Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: [email protected]

In today’s newsletter:

-

Musk on markets

-

The tale of First Boston

-

Foley buys Bournemouth

Elon Musk becomes a Fed watcher

During a post-crisis era of low interest rates, Elon Musk became the wealthiest person on earth by using opportunistic stock and convertible debt offerings to finance the rise of Tesla.

When its shares soared, he turned Tesla into an ATM, borrowing billions against its stock to broaden his empire.

It’s fitting that Musk has now become Wall Street’s poster child for getting caught off-guard as surging interest rates this year put a halt to the era of cheap money.

Musk impulsively agreed to buy Twitter for $44bn just as the tide turned and was unable to back out. Now he’s facing a steamroller from the Federal Reserve. This week, he used his new position as a social media mogul to prognosticate on central bank liquidity.

“At risk of stating obvious, beware of debt in turbulent macroeconomic conditions, especially when Fed keeps raising rates,” Musk tweeted on December 13. Ray Dalio and Howard Marks could take tips in brevity from the billionaire.

As he was tweeting, Musk was also selling Tesla stock. From Monday to Wednesday of this week, Musk sold more than $3.5bn of Tesla shares, the FT reported.

The cash should help Musk trim his sizeable debts just as rising rates make them increasingly burdensome.

He’ll be able to retire billions of dollars in high-cost debt that was used to finance his Twitter takeover.

Banks led by Morgan Stanley haven’t been able to syndicate $12.7bn of debt they funded for the buyout. Musk could potentially repurchase Twitter’s costliest debt at a discount, saving himself hundreds of millions of dollars in annual interest costs in the process.

Bankers and lawyers tell DD they’re ending the year with a heavy slate of Rote “liability management” transactions, the act of alleviating or even restructuring overburdensome debt loads.

Musk is self-administering his own unwinding, but he may uncover a juicy trade browbeating Morgan Stanley, of which he’s a whale of a client.

Margining Tesla stock to buy Twitter debt off its books would be a good arbitrage for Musk. Margin loans can be secured at about 250-to-350 basis points over Sofr, the floating interest rate benchmark, bankers told DD’s Eric Platt — a far better rate than Twitter’s current interest cost.

Musk did well conserving Tesla’s cash on his road to riches. Now that his fortune is plunging, he appears aware that every penny counts.

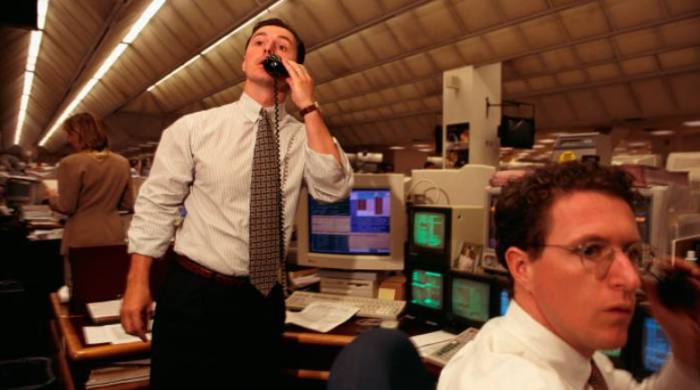

Resurrecting the ghost of Credit Suisse past

While cutting his teeth at First Boston in the 1980s, options trader Nassim Nicholas Taleb did not take well to his first career evaluation. “I tore it to pieces in front of them,” he told New York Magazine.

Instead of getting fired, he later proceeded to make what he called “fuck you” money by shorting the market on Black Monday in 1987 — the day the Dow plunged by 22.6 per cent, the largest one-day percentage drop in the index’s history — before moving on to UBS.

He wasn’t the only one at First Boston, the once celebrated investment bank taken over by Credit Suisse in 1988, to make a name for himself.

The newly minted graduates Joe Perella and Bruce Wasserstein would become the biggest rainmakers on Wall Street. Laurence Fink, a talented First Boston mortgage bond trader, would also leave to start a little money manager called BlackRock. Adebayo Ogunlesi, First Boston’s former head of investment banking, went on to launch Global Infrastructure Partners.

The bank itself, though, didn’t age well. Caught in the highly lucrative but risky junk bond craze popularised at the time by Michael Milken’s Drexel Burnham Lambert, First Boston’s game of leveraged loan roulette left it with huge paper losses.

By 2005, things had become so bad that Credit Suisse dropped the First Boston name altogether.

For a while, working at First Boston carried a certain cache akin to Goldman or Morgan Stanley. As recently as this year, alumni would give their name and then say “First Boston” when answering the phone, a former Credit Suisse banker told DD’s Sujeet Indap and James Fontanella-Khan.

But that prestige has since faded and become a distant memory. As has the reputation of Credit Suisse, for that matter, as DD readers will be painfully aware.

