Good morning. We had been looking forward, in a macabre way, to Sam Bankman-Fried’s appearance in front of the US House Committee on Financial Services, scheduled for this morning. Now it seems unlikely to happen; he was arrested by Bahamian police last night. The US wants him extradited. “I didn’t knowingly co-mingle funds” (sadly, a real quote) doesn’t seem to have appeased the American authorities. Send us your thoughts: [email protected] and [email protected].

GDP recessions vs earnings recessions

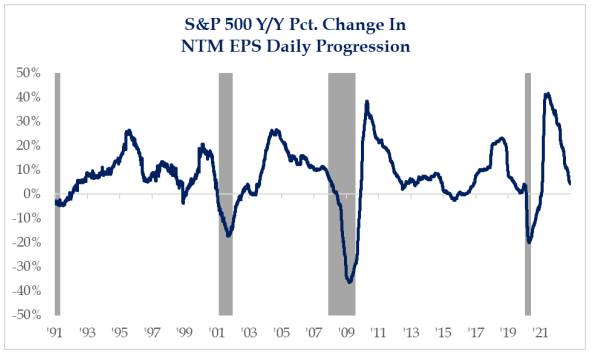

We and much of Wall Street have been singing from the same hymnal for some time now: recession is coming and earnings are going to roll over hard. Ever so slowly, analysts are starting to listen. This chart from Strategas shows how bottom-up earnings estimates for the next 12 months have climbed down since the 2021 peak:

But again: slowly. Yearly profits growth of 5.5 per cent is still the 2023 consensus expectation for the S&P 500. Some think this is plausible. Diane Jaffee, a portfolio manager at TCW, made the point to us last month that a little inflation tends to boost earnings, a nominal variable, and is especially helpful to sectors such as consumer staples. If there’s not a recession, she buys 5 ish per cent earnings growth next year.

A look at net profit margin estimates, derived from analyst revenue and profits estimates, inspires doubt, however. Analysts expect them to nudge up from 12 per cent this year to 12.3 per cent in 2023. According to John Butters of FactSet, such a result would make 2023 profit margins the second-widest since 2008 (when FactSet started tracking this), second only to the bull market of 2021.

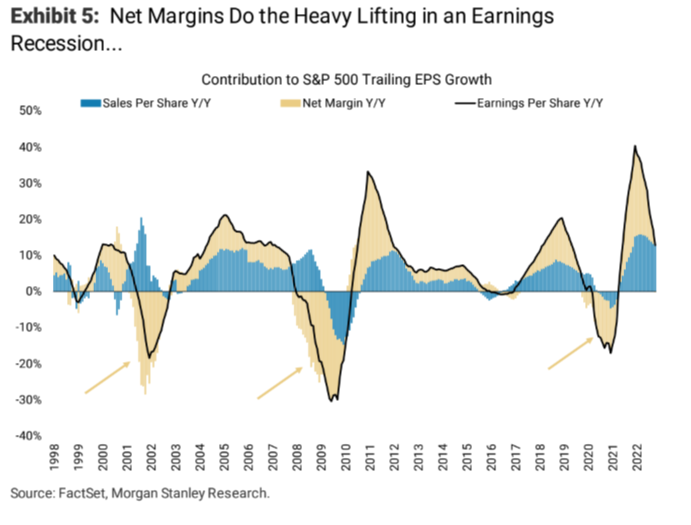

That beggars belief, even if you are sceptical that a proper recession is coming. One reason is that sales don’t have to fall much to squish margins. Since most firms have some level of fixed costs, a slowdown or mild contraction in topline revenue can become a heavy weight on margins and earnings. In a note out yesterday, Michael Wilson of Morgan Stanley offers this chart showing how smallish swings in sales become big swings in margins:

Even a sales slowdown, as the chart shows, can significantly compress margins. Not to mention the abundance of recent data pointing to other pressures on margins: elevated wage growth raising fixed costs still higher, or discounted sales of excess inventory dragging down revenue. How all this adds up to 5.5 per cent earnings growth next year is something we cannot figure. (Ethan Wu)

Oil prices vs oil stock prices

West Texas Intermediate crude oil peaked at about $120 a barrel in mid-June and is down 40 per cent since, to $73 a barrel. The decline in Russian supply has not been as big as originally feared; the US has released reserves; the global economy is weakening; and so on.

