The Blackstone Real Estate Income Trust made headlines for the wrong reasons last week. But Blackstone also has a similar investment trust focused on corporate debt that has yet to come under similar scrutiny. We suspect that will change.

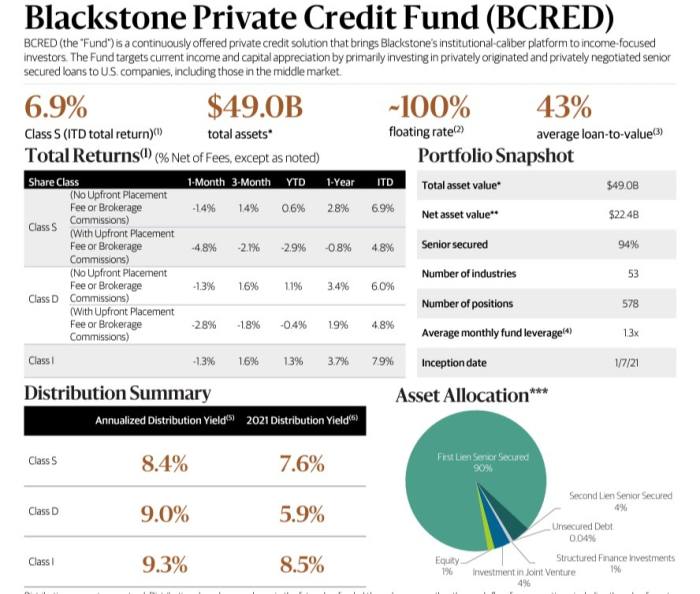

While BREIT buys real estate, the Blackstone Private Credit Fund (BCRED) lends money to companies. Despite only celebrating its first birthday in February, BCRED had amassed a $50bn portfolio of corporate loans as of Oct. 31, according to its website.

That makes it nearly as big as Pimco’s Total Return Fund, the bond fund that Bill Gross at one point turned into the world’s biggest investment vehicle (though if you take out leverage, BCRED’s net asset value is about $22bn).

And it is still a few months away from entering the terrible twos. Some tidbits from its latest fact sheet (data as of end-September):

Since last week, most of the immediate focus has been on BREIT, its importance to Blackstone, and whether its soft gating could trigger contagion elsewhere in the property industry. The $14.6bn Starwood Real Estate Income Trust has already announced similar investor withdrawal limits.

But how vulnerable is the smaller but still chunky BCRED to BREIT-style constraints on investor withdrawals?

As you can see from above fact sheet, nearly all of its exposure is to floating-rate debt, which is handy in a rising rate environment. And the vast majority of BCRED’s loans are first lien and senior secured, which is somewhat encouraging given rising fears over a recession and the turning credit cycle.

Less great is its 29-per-cent allocation to software and IT, given that industry’s current problems. BCRED also has a similar fee structure and withdrawal process as BREIT — structured as repurchasing shares at the net asset value — but only promises quarterly withdrawals, compared to BREIT’s monthly liquidity. And both have similar redemption limits, which can toggle into a full gating at Blackstone’s discretion:

Quarterly tender offers are expected but not guaranteed. Quarterly repurchases are limited to 5.0% of aggregate shares outstanding (either by number of shares or aggregate NAV) as of the close of the previous calendar quarter. Shares not held for one year will be repurchased at 98% of NAV. The Board of Trustees may amend, suspend or terminate these share repurchases in its discretion if it deems such action to be in the best interest of shareholders.

That could be useful, as most of BCRED’s portfolio is made up of illiquid, bespoke ‘unitranche’ loans that are hard to sell quickly if it needs to raise cash for outflows.

Blackstone told FTAV that had net inflows in the quarterly tender window that ended on November 30, and although it anticipates 5 per cent of its shares being redeemed, it intends to meet those in full. Here is the company’s statement:

BCRED is well positioned with 100% floating rate and 94% senior secured loans and zero payment defaults. We saw net positive flows this quarter as investors sought compelling yields in high quality assets with little volatility. Share repurchase requests are expected to be approximately 5% of BCRED’s outstanding shares as of September 30, 2022 and we plan to honor all repurchase requests this quarter.

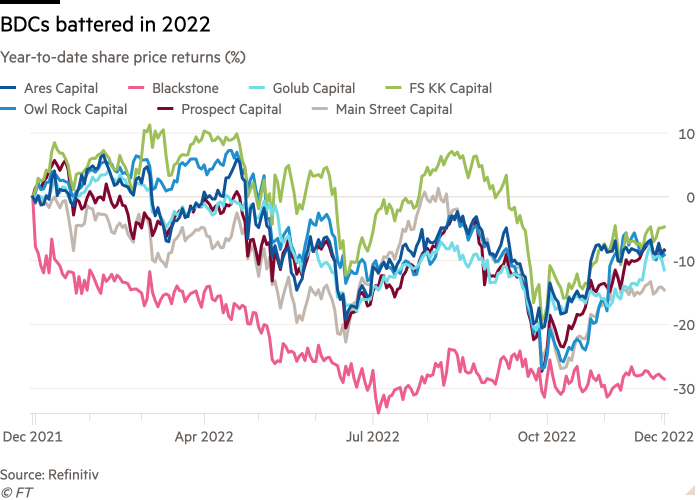

Even setting aside the specificity of “plan to honor” and “this quarter”, there are other areas of concern. For example, the performance discrepancy between the private untraded BCRED and similar(ish) “business development companies” is almost as stark as the divergence between BREIT and listed real estate investment trusts.

While BCRED’s total returns are basically flat this year (depending slightly on the fee class), all public BDC shares have fallen this year, in some cases sharply. Even shares of Blackstone’s own listed BDC — the Blackstone Secured Lending Fund — have dropped more than 28 per cent in 2022

(Blackstone said the poor performance of its listed BXSL is partly because it trades now at a 7 per cent discount to its NAV after an increase in its free float, but that still begs the question why the listed and public NAVs differ so much.)

The more muted redemptions from BCRED may also change now that Blackstone has limited withdrawals from its real estate trust, as JPMorgan analyst Kenneth Worthington wrote last week:

We also note that issues in BREIT could also weigh on BCRED somewhat. While gatekeepers see BCRED as a separate product, we nonetheless have seen BCRED net sales slow as well. Given the pipeline of redemptions for BREIT in November, we see BREIT and BCRED sales likely under pressure into 1H23.

FT Alphaville was therefore intrigued to see that Blackstone today announced another increase in BCRED’s monthly distribution again, by about 10 per cent to $0.21 a share.

That leaves its payout equal to a roughly 10 per cent annual yield, depending on share class. Blackstone attributed this to rising earnings from its floating-rate debt portfolio, and the fact that BDCs are required to pay out 90 per cent of their income.

But given the recent newsflow, it also looks like a timely enticement for investors to stay, pretty please.