Inflation slowed more sharply than expected in November, an encouraging sign for both Federal Reserve officials and consumers that 18 months of rapid and unrelenting price increases are beginning to meaningfully abate.

The new data is unlikely to alter the Fed’s plan to raise interest rates by another half point at the conclusion of its two-day meeting on Wednesday. But the moderation in price increases, which affected used cars, food and airline tickets, caused investors to speculate that the Fed could pursue a less aggressive policy path next year — potentially increasing the chances of a “soft landing,” or one in which the economy slows gradually and without a painful recession.

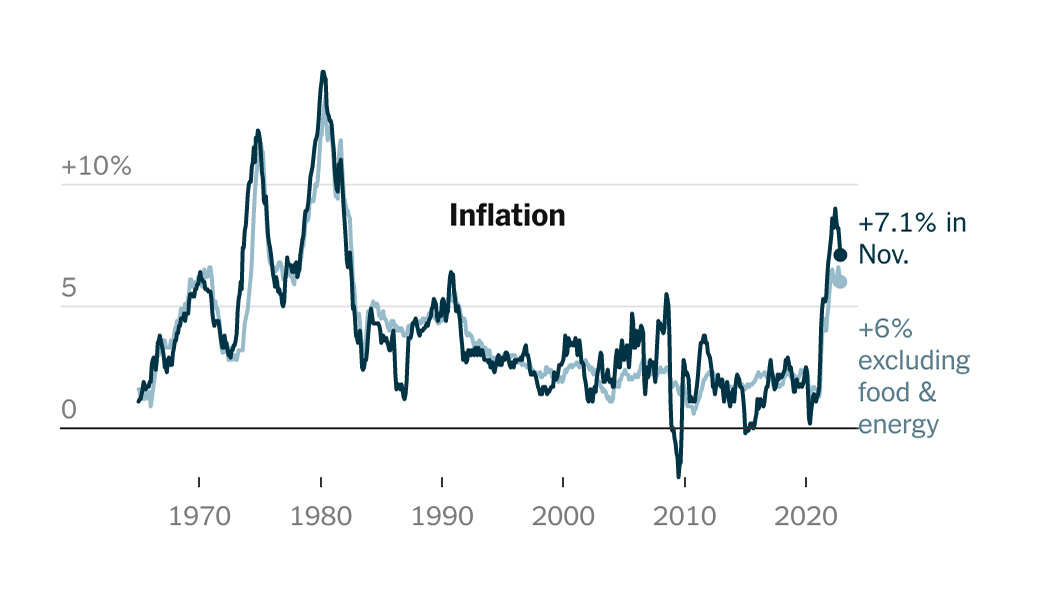

Stock prices jumped sharply higher after government data showed that inflation eased to 7.1 percent in the year through November, dropping from 7.7 percent in the previous reading and less than economists had expected.

The Fed, which has been rapidly raising rates in three-quarter point increments, is expected to make a smaller move on Wednesday, bringing rates to a range between 4.25 and 4.5 percent. Central bankers will also release economic projections showing how much they expect to raise interest rates next year, and investors are now betting that they will slow to quarter-point adjustments by their February meeting as fading price pressures give them latitude to proceed more cautiously.

“The overall picture is definitely improving,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics. “It’s unambiguously good news, but it would not be fair to say that inflation is falling everywhere — there are still pockets of big increases.”

While price increases are not yet slowing across the board, prices are moderating for key goods and services that consumers buy every day, including gas and meat. That is good news for President Biden, who has struggled to convince Americans that the economy is strong as the surging cost of living erodes voter confidence.

“Inflation is coming down in America,” Mr. Biden said during remarks at the White House on Tuesday morning. He hailed the report as “news that provides some optimism for the holiday season, and I would argue, the year ahead.”

Inflation F.A.Q.

What is inflation? Inflation is a loss of purchasing power over time, meaning your dollar will not go as far tomorrow as it did today. It is typically expressed as the annual change in prices for everyday goods and services such as food, furniture, apparel, transportation and toys.

Still, he cautioned that the nation could face more setbacks in its efforts to bring inflation under control. “We shouldn’t take anything for granted,” he said.