Somehow, the S&P 500 sub-index of oil and gas stocks is down only 1 per cent over the same period. The one-year chart of the two is striking:

It is tempting to look at this chart — and lots of people are looking at it — and say “something has to give”. Either the commodity has to rise quite a bit or the equities have to fall quite a bit.

Maybe, but there are a couple of reasons to remain calm.

Most generally, an oil company’s stock price ought to be less volatile than the commodity, in both directions: its value is the present value of future cash flows, which will be determined by a whole range of possible oil prices stretching to the temporal horizon. And for dividend investors, a decline is no longer a big deal so long as prices are high enough to support the payout. Furthermore, a significant chunk of oil company output has been hedged, further reducing volatility. Many oil companies also sell natural gas, where prices have fallen less.

Some industry observers point out that (a) supply and demand fundamentals will push the oil price back up soon and (b) oil stocks are priced for oil prices not far from their current level. Here, for example, is Matt Portillo of TPH & Co:

In a moderate recession crude should linger around $70/bbl; which combined with the potential for an [strategic petroleum reserve] refill and further actions by OPEC could start to support more of a floor on the commodity. Using upstream stocks as a proxy, with the recent sell off in the space, names are now discounting $55-65/bbl long term . . . heading into 2024 as we see falling global spare capacity pushing oil back towards $100/bbl

Others argue that bearish macro traders have taken effective control of the oil price, driving it below its fundamental value.

Unhedged has no particular insight into the future supply-demand balance in crude oil or the speculative positioning of macro traders. But it does seem to us that the above chart is a nice example of a wider phenomenon: the sharp contrast between expectations of recession next year and relatively resilient equity prices. Something does indeed have to give, somewhere.

Value is not like other factors

In response to yesterday’s letter about value investing, an alert reader noted that two experts we quoted, Rob Arnott of Research Affiliates and Clifford Asness of AQR, have disagreed in the past about factor investing — the general class of strategies that includes value, momentum, low volatility and other systematic approaches to beating broad stock indices. In short, Arnott thinks that relative valuation can be useful in timing investments in a particular factor; Asness is generally sceptical (see here, for example).

When it comes to the value factor, however, the Research Affiliates and AQR approaches are not diametrically opposed. AQR agrees that there may be advantages to timing value investments, at least in extreme circumstances. We spoke yesterday to Andreas Frazzini, a principal at AQR and head of its stock selection team, about this.

Timing cyclical moves in factors, Frazzini says, is “extremely, extremely difficult . . . something for which we would not have a lot of risk budget, given the evidence — the success rate is very low”. Diversifying across factors is a better way of managing cyclical risks than timing, he argues.

The exception is the value factor. “This is one of the few factors for which we have a direct measure, which is the extremity of the divergence in valuation between cheap and expensive stocks.”

Adding to value factor exposure on the basis of relative valuations “is not something [we] do every day, but in periods of extreme dislocation, it causes models like ours to take more risk”, Frazzini says. “It’s a painful thing to do, because it is a contrarian investment — you are buying the factor when it is doing badly. But under reasonable assumptions about mean-reversion”, one can expect some additional return.

Frazzini notes that while the divergence between the valuations of cheap and expensive stocks is less extreme than it was, it remains significantly elevated — it is at levels similar to the tech bubble period. While the prices of expensive companies have fallen more into line with those companies’ economic fundamentals, “the fundamentals of expensive companies have also deteriorated versus cheap companies”, keeping the valuation gap wide. “This is good news for value investors,” he says.

One good read

Jonathan Guthrie on the prospects for Credit Suisse First Boston 2.0.