Michael Klein, the ex-Citigroup dealmaker and former Credit Suisse board member who re-entered the spotlight as a face of the Spac boom, thinks he can resuscitate two birds with one stone.

He has been tasked with restoring First Boston, the soon-to-be-spun-off advisory and corporate finance firm of which the Swiss lender hopes will solve many of its problems, to its former glory.

The next incarnation of First Boston would do best to leave its proclivity for junk bonds in the past, especially as temptation looms large.

Bill Foley: from Spac-man to Bournemouth fan

The top end of English football is like catnip for big characters. Russian oligarchs, former prime ministers, royalty — they’ve all put skin in the game. All signs point to the fact that the latest club owners to join them won’t disappoint.

Leading the £120mn acquisition of AFC Bournemouth, a team on the south coast of England, is Bill Foley.

The US Air Force and Wall Street veteran has been known to write blank cheques. He dabbled in the Spac boom, including his $600mn Spac with famed former Blackstone dealmaker Chinh Chu in 2018 and a blank-cheque deal with UK fintech group Paysafe in 2020.

Now, the US billionaire — who also owns the Vegas Golden Knights ice hockey team — has turned his attention back to sport, teaming up with a consortium of investors that includes Hollywood star Michael B Jordan of the Black Panther and Creed cinematic universes.

“Bill doesn’t do things by halves,” said Les Allan, managing director at Santa Monica-based investment bank Montminy, which advised the club and former owner Maxim Demin on the deal.

That might be an understatement. Foley hopped on the radio this week to tell listeners that he’s “a dictator” who feels the “need to be the captain of the ship”.

One of the most interesting aspects of Foley’s foray into English football is price.

Bournemouth may be in the Premier League — the world’s richest domestic football division by revenues — but £120mn is a far lower entry point than what an investor would pay for a US sports franchise.

That’s partly because Europe’s football leagues include the possibility of relegation, or demotion to a lower division. That’s the punishment for poor sporting performance. It’s value destructive, if you couldn’t guess.

Bournemouth — and former owner Demin — know the story all too well. This is the club’s first season back in the big time after two seasons in the Championship, the second-tier of English football.

Foley’s purchase was a bargain as far as football clubs are concerned. He’ll now need to focus on keeping it that way.

Job moves

-

Lloyds Banking Group has hired Ron van Kemenade, the tech boss of Dutch banking group ING, as its next chief operating officer. He will start in June.

-

Swedish battery start-up Northvolt has named Jim Hagemann Snabe, the current chair of Siemens and former chief of software company SAP, as its next chair.

-

Numis has made three hires at its Dublin office: Citi’s Peter Davis as director of investment banking, Davy’s Cian Fanning as a director of equity sales, and wealth manager Goodbody’s Rob Fallon as a director of equity sales trading.

-

Fried Frank has named Andrew Rearick as a partner in its M&A and private equity practice, based in London. He joins from Debevoise & Plimpton.

Smart reads

Collateral damage Hong Kong had been raring to become Asia’s premier hub for digital currencies. The catastrophic collapse of Sam Bankman-Fried’s crypto empire couldn’t have come at a worse time, the FT’s Primrose Riordan writes.

Tough crowd Those opposed to a polarising proposal to merge the two sides of Rupert Murdoch’s media empire, News Corp and Fox, have suggested spinning off a lucrative real estate investment held by News Corp, instead. That plan has also garnered critics, Bloomberg reports.

‘Lying, lying, lying’ Fallen banking tycoon Sergei Leontiev has positioned himself as a refugee of the Putin regime. But as our FT colleagues attempted to find out why he left, a different story emerged. In wartime, nothing is black and white.

News round-up

Bahamian authorities were tipped off by top Bankman-Fried associate (FT)

Rio Tinto reluctantly hunts for deals as mining industry consolidates (FT)

Jefferies cuts dealmaker bonuses by 25 per cent as investment banks rein in costs (Financial News)

Luxury group Lanvin shares surge in New York listing (FT)

US adds 36 Chinese companies to trade blacklist (FT + Lex)

EY looks at back-up plans on split amid higher costs, slower growth (Wall Street Journal)

Deutsche Post eyes takeover of Deutsche Bahn’s Schenker (Reuters + Manager Magazin)

Citi’s employees can work from anywhere for last two weeks of year (Bloomberg)

Unilever resolves Ben & Jerry’s lawsuit over Palestinian sales (FT)

Recommended newsletters for you

Cryptofinance — Scott Chipolina filters out the noise of the global cryptocurrency industry. Sign up here

The Lex Newsletter — Catch up with a letter from Lex’s centres around the world each Wednesday, and a review of the week’s best commentary every Friday. Sign up here