Inflation remains unusually rapid for now: Tuesday’s 7.1 percent reading is an improvement, but it is still much faster than the roughly 2 percent that prevailed before the pandemic.

The details of the report suggested that further cooling is likely in store.

Many of the categories in which price increases are now slowing are tied more to the pandemic and supply chains than to Fed policy. For instance, food and fuel prices are moderating after climbing rapidly earlier this year, an effect of transportation issues and fallout from the war in Ukraine. Used car prices, which were severely elevated by a collision of consumer demand and parts shortages, are now falling sharply.

Officials are “getting the help that they expected” from healing supply chains and cheaper goods, said Michael Gapen, chief U.S. economist at Bank of America.

The question now is what will happen with inflation in service categories, which can be more stubborn and difficult to cool. The Fed has lifted interest rates from just above zero early this year to about 4 percent — and those higher borrowing costs are now trickling through the economy to cool both consumer demand and the labor market. That should slow down many types of inflation in 2023.

For instance, used car prices are likely to continue to decline as car loans become so pricey that would-be buyers are squeezed out of the market. Wage growth remains rapid now, but as businesses hold off on expansions or lay off workers, it is expected to slow, which could help prices for many kinds of services to slow down.

Already, market-based rent increases have pulled back sharply, which should trickle into inflation data over the next year.

Rents were 7.9 percent higher than a year earlier in November, the fastest year-over-year increase in four decades, as tenants renew their leases after a big pop in market rent prices in 2021 and early 2022. That is poised to slow down notably in the coming months.

The Consumer Price Index figures released on Tuesday are closely watched because they are the first major inflation data points to come out each month. The Fed officially targets a more delayed measure, the Personal Consumption Expenditures index, and aims for 2 percent on average over time. That measure came in at 6 percent in the year through October.

As price increases begin to moderate notably, investors and households alike are wondering how high the Fed is likely to raise interest rates in 2023 — and how long officials will leave borrowing costs elevated.

One camp argues that the central bank should be cautious, avoiding doing too much and causing a recession at a time when price increases are already on their way back toward normal.

Understand Inflation and How It Affects You

But other economists and policymakers contend that underlying inflation pressures remain. They warn that the Fed needs to stick with the program to ensure that inflation does not become a permanent feature of the American economy.

Services inflation contributed about 3.9 percentage points of November’s inflation reading. Much of that comes from the rapid increase in rents that is poised to taper off, but some is from a tick-up in other categories, such as garbage collection, dentist visits and tickets to sports games.

“Although the long awaited moderation in goods categories is finally underway, the underlying pace of inflation still looks inconsistent with the Fed’s target,” Tiffany Wilding, North American economist at PIMCO, wrote in a note following the inflation release.

If price increases remained stubbornly higher for years on end, they could begin to feed on themselves, with consumers asking for bigger raises to keep up and companies instituting bigger or more frequent price adjustments to cover rising labor bills. That sort of self-fulfilling cycle is exactly what the Fed is trying to avoid.

In the 1970s, officials allowed inflation to remain slightly more rapid than usual for years on end, which created what economists since have called an “inflationary psychology.” When oil prices spiked for geopolitical reasons, an already elevated inflation base and high inflation expectations helped price increases climb drastically. Fed policymakers ultimately raised rates to nearly 20 percent and pushed unemployment to double digits to bring prices back under control.

Central bankers today want to avoid a rerun of that painful experience. For now, they have signaled that they expect to raise interest rates slightly in early 2023, then leave them at high levels for some time to constrain the economy.

“It is likely that restoring price stability will require holding policy at a restrictive level for some time,” Jerome H. Powell, the Fed chair, said during a speech late last month. “We will stay the course until the job is done.”

Ms. Wilding said she expected the labor market to slow down notably in early 2023, allowing the Fed to stop raising interest rates, as did Mr. Shepherdson at Pantheon.

“I think that they are going to be done in February,” he said. But he expects rates to remain at a relatively high rate — just shy of 5 percent — for a long time, as the Fed avoids letting up too soon and allowing inflation to stage a comeback.

“They’re going to be very cautious: They’ve had their fingers burned.”