South African miner Sibanye-Stillwater has approved a €588mn lithium mine and refinery in Finland that is set to play a key role in helping Europe reduce its reliance on China for the key battery metal for electric vehicles.

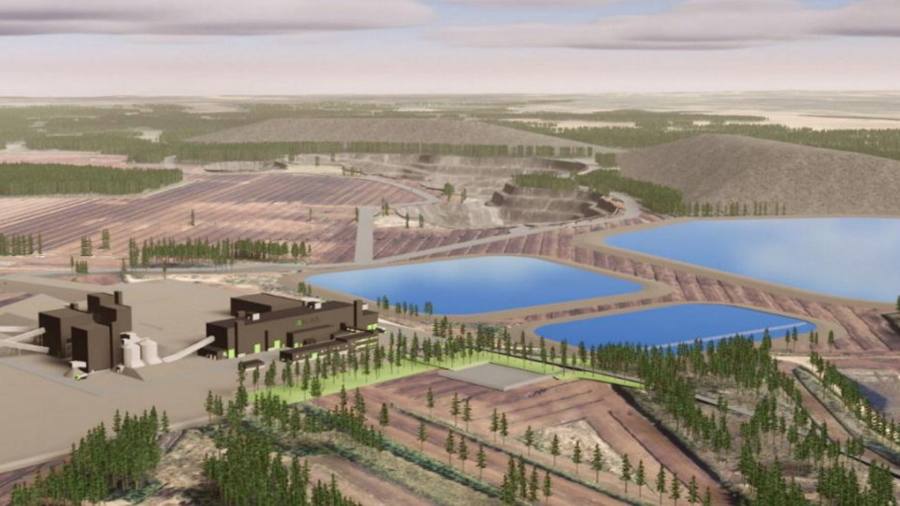

The Keliber project, which because of inflation is set to cost far more than previously forecast, will supply Europe with 15,000 tonnes of lithium hydroxide monohydrate, enough for 300,000 EVs.

“This is a strategically important project for both Finland and the European battery sector,” said Neal Froneman, chief executive.

Sibanye believes the Keliber project will be the region’s first fully integrated European lithium hydroxide producer, with first output scheduled for 2025. The global lithium market is expected to reach 700,000 tonnes of lithium carbonate equivalent this year.

Lithium prices have surged tenfold to $75,000 per tonne since the start of 2021, reflecting a deep supply shortage that has stoked nervousness among automotive supply chain managers about crippling raw material shortages that could hold back the rollout of electric vehicles.

China controls 60 per cent of global capacity to process lithium raw materials into battery-grade chemicals.

Europe has a small number of lithium mining and refinery projects under development but many are yet to secure financing or environmental permits. Tees Valley Lithium, which is hoping to build a lithium refinery in the UK, last week became one of the few to have secured planning permission.

Sibanye has secured permits for one of the mining sites and the lithium hydroxide refinery but still has some hurdles to clear for another of the mining sites and its concentrator facility. Keliber has already raised €146mn and plans to raise a further €104mn in equity by the end of next January, as well as at least €250mn of debt to fund project construction.

Sibanye-Stillwater, which is one of the world’s largest producers of platinum and palladium, has been on a push to diversify into the battery metals sector in recent years.

The South African miner in October raised its stake in Keliber from 30 per cent to 85 per cent, giving it control of the Finnish mining and battery chemicals maker.

The investment plans mark Sibanye’s deepening involvement in the European battery supply chain, building on its investment in Verkor, a French battery manufacturing start-up, and a nickel processing plant in Le Havre, France.

Tyler Broda, an analyst at RBC, said that the project approval was a “positive milestone” in Sibanye-Stillwater’s green metals strategy but “the economics are materially lower as the company incorporates recent inflation into its forecasts”.

Since February the project’s projected capital expenditure has risen by roughly a quarter to €588mn and the estimated cost of running the mine and refinery to produce a tonne of metal has jumped by more than 60 per cent to €6,750.