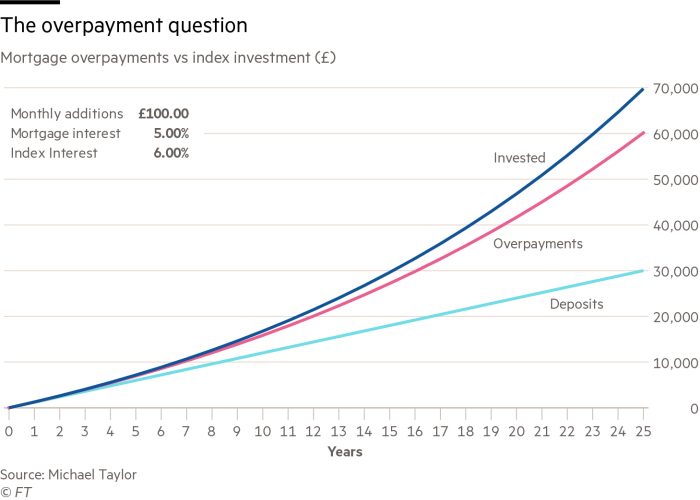

Let’s assume that over a 25-year mortgage you overpay £100 a month. If your mortgage is financed at a maximum rate of 5 per cent (again, impossible to predict) overpaying will save you £60,136.14 in interest (compounded annually).

But if we invest that in index funds and generate an achievable 6 per cent return (compounded annually), our total balance would be £69,787.66. That’s 16.05 per cent higher. Regardless of your opinion on overpayments, it’s clearly worth considering.

You also need to consider tax. Both mortgage overpayments and stock market investments are made with taxed earnings. But mortgage overpayments are tax-free investments and stock market investments are often not, though there are tax-free tools available, such as Isas.

Since both interest rates and stock market returns vary, there is neither a right nor wrong answer here. It depends on the individual’s circumstances and appetite for risk.

Some people can accept they may be worse off financially by overpaying but feel a deep sense of comfort knowing their mortgage will be paid off quicker. Others may be able to accept extra risk in the stock market in the hope of reward.

While I firmly believe overpayments are overly cautious for younger people, with middle age come new priorities and anyone approaching their later years is likely to be risk averse (and with good reason).

Telling people to consider extending their mortgage is likely to turn you into a social pariah. But that’s exactly what I’ve done, because it makes sense to me as I can allow my capital to compound in the stock market.

Choose wisely, because the decisions you make on overpaying your mortgage can be hugely influential on your future wealth.

Michael Taylor is a trader of his own capital and founder of trading education website shiftingshares.com. He has long and short positions in Aim and main market London Stock Exchange securities